Best Crypto to Buy Now? Hedera Price Prediction, New Crypto Coins

After ending November with a 10% loss, Hedera (HBAR) has declined an additional 7% over the past week, trading at $0.113 and down 58% from its yearly high.

The continued HBAR price drop reflects trends in the broader crypto market. Bitcoin, for instance, has fallen from $126,200 in October to around $87,000 today, making Hedera price prediction an important focus for investors seeking guidance.

Hedera’s unique network architecture and governance model may keep it in consideration for those seeking the best crypto to buy now, though some traders are also exploring new crypto presales for potentially higher-growth opportunities.

Source – Cilinix Crypto YouTube Channel

Challenges Mount for Hedera: ETF Inflows Stall and Platform Activity Remains Low

Hedera has faced several challenges impacting its performance, with the newly launched Canary HBAR ETF being a major factor. The ETF has seen no inflows over five consecutive days, and its total inflows since launching in October amount to just $82 million.

By comparison, XRP ETFs have surpassed $1 billion in cumulative inflows. HBAR’s ETF performance reflects trends seen in other smaller cryptocurrencies such as Litecoin and Dogecoin.

At the same time, Hedera is experiencing ecosystem limitations, raising concerns that it may be turning into a ghost chain, which refers to networks with minimal active participation.

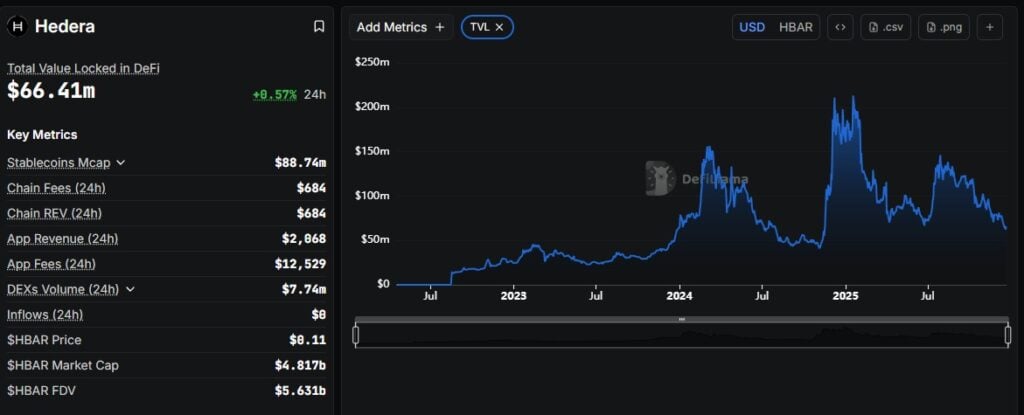

Source – DefiLlama

The platform has attracted no new DeFi protocols in recent months, hosts fewer than five dApps, and has a total value locked (TVL) of only $66 million, far below newer networks like Monad and Plasma.

Its role in the stablecoin sector is limited, holding $88 million in assets, and despite its speed and corporate partnerships, Hedera currently holds no market share in the expanding RWA industry.

Hedera Price Prediction

Hedera’s price action shows early signs of potential recovery after an extended bearish trend. Key resistance is observed around $0.117, while immediate support lies between $0.10 and $0.114, forming a critical zone for price stabilization.

Technical indicators, including triple bullish divergences and spot buying absorption, suggest that a local bottom may be forming near the $0.10–$0.12 range. If Bitcoin can reclaim $89,500, $HBAR could attempt to test higher resistance levels at $0.116–$0.117.

Imbalances to the downside may still trigger short-term dips, but the overall outlook shows potential for gradual upward movement. Hedera price prediction points to cautious optimism, contingent on broader market strength and investor activity.

Top Crypto to Buy Now: High-Potential Presales Ahead of 2026 Rally

While networks like Hedera face challenges from declining ETF inflows, weakening DeFi activity, and breaking support levels, several new crypto projects are trending upward.

Three promising crypto presales have already raised millions in funding, positioning them as some of the best crypto to buy now. The following discussion highlights these emerging coins and explains why they deserve attention ahead of the anticipated 2026 market rally.

Pepenode (PEPENODE)

Pepenode is a crypto presale generating interest with its unique approach to meme coin mining. The project has successfully raised $2.3 million, with only 18 days left before it concludes.

Pepenode offers a secure and accessible way for participants to claim tokens through official channels. Its innovative concept appeals to retail investors who are often drawn to meme coins, adding a cultural and community-driven dimension to the project.

While market conditions are still developing, Pepenode provides a clear framework for engaging with new presale opportunities. It represents an intriguing option for those exploring emerging crypto opportunities and the best meme coins to buy.

Visit Pepenode

Maxi Doge (MAXI)

Maxi Doge is a new meme coin positioned as a more ambitious version of Dogecoin, offering a unique mix of entertainment and investment potential. The project has already raised $4.3 million during its presale.

Its tokenomics allocate 25% to the Maxi fund, 40% to marketing, 15% to development, 15% to liquidity, and 5% to staking, creating a balanced ecosystem for growth and rewards. Maxi Doge also features a four-stage roadmap and a user-friendly platform.

With staking opportunities offering attractive returns, the token aims to engage both retail and crypto enthusiasts. Overall, Maxi Doge combines a strong community focus with clear utility for participants.

Visit Maxi Doge

Bitcoin Hyper (HYPER)

Bitcoin Hyper is a standout ICO, raising nearly $30 million despite a cautious market environment. The project combines meme coin appeal with practical technical features, including a capped supply and staking rewards linked to liquidity pools.

Its Layer 2 blockchain on Bitcoin enables near-instant transactions while maintaining security through zero-knowledge proofs, addressing Bitcoin’s slower transaction times. The on-chain design and clear use cases provide investors with transparency, testing options, and utility beyond typical meme coins.

Community growth has been strong, reflecting interest in both the token and its Layer 2 ecosystem. Bitcoin Hyper’s structure and innovation position it as a promising contender, offering potential upside in the next meme coin rally.

Visit Bitcoin Hyper

Conclusion

While Hedera shows promise, its drawbacks, including limited ETF inflows and sensitivity to broader market fluctuations, highlight the need for diversification. The crypto presales mentioned above have emerged as attractive options for investors seeking the best crypto to buy now.

By balancing established networks like Hedera with carefully researched presale opportunities, investors can optimize their portfolios while mitigating some of the risks associated with relying on a single token.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Dramatic Spot Crypto ETF Outflows Rock US Market

Remittix Success Leads To Rewarding Presale Investors With 300% Bonus – Here’s How To Get Involved