4 Crypto Cards for Everyday Spending in 2026 – Why Digitap’s ($TAP) Unified Balance Is a Game Changer

The post 4 Crypto Cards for Everyday Spending in 2026 – Why Digitap’s ($TAP) Unified Balance Is a Game Changer appeared first on Coinpedia Fintech News

Using cryptocurrency for everyday purchases shouldn’t be complicated. Several industry titans have come close to solving one of crypto’s longest-standing problems. However, while most have come close, only Digitap ($TAP), a crypto presale startup and creator of the world’s first “omni-bank”, truly solves this problem.

Digitap’s Visa-powered crypto-linked card automatically converts digital assets into fiat at the point of sale. Of course, fiat users aren’t left out as Digitap’s card can also be funded with cash. This unified balance is a game-changer for the industry and makes Digitap a top crypto to buy for 2026.

Below are the top 4 crypto cards for everyday spending and why Digitap ranks as number one.

- Digitap Visa Card ($TAP): A unified fiat–crypto card available with no staking or credit checks.

- Crypto.com Visa Card: A widely available crypto card with tiered cashback rewards.

- Robinhood Gold Card: A 3% flat cashback card exclusive to Gold members.

- Coinbase One Card: A U.S.-based Amex credit card offering up to 4% cashback in BTC.

Digitap’s Unified Card Appeals As Best Crypto To Buy

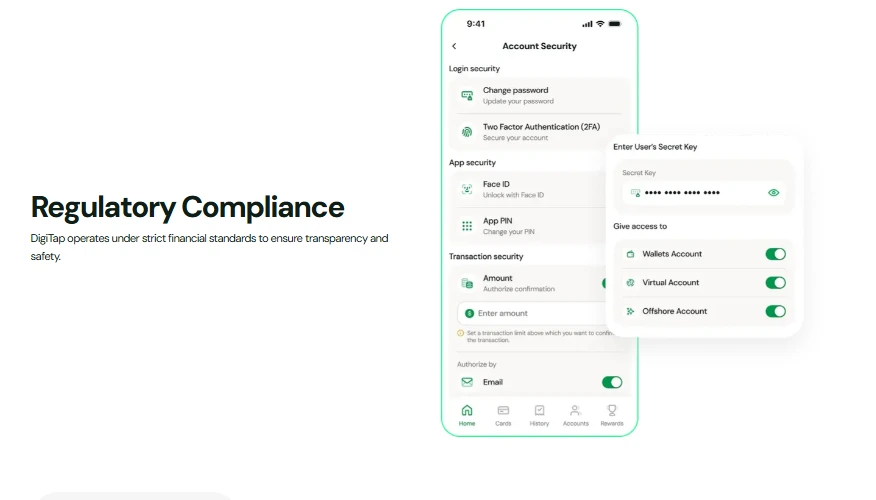

Digitap is the fintech company behind the world’s first superbank app that blends fiat and crypto together. Users can send, receive, store, save, invest, and, more importantly, spend, either fiat or crypto, seamlessly, making it a crypto to buy with real utility.

The Digitap card, powered by Visa and available to all Digitap users,, connects to a single account that holds both crypto and fiat. This means users don’t have to manually preload a separate fiat wallet or decide which asset to spend.

Users can hold multiple cryptocurrencies and traditional currencies in one Digitap account, and the AI-powered software will swap the appropriate asset at the time of purchase.

Another advantage is that Digitap doesn’t require staking tokens for better rates or paid memberships for access. Its goal is to function as a crypto-friendly bank account that is open, fair, and accessible to a global population.

Source: Digitap

Source: Digitap

How Digitap’s Visa Deal Boosts Confidence In $TAP Presale

Digitap’s successful crypto presale of its native $TAP token can in part be attributed to its Visa partnership. This adds a layer of credibility to Digitap’s ecosystem, signaling to investors that it is a top altcoin to buy as it has passed Visa’s rigorous compliance and integration standards.

It also means users can spend their crypto seamlessly at over 80 million merchants worldwide. This real-world spending capability has set Digitap apart from other presale tokens.

As part of a presale structured in stages, the price of $TAP was first for sale at $0.0125 in the late summer. After each round is complete, the price of $TAP slightly appreciates. Currently for sale at $0.0361, early backers are sitting on a paper profit of nearly 200%.

Digitap’s team recently confirmed its presale will end with $TAP graduating to a live exchange. A date has yet to be confirmed, but the expected listing price of $0.14 implies investors don’t have much time left to buy the token before it is available to the general public.

Why Crypto.com’s Metal Cards Come With Heavy Conditions

One of the most globally recognized crypto cards comes from Crypto.com. It offers a basic free card along with tiered Visa cards with sleek metal card options and rewards like free Netflix and cashback paid in the platform’s native CRO token.

However, the flashy metal card design is purely aesthetic, and the rewards come with strings attached, especially six-month token lockups.

Users can indeed get up to 5% cashback on purchases, although this requires staking $500,000 worth of CRO. The most basic card doesn’t provide any rewards and has to be preloaded with cash.

Why Robinhood’s Card Suits Some, But Requires Membership

Stock and crypto trading platform Robinhood launched an invite-only Gold card in 2025. This is a true credit card (i.e., not a preloaded debit card) that is available to Robinhood’s Gold subscription members.

The card’s headline feature is a flat 3% cashback on all purchases with no categories or foreign transaction fees. This is an industry-leading rate for an uncapped, all-category card. Rewards can be redeemed into a Robinhood brokerage account, making it a convenient option to invest rewards.

However, access is limited, and users must be on a Robinhood Gold subscription, although it isn’t as prohibitive as rivals at around $5 per month. But, as a conventional credit card, it requires a credit check and approval based on creditworthiness.

An Elite Coinbase Amex Card With Access Limited to a Few

Coinbase, one of the largest crypto exchanges, launched the Coinbase One Card that operates on the American Express network. A sleek-looking metal card offers users up to 4% cashback in Bitcoin on every purchase.

There is no annual fee for Coinbase One members, and benefits include American Express’ standard protections like warranty on purchases and travel insurance. While certainly a premier, if not elite, card, it ranks lower on the list because it is subject to approval based on credit score.

Coinbase does offer the opportunity for users to check eligibility with no hard credit impact, which is a nice touch. It is also, for the time being, limited to U.S.-based users. Still, it provides a convenient way for existing and eligible Coinbase users to earn Bitcoin rewards.

Why Digitap’s No-Strings Card Already Stands Out From Rivals

Crypto.com, Robinhood, and Coinbase all offer useful and appealing cards to certain demographic groups. They come with conditions, such as staking tokens, paying for memberships, or navigating credit checks. While there is certainly a market for this, Digitap stands out with its more unifying approach.

Digitap, despite still being a crypto presale project, removes the hurdles and allows anyone to spend crypto hassle-free. This means fewer steps and no surprises. A user’s money in any form should be available to tap-and-pay anywhere, anytime, with no conditions.

As crypto cards continue to gain momentum, 2026 could be the year they go mainstream. Solutions like Digitap’s card, which blur the line between traditional and digital finance, are likely to lead the evolution. Buying a coffee with leftover USDC or BTC with a bank card is a narrative that could gain traction and make $TAP a leading altcoin to buy next year.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

- Presale https://presale.digitap.app

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

- Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

You May Also Like

Obscura Brings Bulletproofs++ to the Beldex Mainnet for Sustainable Scaling

Ondas Holdings (ONDS) Stock: Why Analysts Just Raised Their Price Target to $12