Ethereum Price Prediction As Tom Lee’s BitMine Buys The Dip With $140M ETH Purchase

The Ethereum price rose a fraction of a percent in the past 24 hours to trade at $2,926 as of 3:50 a.m. EST on a 30% drop in trading volume to $20 billion.

That surge in the ETH price comes as treasury firm BitMine, led by Fundstrat co-founder Tom Lee, expanded its holdings on Dec. 16 with another purchase of 48,049 ETH worth $140.58 million.

In its latest disclosure released on Monday, the NYSE–listed firm said it holds a total of 3,967,210 ETH, bought at an average price of $3,074. At current market prices, BitMine’s ETH holdings are worth about $11.6 billion, making it the world’s largest corporate holder of the biggest altcoin.

The company has followed an aggressive buying strategy throughout the year, repeatedly saying it believes Ethereum is in a ”supercycle” and will play a growing role in global finance. As part of its long-term strategy, the firm aims to control 5% of Ethereum’s total circulating supply.

Despite the ongoing market downturn, BitMine recently stepped up its purchases. The company bought 240,711 ETH in the first two weeks of December alone, underlining its strong conviction in Ethereum’s long-term prospects.

Tom Lee says the “best days for crypto” are still ahead. He pointed to positive developments such as progress on crypto regulation in Washington and increasing interest from Wall Street institutions.

Ethereum Price Slides As Bears Take Control

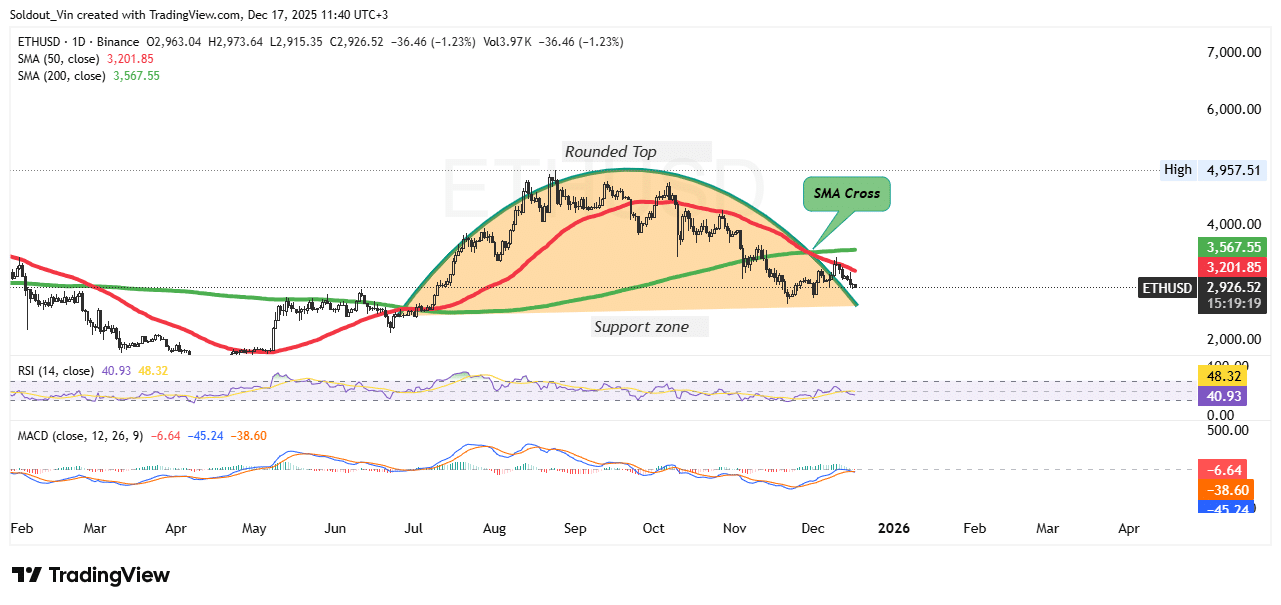

Ethereum is facing sustained bearish pressure after failing to stay above key resistance levels. The token is currently trading around $2,935, which is well below both the 50-day simple moving average (SMA) at $3,202 and the 200-day SMA at $3,568.

The 50-day SMA has crossed below the 200-day SMA, forming a “death cross,” a strong technical signal that suggests continued downside risk for the market. This setup shows that sellers remain in control, and the broader trend is still negative.

The price action also highlights a rounded top pattern. This structure formed after ETH peaked near $4,950 earlier this year and gradually lost momentum.

Rounded tops often indicate a shift from bullish to bearish control, and the subsequent breakdown confirms that Ethereum has entered a corrective phase. This pattern adds weight to the bearish outlook on the daily timeframe.

ETHUSDT Chart Analysis Source: Tradingview

ETHUSDT Chart Analysis Source: Tradingview

Currently, ETH is testing a key support zone between $2,850 and $2,900. This zone has historically acted as a demand area, making it crucial for short-term direction. If Ethereum closes below this support, the next downside targets could be $2,500 and, in the event of increased selling pressure, $2,200.

On the other hand, if buyers defend this level, a short-term bounce remains possible, though it would likely be corrective rather than the start of a new uptrend.

Ethereum Price Targets Key $2,850 Support Level For A Reversal

The Relative Strength Index (RSI) is near 41, which is below the neutral 50 level, indicating bearish momentum, but it is not yet in oversold territory. This suggests there is room for further downside.

Meanwhile, the MACD remains negative, with the MACD line below the signal line. While the histogram shows signs of flattening, signaling that bearish momentum may be slowing, there is no clear bullish crossover yet. This means any near-term recovery may be temporary.

Ethereum remains technically bearish on the daily chart. Bulls need to reclaim the $3,200 level and push above the 50-day SMA to reduce downside risks.

Until this happens, the $2,850 support zone will be the key level to watch, as a break below it could open the door to deeper losses. Short-term bounces are possible, but overall the trend favors sellers.

Related Articles:

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

ServicePower Closes Transformative Year with AI-Driven Growth and Market Expansion