Best Crypto To Buy Now As New Crypto Regulations Boost Institutional Participation

The crypto market has started to heat up again, and this time the momentum isn’t coming from hype or speculation.

Real changes are happening behind the scenes. Regulators are opening new doors, major financial institutions are rolling out fresh crypto products, and macro conditions are turning more supportive.

Put together, these shifts are giving investors strong reasons to take another look at which assets could perform best in the weeks ahead.

Regulators Finally Move the Industry Forward

One of the biggest surprises came from US banking regulators. The OCC clarified that banks are now allowed to step into crypto in a practical way; they can help customers buy and sell digital assets without taking on the risk of holding the crypto themselves.

Instead of keeping tokens on their balance sheets, banks act as intermediaries and simply match buy and sell orders, similar to how a broker handles transactions.

This change may look small, but it opens a massive door. It gives millions of people a simpler and safer way to access Bitcoin and Ethereum through the same banks they already use every day.

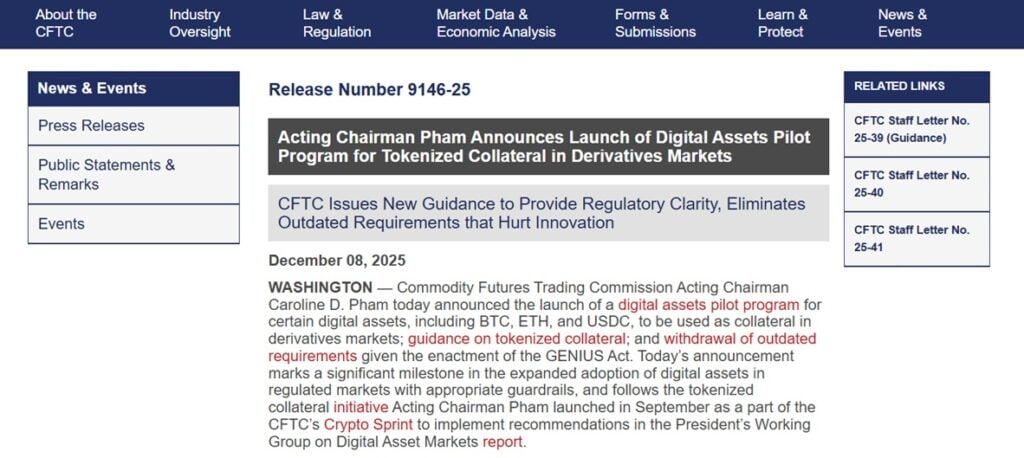

Shortly after, the CFTC launched a pilot program allowing Bitcoin, Ethereum, and USDC to be used as tokenized collateral in derivatives markets. The move aims to provide greater regulatory clarity for using digital assets in traditional finance, making it easier for institutions to move money into crypto.

These updates are arriving just as lawmakers prepare to release a major bipartisan crypto bill. A full draft is expected soon, with discussions and potential voting scheduled right after.

If this bill passes, it could become the clearest and most practical regulatory framework the industry has seen. For the first time in years, crypto appears to be moving toward real, workable rules instead of uncertainty.

Institutions Move In With New Crypto Projects

Institutional interest in crypto is growing. At the Bitcoin MENA conference, Michael Saylor of MicroStrategy explained how his company is using Bitcoin to build a digital Treasury and create Bitcoin-backed credit products that offer steady cash flow while keeping long-term exposure to the asset.

Saylor also highlighted that major U.S. banks, including Bank of America, Wells Fargo, JPMorgan, and Citi, are now actively engaging with crypto, offering custody and credit solutions tied to Bitcoin.

Beyond banks, large asset managers and sovereign wealth funds are exploring substantial positions in Bitcoin as part of long-term strategies.

Meetings between institutional investors and crypto-focused companies are increasing, reflecting serious, structured approaches to investment rather than short-term speculation.

Macro Conditions Give Extra Support

Monetary policy is another piece of the puzzle. Expectations of a Federal Reserve rate cut have increased sharply, and risk assets typically benefit when borrowing costs move lower.

Crypto tends to respond quickly to these shifts because investors look for assets with strong upside potential whenever liquidity becomes cheaper.

Bitcoin’s recent price action reinforces this setup. After reclaiming support around the $92K zone, the market has shown steady momentum. If this range continues to hold, a move toward the $100K mark becomes more realistic.

Ethereum is also building strength, powered by massive settlement volumes and growing interest from both retail and institutional buyers.

The mix of improving macro conditions and renewed on-chain activity gives the market a healthier foundation compared to previous rallies.

The Next Big Move in Bitcoin Infrastructure: Bitcoin Hyper

As major institutions increasingly engage with Bitcoin, networks designed to facilitate faster and cheaper transactions are gaining attention.

One project making waves in this area is Bitcoin Hyper, a Layer 2 ecosystem built to improve transaction speed and enable small payments and lightweight applications.

The project is nearing a $30 million presale, and recent activity shows whales investing around $500k in HYPER tokens. Bitcoin Hyper offers a complete ecosystem, including a wallet, blockchain explorer, staking, a bridge, and support for meme tokens.

Users can deposit Bitcoin into the bridge, utilize it within the Layer 2 ecosystem for DeFi, token creation, or staking, and then withdraw it back to the main network without losing their assets.

Recent reviews from Cryptonews YouTube channel highlight how projects like Bitcoin Hyper are becoming increasingly relevant. As banks handle more crypto transactions and institutional demand grows, efficient settlement layers will be critical.

Bitcoin Hyper aims to fill this gap, positioning itself as a complementary ecosystem to Bitcoin rather than a competitor, making it one of the best crypto to buy now.

Conclusion

The market is shifting due to real structural changes, not just price swings. Regulations are becoming clearer, big institutions are committing for the long term, and monetary conditions are becoming more favorable.

Bitcoin still leads the way, but projects that improve how these networks work, like Bitcoin Hyper, are starting to stand out.

For investors looking for the best crypto to buy now, Bitcoin Hyper represents a concrete opportunity in infrastructure-focused projects that benefit from growing institutional support and clearer rules, rather than just chasing short-term hype.

Visit Bitcoin Hyper

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Obscura Brings Bulletproofs++ to the Beldex Mainnet for Sustainable Scaling

Ondas Holdings (ONDS) Stock: Why Analysts Just Raised Their Price Target to $12