December Exploit Causes $3.9M in Counterfeit Token Losses — Shocking Details

Flow Network Recoveres After Protocol Exploit

The Flow Foundation has disclosed details of a security breach that compromised the blockchain on December 27, resulting in approximately $3.9 million in confirmed losses. The incident stemmed from a flaw in the network’s Cadence runtime, which allowed an attacker to duplicate tokens without draining user accounts or bypassing supply controls.

In its technical post-mortem, the Foundation explained that the attacker exploited a vulnerability that enabled asset duplication rather than actual minting, creating counterfeit tokens that temporarily flooded the network. The development team responded swiftly—validators coordinated a network halt within six hours of the malicious activity, switching the system into a read-only state to contain the problem and prevent further asset duplication.

Collaborating with exchange partners and security teams, most counterfeit tokens were frozen before they could be liquidated. The network recovery plan involved a two-day hiatus, during which legitimate transaction histories were preserved. Subsequently, the team executed a governance-approved process to permanently destroy the counterfeit assets, ensuring they did not circulate further.

Source: Flow BlockchainThe Foundation emphasized that no user account balances were compromised, as the attack only duplicated existing assets instead of extracting funds. A limited number of accounts involved with counterfeit tokens were temporarily restricted as a precaution, but over 99% of users maintained full access during and after the containment efforts.

Flow stated that it has since patched the underlying vulnerability, imposed stricter runtime validation checks, and expanded testing procedures to prevent similar exploits. Additionally, the project is working with forensic investigators and law enforcement agencies, with plans to enhance its monitoring and bug bounty programs as part of a broader security enhancement initiative.

Post-Hack Market Impact and Flow’s Turbulent Road

Developed by Dapper Labs—creators of CryptoKitties—the Flow blockchain was launched in September 2019 to address scalability issues faced by consumer applications like games and digital collectibles. The platform gained significant attention with the success of NBA Top Shot, an NFT platform for trading officially licensed NBA highlights, which helped propel the FLOW token above $40 in 2021, according to CoinGecko data.

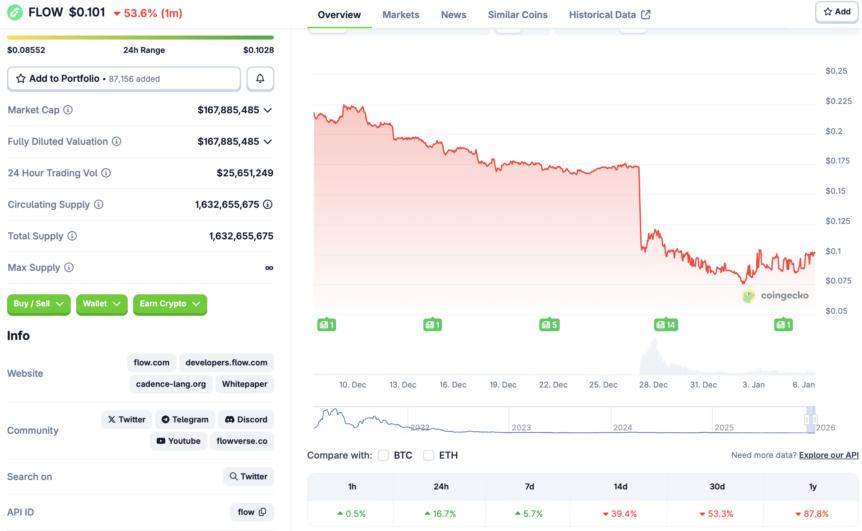

In 2022, Flow secured approximately $725 million from investors such as Andreessen Horowitz and Union Square Ventures to foster ecosystem growth. However, as the NFT market cooled in subsequent years, FLOW lost considerable momentum and fell outside the top 300 cryptocurrencies by market capitalization. Following the December hack, the token experienced a steep decline of around 40% over a five-hour period, plunging to a low of $0.075 on January 2.

Since then, the token has shown signs of recovery, climbing to about $0.10, a 16% increase within 24 hours. Despite the setback, the community remains optimistic about the platform’s future prospects amid ongoing security enhancements and renewed investor interest.

Source: CoinGecko

Source: CoinGecko

This article was originally published as December Exploit Causes $3.9M in Counterfeit Token Losses — Shocking Details on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

“Vibes Should Match Substance”: Vitalik on Fake Ethereum Connections