Bitcoin Flirts With $88K As Polymarket Shows 87% Chance Fed Holds Rates in January

The Bitcoin price edged up by over 1% in the past 24 hours to trade at $88,445 as of 1:27 a.m. EST, on trading volume that dropped 8% to $39.3 billion.

This comes as investors betting that January rate cuts will remain the same odds hit 87% on Polymarket, a signal that the Federal Reserve may leave them untouched.

Meanwhile, most Fed officials believe additional interest cuts are appropriate as long as inflation continues to cool, according to minutes released on Wednesday, December 30.

According to the minutes, policymakers slashed interest rates earlier this month to a range of 3.5% to 3.75% in a 9-3 vote.

Bitcoin Price On A Cautious Trend As Bears And Bulls Fight For Dominance

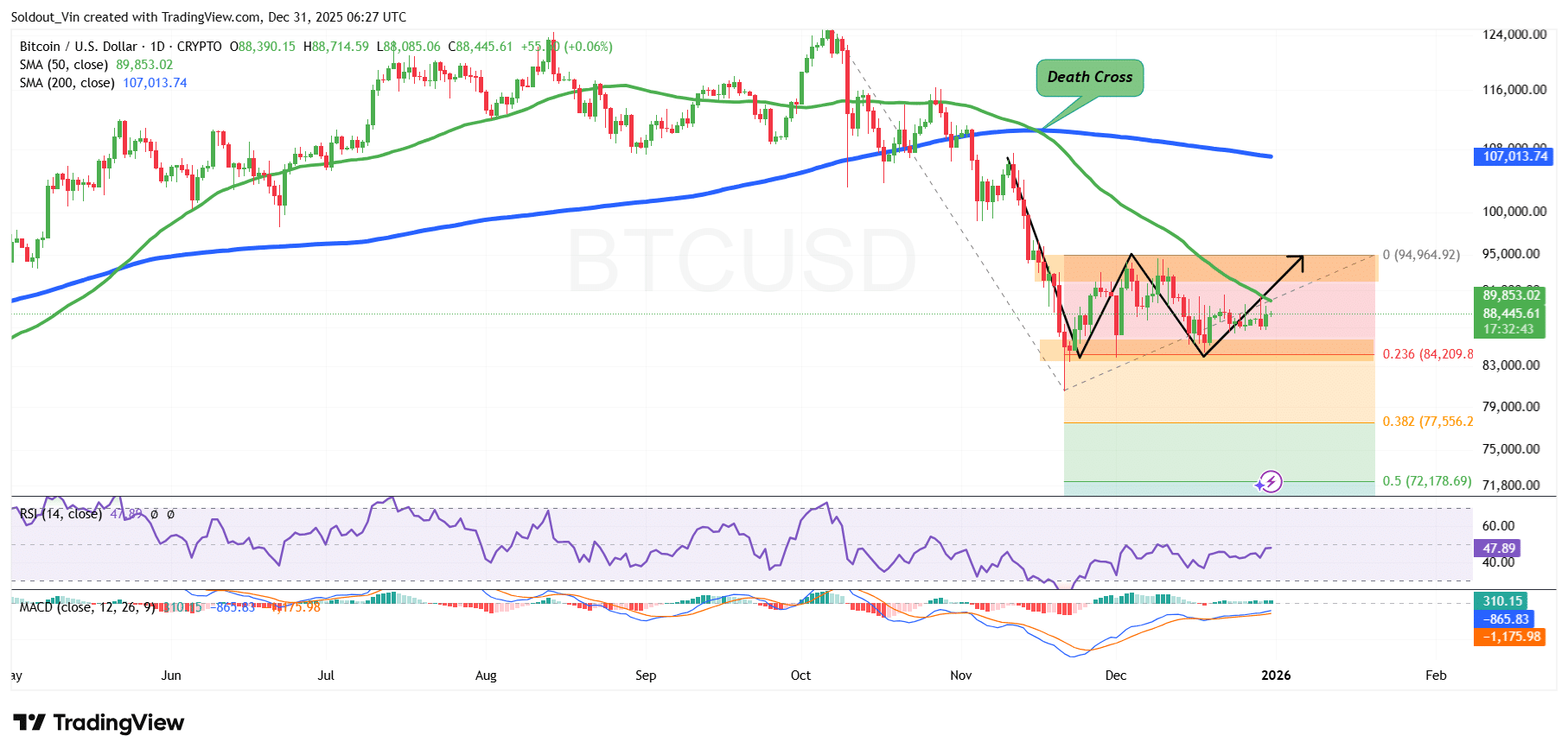

Investors are cautious about the BTC price, as the asset trades in a sideways pattern and indicators signal indecision in the market.

After a surge in April and May, the Bitcoin price consolidated above the $100,800 support area, allowing BTC to hit its all-time high (ATH) around $126,200.

However, bulls could not sustain the uptrend, after which bears took control, pushing the asset down and prompting investors to book profits, as shown by the trend-based Fibonacci retracement chart.

This downtrend was also fueled by the Simple Moving Averages (SMAs) forming a death cross at $110,404, after the 200-day SMA crossed above the 50-day SMA.

BTC is now trading below both SMAs, signaling that sellers still have some control.

After the downtrend, the price of BTC then hit a key support area around the $81,000 zone, now acting as a significant demand area. Since hitting this level in late November, Bitcoin has been trading in a consolidation phase, with the $94,964 level on the 0 Fib zone acting as a hurdle above.

However, Bitcoin is showing signs of a breakout, with trend indicators suggesting slight bullish pressure.

The Moving Average Convergence Divergence (MACD) has turned positive, as the blue MACD line has crossed above the orange signal line on the daily timeframe. The green bars on the histogram are also rising above the neutral line, confirming increased positive momentum.

Meanwhile, the Relative Strength Index has been trading between the 40-50 zone, indicating continued consolidation. The RSI, currently at 47.89, shows signs of a rebound, with buyers settling in.

BTC/USD Chart Analysis Source: TradingView

BTC/USD Chart Analysis Source: TradingView

BTC Price Prediction

Based on the BTC/USD chart analysis, the BTC price is currently in a tug-of-war, with the bears and bulls fighting for dominance at the 0 and 0.236 Fibonacci Retracement levels.

If bulls pick up from the last daily candle to maintain the upward move, and if they push BTC above the 50-day SMA ($89,853), the Bitcoin price could surge even more, crossing the $94,000 barrier as they target $107,100, the previous supply zone, and within the 200-day SMA.

According to Michaël van de Poppe, a crypto analyst on X with over 816k followers, BTC is currently testing the 21-day MA (around $88,300) on the daily chart. A close above this could indicate a sustained bullish rally.

However, on the downside, if bears take control, the price of BTC could drop back to the 0.382 Fib zone at $77,556, which is now acting as stable support in case of a sustained drop.

Related News

You May Also Like

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse