US Crypto Market Structure Bill Delayed Until 2026

The post US Crypto Market Structure Bill Delayed Until 2026 appeared first on Coinpedia Fintech News

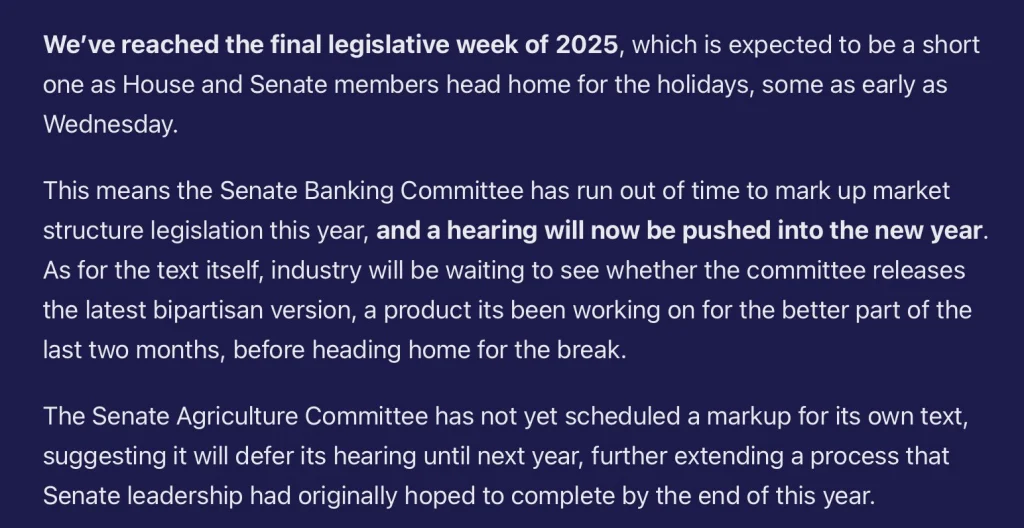

The US government has again delayed long-promised crypto rules. The Senate Banking Committee has postponed hearings on the crypto market structure bill until early 2026. This ends hopes that clear federal rules will be in place by 2025.

Committee Chair Tim Scott said the bill needs support from both parties, and lawmakers are not willing to rush it. For crypto companies and investors, the delay means continued confusion about what is allowed and who regulates what.

Which Crypto Bill Is on Hold?

The delay affects the Senate’s version of the crypto market structure bill, which follows the House-passed FIT21 bill from 2024. While the House moved ahead, the Senate has struggled to agree on key points, including who should regulate crypto markets and how much power regulators should have.

The bill was expected to reach the Senate markup stage this year. That step has now been pushed to 2026, raising doubts about whether it will move forward at all.

Why This Bill Matters

This bill is important because it would finally set clear rules for crypto in the US.

The main goals include:

- Deciding whether crypto assets fall under the SEC or the CFTC

- Giving the CFTC control over spot crypto markets

- Setting clear rules for exchanges and platforms

- Reducing lawsuits as the main way to regulate crypto

Without these rules, crypto businesses operate in a grey area. That uncertainty makes companies cautious and often pushes traders to pull back during weak market conditions.

Why the US Crypto Market Structure Bill is Delayed?

Lawmakers now have bigger political issues to deal with, including budget deadlines and upcoming elections. Crypto regulation has slipped down the priority list. What was once seen as a delay now looks more like a reset. Even moving the bill in early 2026 is no longer guaranteed.

- Also Read :

- “Crypto Cases Were Dropped Under Trump’s Second Term”, NYT Investigation Says

- ,

Market and Industry Reaction

Crypto prices showed little reaction to the news, suggesting traders expected the delay. Still, concern remains high.

Analyst Paul Barron said the bill has effectively stalled and warned that it may not return anytime soon. With elections coming up, he believes crypto laws could stay stuck for years.

Crypto lawyer John E. Deaton pointed to pressure from the traditional banking sector. He argues that large banks are working behind the scenes to slow crypto-friendly rules and protect their own interests. Lawmakers deny this, saying their focus is on consumer safety.

What Happens Next?

For now, nothing changes.

The crypto industry will likely face:

- More enforcement actions instead of clear rules

- Ongoing uncertainty for exchanges and builders

- States creating their own rules in the absence of federal law

- Slower growth from institutions waiting for clarity

Clear US crypto rules are now unlikely before 2026. Until then, the industry remains stuck waiting.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The bill is delayed due to a lack of bipartisan agreement, shifting political priorities like elections, and unresolved debates over which regulators should oversee crypto markets.

Continued uncertainty. Without clear rules, investors face a grey area with cautious companies and potential market pullbacks during volatility.

Crypto businesses face more enforcement lawsuits, operational uncertainty, and a patchwork of state laws, which slows institutional adoption and growth.

You May Also Like

How COAI’s price can rally by 45% after hitting THIS key resistance

UK FCA Plans to Waive Some Rules for Crypto Companies: FT