CFTC Scraps ‘Outdated’ Bitcoin Guidance – What This Means for Future Regulation

The U.S. Commodity Futures Trading Commission has formally scrapped its 2020 “actual delivery” guidance for Bitcoin and other virtual currencies and set the stage for a broader shift in how the agency oversees crypto markets.

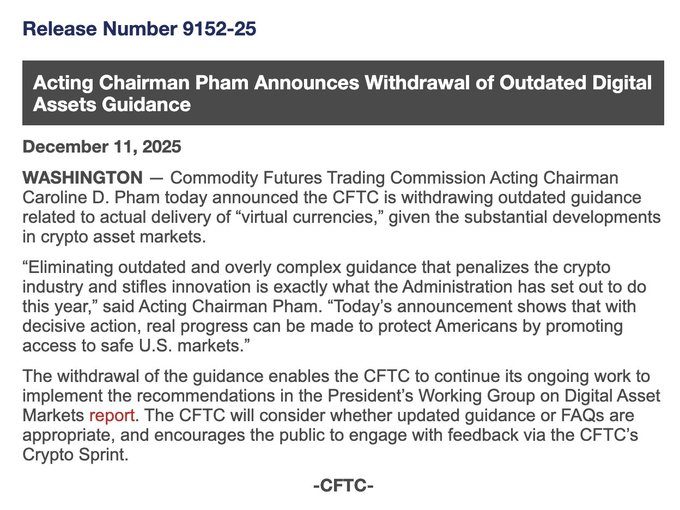

Acting Chair Caroline Pham announced the withdrawal on December 11, calling the old framework outdated and inconsistent with the market’s level of maturity.

Source: CTFC

She said the move reflects the administration’s push this year to remove rules that had become overly complex and deterred crypto firms from operating within the U.S., adding that eliminating such barriers shows “real progress can be made to protect Americans by promoting access to safe U.S. markets.”

CFTC Withdraws 28-Day Crypto Delivery Standard, Easing Path for New Products

The guidance that has now been withdrawn defined the conditions under which a leveraged or margined crypto purchase could be considered “actual delivery,” a standard built around a 28-day window that required the buyer to have full possession and control of the asset.

It was introduced at a time when regulators were still unsure how virtual currency markets would develop, and it placed crypto in a category separate from other commodities.

Pham said the agency’s experience with virtual currency derivatives listings, along with years of market growth and the development of stronger custody practices, made the old rules incompatible with how the industry now operates.

The withdrawal allows digital assets to be regulated under the CFTC’s general, technology-neutral framework, a shift that reduces compliance burdens for exchanges seeking to list new products.

It also marks a step toward normalizing Bitcoin and Ethereum alongside traditional commodities.

The update lands at a time when U.S. regulators are moving quickly on crypto policy. Only days before scrapping the old guidance, the CFTC cleared the way for spot crypto trading to occur directly on federally regulated futures exchanges, a first for the industry.

Acting Chair Caroline Pham called the move a major shift, saying it brings spot trading onto platforms that have operated under federal rules for decades.

It also forces leveraged retail crypto trades, previously stuck in a gray zone, onto exchanges that already follow strict market protections.

The move comes after months of coordination with other agencies, including the SEC. Earlier this year, both regulators confirmed that registered exchanges under either agency could support certain spot crypto products.

CFTC Advances Crypto Sprint With New Tokenized Collateral Pilot

These moves are part of a wider effort tied to the CFTC’s “Crypto Sprint,” a program examining tokenized collateral, stablecoin use in derivatives markets, and ways to modernize clearing and settlement rules through blockchain systems.

The agency has already begun testing some of these ideas in practice. On December 8, it launched a pilot program that allows Bitcoin, Ether, and USDC to be used as collateral in derivatives markets, giving the agency real-time insight into how tokenized assets behave under regulated conditions.

For the first three months of the pilot, futures commission merchants can only accept those three digital assets and must submit weekly reports on their holdings, a structure the agency says will help it monitor risk while still expanding access to new tools.

The CFTC’s divisions have also issued guidance confirming that tokenized real-world assets, such as U.S. Treasuries and money market funds, can be evaluated within the existing regulatory framework.

To ease the transition, the agency granted no-action relief to firms that want to accept certain non-securities digital assets as customer margin.

Pham has emphasized that the goal is to give U.S. traders safer alternatives to offshore platforms after years of high-profile failures and losses.

The shift is unfolding as the agency undergoes its own leadership transition. Pham has been serving as acting chair since January and is expected to step down once the Senate confirms President Donald Trump’s nominee, Michael Selig.

You May Also Like

BlackRock Increases U.S. Stock Exposure Amid AI Surge

Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps