U.S. OCC Targets Bank Debanking in New Initiative

- U.S. OCC moves against unlawful debanking led by Acting Comptroller Hsu.

- Strengthens fair banking policies; focuses on non-discrimination.

- Potential impact on U.S. banking practices, affecting crypto businesses.

The U.S. Office of the Comptroller of the Currency targets banks’ debanking practices, following an Executive Order from President Trump aimed at ensuring fair access to banking services.

This move impacts crypto industries reliant on bank services, potentially limiting arbitrary debanking practices, while prompting banks towards lawful, non-discriminatory client relations.

OCC Holds Banks Accountable for Debanking Violations

The U.S. OCC, led by Acting Comptroller Michael J. Hsu, is taking steps to examine and hold banks accountable for any unlawful debanking activities. This follows Trump’s Executive Order on Fair Banking.

The Executive Order, aimed at preventing politically motivated debanking, mandates federal regulators, including the Federal Reserve and FDIC, to review their debanking criteria by December 5, 2025.

Crypto Sector Could Benefit from Policy Shift

Crypto markets might face changes as banks could alter their client selection processes, potentially easing access to banking services for crypto businesses considered risky or controversial.

Financial institutions may need to revisit their policies to ensure fairness, thus possibly altering existing political and ideological banking practices.

Historical Parallels: Operation Choke Point Insights

Previous regulatory attempts like Operation Choke Point highlighted similar debanking issues. The current initiative continues this regulatory scrutiny over banking services and their accessibility.

Though not explicitly about crypto, past trends suggest better banking access could enhance crypto market stability, particularly for tokens reliant on U.S. fiat rails.

| Disclaimer: The information on this website is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile, and investing involves risk. Always do your own research and consult a financial advisor. |

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

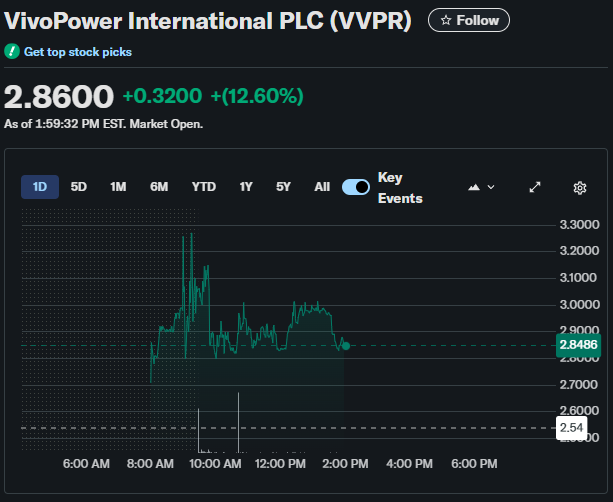

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally