Best Crypto to Buy With $300 Before Q2 2026? Experts Prefer This $0.04 Altcoin to XRP

The post Best Crypto to Buy With $300 Before Q2 2026? Experts Prefer This $0.04 Altcoin to XRP appeared first on Coinpedia Fintech News

Crypto rotation has already begun ahead of Q2 2026. Traders are watching large caps that have slowed, while early stage projects with real product timelines begin to attract attention. In this shift, some analysts are now asking which asset offers better upside for a smaller ticket allocation such as $300. One name that has entered this discussion sits at only $0.04 and is approaching an important launch window.

Ripple (XRP)

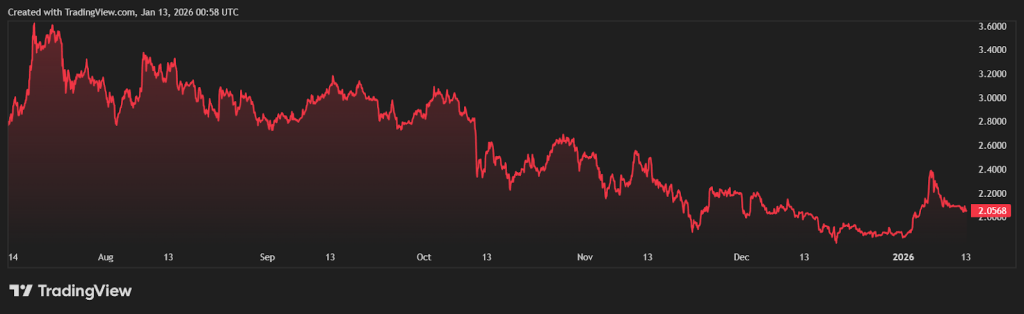

Ripple’s native token XRP remains one of the largest and most widely held cryptocurrencies in the market. The token is trading near $2.05–$2.10, with a market cap around $125 B–$140 B, keeping it among the top few assets by valuation in the space.

Early holders saw outsized gains during prior cycles as XRP captured broad exchange support and adoption narratives, helping it reach multi-billion dollar valuations and wide distribution across retail and institutional wallets.

Despite its size, XRP’s recent price action has shown limited bullish momentum. The token has encountered resistance near the $2.20–$2.35 zone, and trading ranges have tightened as new catalysts remain uncertain.

Large market cap assets typically need significant inflows to break higher, and several technical outlooks suggest modest upside potential near current levels unless fresh adoption drivers emerge. This has led some holders to look toward lower-priced assets with earlier usage curves and stronger growth signals rather than expecting another explosive move from a mature token.

Mutuum Finance (MUTM)

One project gaining attention in these rotation conversations is Mutuum Finance (MUTM). Mutuum Finance is building a lending and borrowing protocol with structured markets. Users will be able to supply liquidity to earn yield or access loans with collateral under defined rules. Interest logic and liquidation mechanics are built into the system so that usage is driven by financial activity rather than sentiment alone.

Mutuum Finance opened its token offering in early 2025 at $0.01. The token offering is structured into pricing phases with fixed allocation per stage. The token now sells at $0.04 in Phase 7.

The confirmed listing price is $0.06. More than $19.7 million has been raised and over 18,800 investors now hold MUTM. Analysts note that this growth has happened over time rather than as a one day hype event which gives the pattern a more steady character.

Three Reasons MUTM Could Follow Early XRP Style Steps

First is infrastructure before liquidity. XRP gained traction when Ripple began delivering on use cases for cross border value transfer. That utility separated XRP from meme tokens. Mutuum Finance is approaching its own utility window with its V1 protocol launch.

Once V1 goes live, depositors can supply assets for yield and borrowers can access funds with collateral. This introduces usage and transaction flow, which analysts consider a base for price models that are not purely speculative.

Second is adoption before attention. XRP’s breakout did not start with mainstream excitement. It began with growing wallet counts and exchange access. Mutuum Finance shows early signs of this pattern. Holder count has grown steadily. Allocation has filled over multiple pricing tiers.

More than 18,800 wallets now hold MUTM. These indicators are often watched by analysts because they represent early participation before broader visibility. The 24 hour leaderboard also rewards the most active participant with $500 in MUTM each day which keeps participation steady and reduces idle holding.

Third is timing before expansion. XRP’s early surge came before it peaked in attention. Analysts think MUTM sits in a similar expectation window. It still sells below one dollar. It has not yet entered public market liquidity.

It has a confirmed listing price above the current offered rate. Many analysts believe that once usage begins and revenue flow appears, attention could migrate and pricing models may adjust.

Phase 7 Importance

Phase 7 is important because it sits below the listing price. The $0.04 offering rate gives early buyers a defined discount to the $0.06 public listing price. With each phase having fixed allocation, supply tightens as more tokens are sold. This creates a clear boundary for late entrants who often attempt to position before price increments.

Security has also been a significant focus. Mutuum Finance completed a smart contract audit with Halborn Security. Halborn is a respected firm that reviews lending logic, collateral processes and liquidation execution.

Card payment support has also been activated which expands access for participants who prefer direct purchase rather than exchange routing. Allocation movement has been steady. Whale participation has also been noted, including a six figure allocation reported within the current phase as larger participants attempt to secure placement before pricing shifts.

For more information about Mutuum Finance (MUTM) visit the links below:

Website:https://www.mutuum.com

Linktree:https://linktr.ee/mutuumfinance

You May Also Like

Grayscale ETF Tracking XRP, Solana and Cardano to Hit Wall Street After SEC Pause

SoftBank (SFTBY) Stock; Slight Dip Amid AMD Collaboration on AI Infrastructure