Iran Revolutionary Guard moved nearly $1B through Zedcex, Zedxion exchanges in 3 years

Iran’s Revolutionary Guard (IRGC) has allegedly been using crypto to slip past Western sanctions for at least 3 years now, according to a report by TRM Labs.

Since early 2023, the Guard has funneled about $1 billion through two UK-based crypto exchanges, Zedcex and Zedxion. Allegedly, these exchanges are helping the Guard send large amounts of USDT across borders without going through banks.

Iranian Guard used crypto to reach groups and suppliers abroad

For the uninitiated, the IRGC is the most powerful piece of Iran’s military, and it’s been under tough sanctions from the United States and others since it was decided that it was too powerful of an ally to Russia during the early days of the Ukraine war.

These rules were meant to block Iran’s Supreme Leader Ayatollah Khamenei from aiding his so-called ‘great friend’ Vladimir Putin and also doing business around the world, specifically when it comes to buying parts for weapons or allegedly supporting groups like Hezbollah, Hamas, and the Houthis.

However, TRM who couldn’t say exactly what the crypto funds were used for, just pointed out that the U.S. Treasury has already said Iranian financiers have used crypto to keep oil sales going.

Source: TRM Labs

Source: TRM Labs

For years, the Guard and others in Iran have run front companies to keep business alive. The report says they’ve now added these two crypto exchanges to the list.

