‘Big Short’ Investor Michael Burry Warns US Economy Flashing Historical Signal That Preceded Multi-Year Bear Markets

An investor who famously nailed the Great Financial Crisis of 2008 by shorting mortgage-backed securities is issuing a new warning on the US economy.

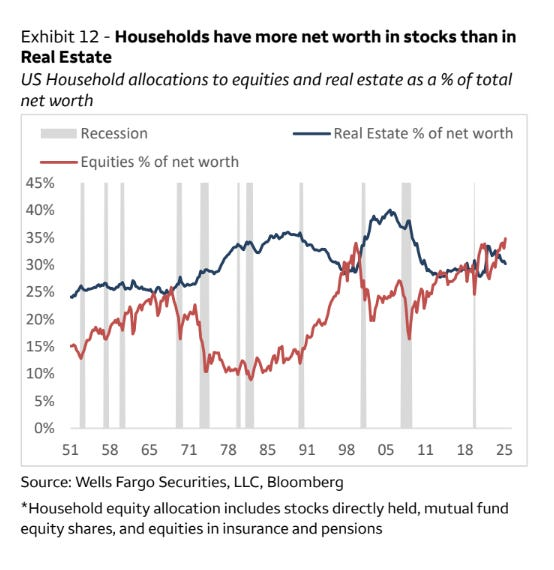

Former Scion Asset Management head Michael Burry is sharing a chart from Wells Fargo and Bloomberg showing the percentage of the average US household’s net worth allocated to real estate and stocks.

The data appears to show that US households have more of their net worth in stocks than real estate, which Burry points out has sometimes led to bear markets in the past.

“This is a very interesting chart, as household stock wealth being higher than real estate wealth has only happened in the late 60s and late 90s, the last two times the ensuing bear market lasted years.

Beary Burry.”

Source: Michael Burry/X

Source: Michael Burry/X

The investor further explains,

“In this case I think the chart explains the situation today really well. After nearly a decade of zero interest rates, trillions in pandemic helicopter cash money, the greatest inflation in 50 years, and a new paradigm of higher Treasury rates for the first time in 50 years, stocks have emerged victorious even over home prices that rose 50%.

Reasons for this are many but certainly include the gamification of stock trading, the nations gambling problem due to its own gamification, and a new ‘AI’ paradigm backed by $trillions of ongoing planned capital investment backed by our richest companies and the political establishment.”

In a recent interview on the Against the Rules with Michael Lewis podcast, Burry says the stock market could enter a years-long bearish phase due to the growth of passive investing.

“Today it’s all passive money. And it’s a lot. It’s over 50% passive money. There are index funds… Less than 10% of money, some say, is actively managed by managers who are actually thinking about the stocks and in any kind of way that’s long-term.

And so the problem is in the United States, I think, when the market goes down, it’s not like in 2000, where there was this other bunch of stocks that were being ignored, and they will come up even if the Nasdaq crashes. Now I think the whole thing is just going to come down. And it would be very hard to be long stocks in the United States and protect yourself.”

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post ‘Big Short’ Investor Michael Burry Warns US Economy Flashing Historical Signal That Preceded Multi-Year Bear Markets appeared first on The Daily Hodl.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

![[OPINION] Honduras’ election turmoil offers a warning — and a mirror — for the Philippines](https://www.rappler.com/tachyon/2025/12/honduras-elections-december-17-2025-reuters.jpg?resize=75%2C75&crop=337px%2C0px%2C1387px%2C1387px)

[OPINION] Honduras’ election turmoil offers a warning — and a mirror — for the Philippines