SEC to Hold Crypto Privacy Roundtable on December 15th

The post SEC to Hold Crypto Privacy Roundtable on December 15th appeared first on Coinpedia Fintech News

The U.S. Securities and Exchange Commission has set a new date for its long-anticipated crypto privacy and surveillance roundtable. After postponing the original October session, the agency will now hold the event on December 15, from 1 p.m. to 5 p.m. at SEC headquarters in Washington, with a public webcast available.

Commissioner Hester M. Peirce said the rapid pace of technological change offers a chance to modernize oversight frameworks.

What to Expect

The roundtable will bring together privacy researchers, federal regulators, blockchain developers, and industry executives. The discussion will center on how crypto firms collect, manage, and secure user data and how oversight can be strengthened without stifling innovation.

Topics include the surveillance tools used by exchanges, companies’ data-protection responsibilities, and the risks of collecting more information than necessary. As blockchain adoption grows, the SEC is using this forum to reassess long-term privacy expectations for a rapidly expanding user base.

Growing Pressure on Crypto Platforms

The timing follows rising criticism of how crypto platforms monitor users. Traditional finance firms like Citadel have recently pushed for tighter oversight, particularly in DeFi, bringing privacy concerns to the forefront.

- Also Read :

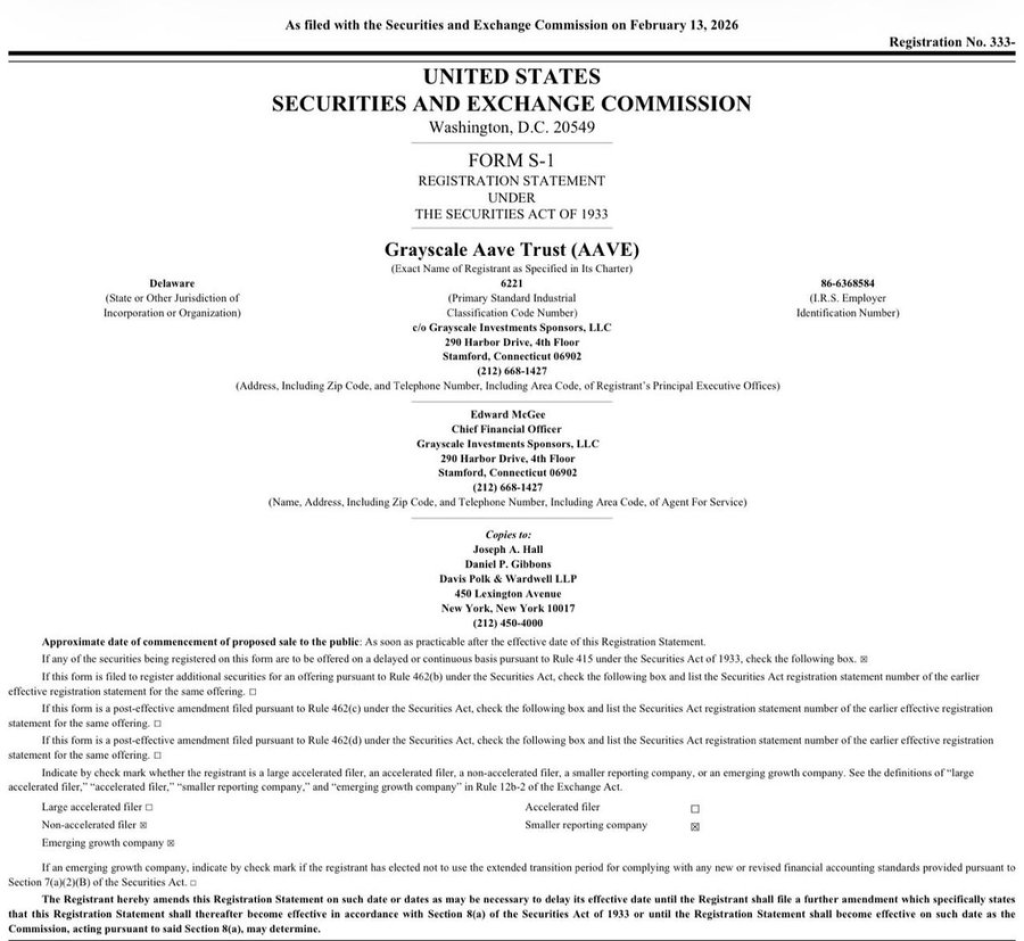

- SEC Approves First 2x SUI ETF, Grayscale Files New SUI Trust

- ,

Many exchanges already rely on advanced monitoring systems to detect fraud and illicit activity. However, critics argue these tools often gather excessive personal data. The December roundtable aims to evaluate whether current surveillance practices are proportionate, transparent, and aligned with user-privacy expectations.

Defining Future U.S. Crypto Privacy Standards

The SEC says insights from the session will help guide the next phase of U.S. crypto privacy policy. The goal is not to slow technological progress, but to encourage secure, balanced practices that protect users while allowing innovation to thrive.

Public comments will be invited, giving individuals and companies a chance to influence regulatory direction. The SEC’s Crypto Task Force is also coordinating with the CFTC to work toward a more unified policy approach. With global regulators tightening reporting requirements, the December 15 roundtable could play a pivotal role in shaping how digital-asset privacy is defined in the years ahead.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The SEC’s crypto privacy roundtable is on December 15, from 1-5 PM ET. It will be held in Washington, D.C., and a live public webcast will be available for remote viewing.

The roundtable aims to balance innovation with user protection. It will discuss how crypto firms handle data and how oversight can be strengthened without stifling technological progress in the sector.

Topics include exchange surveillance tools, data-protection practices, and the risks of collecting more information than needed.

Insights from the meeting may shape new guidelines that balance user privacy, security, and long-term crypto innovation.

You May Also Like

Will SEC Approve the First DeFi ETF? AAVE Filing Sparks Big Question

Wall Street Giants Lead Crypto Hiring Surge: JPMorgan, Citi & More