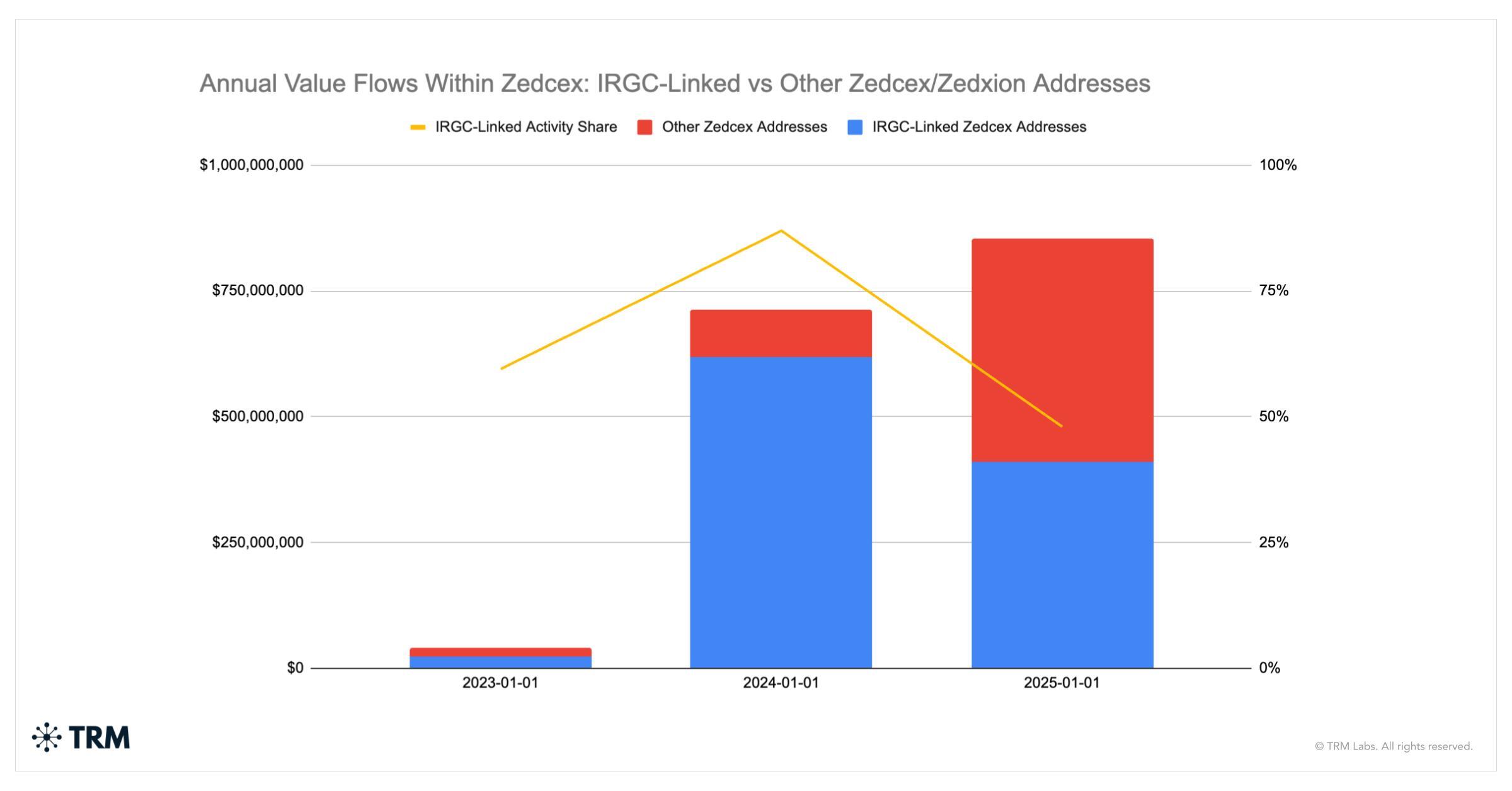

TRM found that between 2023 and 2025, the Guard’s transfers made up 56% of all the activity on Zedcex and Zedxion. It also said both brands are just different faces of the same company.

Ari Redbord, TRM’s policy chief, said, “Iranian-linked actors (including sanctioned military organizations) appear to be testing more persistent crypto infrastructure.”

Zedcex and Zedxion were tied to known Iranian oil smuggler

The numbers were massive: about $24 million in 2023, $619 million in 2024, and $410 million in 2025. Almost all of it went through USDT, the stablecoin made by Tether, and was sent over the Tron network.

TRM reportedly ran test transactions through the exchanges, then tracked where the money went. They followed a list of 187 wallet addresses, flagged by Israel, which were said to be run by the Guard. The money bounced between these wallets, offshore accounts, and other crypto firms inside Iran.

In one case, $10 million ended up in the wallet of a Yemeni man sanctioned by the U.S. in 2021. He was accused of selling Iranian fuel to raise cash for the Houthis.

The Guard also seemed to be working with Babak Zanjani, a name Iran watchers will know well. One of the exchange directors had the same name and birthday as him.

Zanjani was the guy who helped the government sell oil when Mahmoud Ahmadinejad was president. He got slapped with sanctions by Barack Obama in 2013 and was later accused by the Iranian government of stealing more than $2 billion.

Zanjani said he wasn’t guilty, blaming the sanctions for freezing the money. He was sentenced to death, but that never happened. His sentence was dropped in 2024, and he’s now free. The U.S. lifted its sanctions on him back in 2016 after Iran signed a nuclear deal, and those sanctions were never brought back.

Crypto channels helped Iran bypass official systems easily

Snir Levi, who runs the Israeli crypto analysis firm Nominis, backed up TRM’s findings, saying that his team allegedly looked at the same data and found at least $150 million that went through Zedxion and Zedcex tied to the Guard, though he provided absolutely no proof.

The exchanges claim on their websites that they follow anti-money-laundering rules, including checking IDs and banning users in about 30 to 50 countries. Iran is supposed to be on those lists. But the report shows that the Guard still used them.

TRM said they were able to make deposits and withdrawals from the platforms to trace how the Guard moved the money around.

Miad Maleki, who used to work at the U.S. Treasury, said, “The $1 billion figure over two years demonstrates that digital currencies are becoming a financial channel for Iran’s shadow banking apparatus.”

Tron, the crypto network involved in most of the transfers, said it had worked with Tether and TRM to try to stop this kind of activity. They claimed shady transactions have dropped “precipitously.” But clearly, the system worked well enough for the Guard to use it for $800 million over three years.

The smartest crypto minds already read our newsletter. Want in? Join them.

You May Also Like

Valour launches bitcoin staking ETP on London Stock Exchange

USDT Transfer Stuns Market: $238 Million Whale Movement to Bitfinex Reveals Critical Patterns