Singapore Gulf Bank unveils zero-fee stablecoin mint on Solana network

Singapore Gulf Bank (SGB) has taken a significant step in integrating traditional banking with blockchain technology. The regulated digital bank today unveiled a new service that lets clients mint and redeem stablecoins directly on the Solana blockchain, at the ongoing Breakpoint 2025 in Abu Dhabi.

With no fees for a limited launch period. The move underscores growing institutional adoption of blockchain tools for real-world finance.

This new product allows SGB’s corporate clients to convert fiat into major stablecoins, including USDC and USDT on Solana, and redeem them back to fiat. Importantly, the launch programme waives both transaction and gas fees for clients using Solana for these operations. The service will initially focus on corporate treasury operations and cross-border business flows before rolling out to SGB’s personal banking customers later.

According to the bank, this builds on a strong foundation. Since its market entry, SGB has processed more than $7 billion in transactions, showing strong demand for integrated digital asset and banking services across Asia and the Gulf Cooperation Council (GCC) corridor.

The addition of on-chain minting and redemption seeks to streamline financial flows and reduce settlement friction for clients operating across these regions.

Shawn Chan, Chief Executive Officer of SGB

Shawn Chan, Chief Executive Officer of SGB

Shawn Chan, Chief Executive Officer of SGB, said, “The adoption of stablecoins by regulated banks reflects their growing real-world utility. By leveraging Solana’s speed and cost advantages, we are providing our clients across the GCC and Asian markets with a bank-grade compliant stablecoin solution that finally makes real-time, cross-border and cross-counterparty transactions viable for corporates.”

How the Singapore Gulf Bank stablecoin mint works and why it matters

SGB’s new service bridges regulated banking with blockchain rails. Clients can create or destroy stablecoins directly on Solana, without moving assets through intermediaries. Solana’s high throughput and relatively low on-chain costs make it a logical choice for high-volume, real-time transfers that would otherwise be slow and expensive through conventional banking systems.

This integration marks a shift from experimental proofs-of-concept to a regulated, operational infrastructure that supports commercial activity at a bank scale. SGB’s approach aligns with broader trends in the digital asset space, where stablecoins are increasingly used for cross-border payments, liquidity management, and treasury operations because they combine dollar parity with blockchain settlement speed.

For context, other regulated banks and financial infrastructure firms have also been expanding stablecoin services. Institutions such as DBS and others have explored stablecoin custody and issuance frameworks, while networks like the Global Dollar Network and platforms like Fireblocks support secure stablecoin transactions and bank integrations.

These developments emphasise the momentum building behind regulated stablecoin adoption for enterprise users.

The launch forms part of SGB’s larger digital finance strategy. In May 2025, the bank launched SGB Net, a real-time, multi-currency clearing system designed to facilitate instant settlement between financial institutions. This platform aims to reduce settlement times and improve liquidity management across fiat and crypto channels.

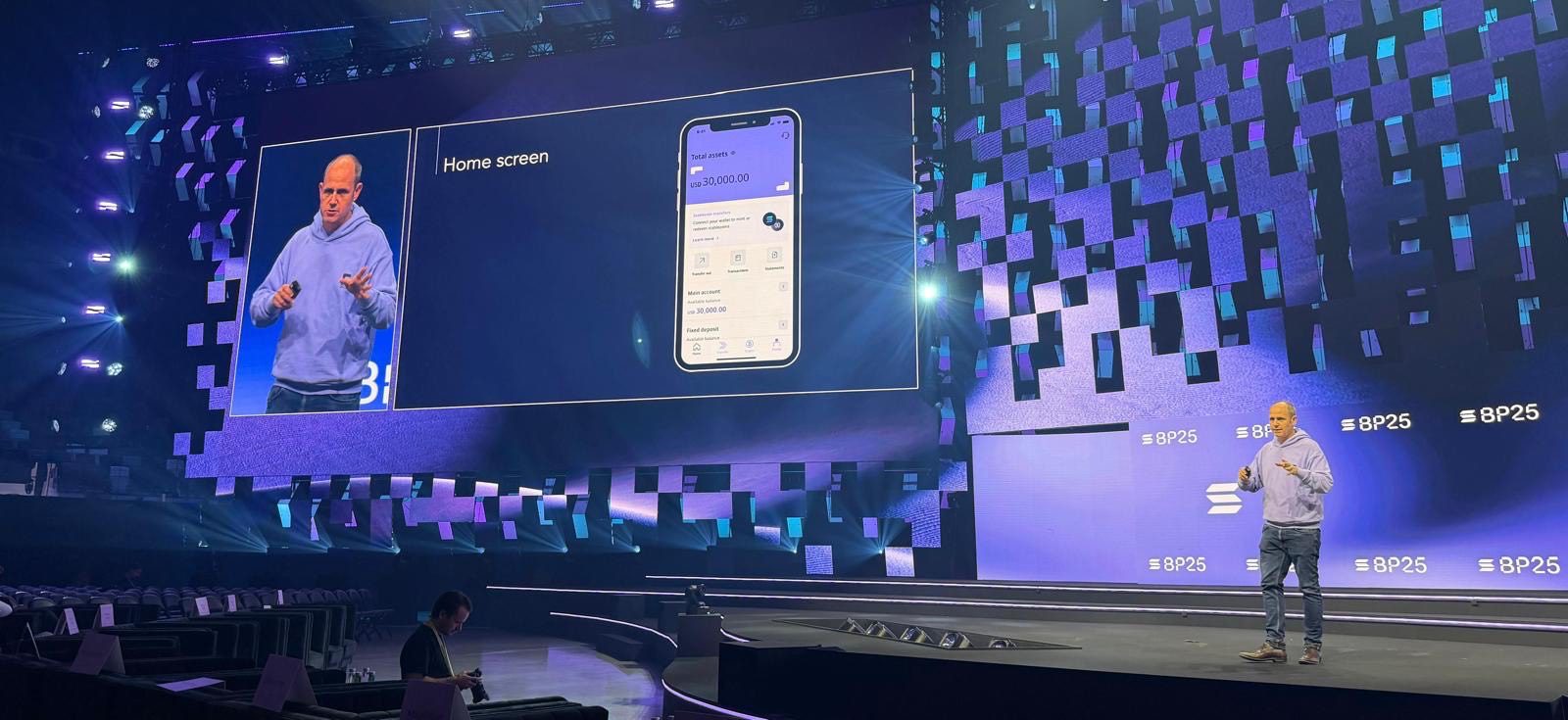

The unavailing of Singapore Gulf Bank’s zero-fee stablecoin mint and redeem service on Solana

The unavailing of Singapore Gulf Bank’s zero-fee stablecoin mint and redeem service on Solana

In addition, SGB announced a partnership with digital asset infrastructure provider Fireblocks to support secure digital asset custody and treasury operations. This partnership allows SGB to offer institutional-grade custody for crypto and stablecoins, backed by multi-party computation (MPC) cryptography and secure wallet infrastructure.

These enhancements are aimed at strengthening compliance, security and operational efficiency for institutional clients navigating the digital asset economy.

With the adoption of real-time settlement technology, secure custody infrastructure, and now on-chain stablecoin mint and redeem capabilities, Singapore Gulf Bank is positioning itself at the nexus of traditional finance and decentralised finance (DeFi).

It also responds to client demand for tools that can operate in 24/7 global markets, without the delays and costs associated with legacy banking systems.

You May Also Like

Obscura Brings Bulletproofs++ to the Beldex Mainnet for Sustainable Scaling

Ondas Holdings (ONDS) Stock: Why Analysts Just Raised Their Price Target to $12