Ripple Moves $152M in XRP to Binance Amid 600M Token Wallet Shuffle

The post Ripple Moves $152M in XRP to Binance Amid 600M Token Wallet Shuffle appeared first on Coinpedia Fintech News

Ripple has carried out another large XRP transfer, sending more than 75 million XRP to a wallet tied to Binance, worth about $152 million. The move was spotted on December 12 by Whale Alert, which tracks major blockchain activity. This transfer happened right after Ripple shuffled over 600 million XRP across several internal wallets, catching the attention of the wider community.

How the Transfers Happened

The latest transfer started from Ripple’s main wallet, known as Ripple (50). From there, the coins were sent to a smaller Ripple-controlled wallet and then forwarded to “rpxh7h,” a wallet activated by Binance. Since Binance wallets handle exchange deposits, movements like this often spark discussion about Ripple’s intentions, especially when the amounts are this large.

Around the same time, Whale Alert also flagged another 90 million XRP transaction. Later checks showed that it was simply an internal move between eToro’s own wallets, not a market-related transfer.

Ripple’s Wallet Shuffle Continues

Ripple has reorganized a huge chunk of its holdings in the last 24 hours, moving more than 600 million XRP into different subwallets and fresh addresses. These reshuffles usually signal internal restructuring rather than market activity, but the community still watches them closely because Ripple holds such a large supply of XRP.

- Also Read :

- Ripple Confirms Swell 2026 in New York: XRP Holders Eye Major Ecosystem Shift

- ,

XRP ETFs See Steady Inflows

While these transfers were taking place, spot XRP ETFs continued to attract money. According to SoSoValue, the funds brought in around $16.42 million in new inflows on Thursday. Total inflows into XRP ETFs are now approaching $1 billion, with the 21Shares TOXR ETF joining other active products in the market. This steady demand has helped XRP maintain some price support even while traders remain cautious.

XRP Price Movement

XRP is trading around $2.04, with 60.33 billion tokens in circulation out of a 100 billion max supply. The token is far below its $3.84 ATH from January 2018 but still massively higher than its $0.0028 ATL, showing a long-term recovery despite recent pressure. The chart remains weak, stuck in a downward pattern since October, with the 50-day SMA at $2.26 and the 200-day SMA at $2.60 sitting above the current price. Trading volume has fallen nearly 30%, and futures open interest sits at $3.69 billion, hinting at softer trader activity even though CME and Binance saw small upticks. After the recent wallet movements, XRP managed only a small bounce.

Analyst EGRAG CRYPTO says XRP is at a make-or-break point: if the asset is sitting in his “red zone,” he believes traders should reduce exposure and prepare for a final push upward; but if it’s in the “green zone,” he views this moment as an opportunity to buy dips and position for a larger long-term move.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Large on-chain moves can hint at liquidity shifts or institutional strategies, so traders watch them as early signals—even when no sale happens.

When funds head toward exchange wallets, some traders assume selling pressure, which can trigger cautious trading or short-term volatility.

XRP remains in a downtrend, trading below key moving averages. Momentum is soft, but analysts say a breakout zone could shift the trend.

You May Also Like

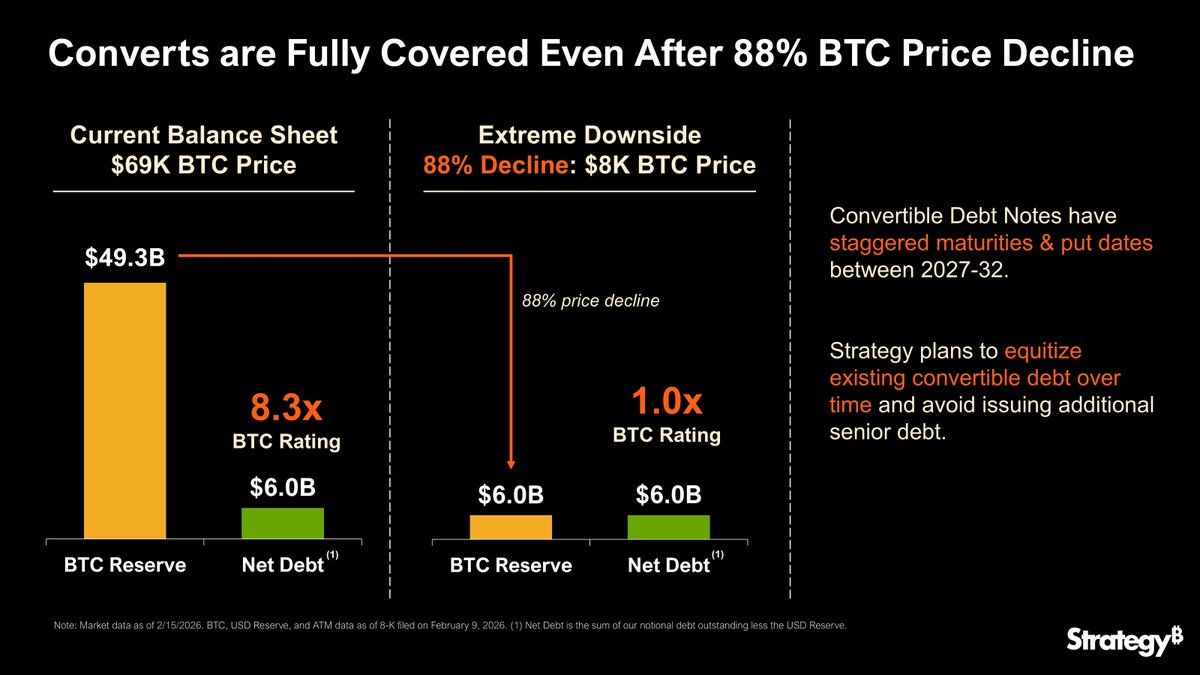

Strategy Can Fully Cover $6 Billion In Debt if Bitcoin Drops 90%, But What Happens Below That Line?

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more