Sonic Recovers 5.8M S Tokens from Hack as Prices Struggle

Sonic Labs has completed the recovery and redistribution of 5,829,196 S tokens related to the November exploit on the Beets platform. The tokens have been returned to affected users through a verified claims process.

Interestingly, the recovery closes a multi-month effort that began immediately after the breach. As reported earlier, hacks and scams haunted crypto in 2025, with related losses hitting $4.04 billion in 2025, a 34% increase from 2024.

What Happened in November

The Beets platform, a Solana-based decentralized exchange and liquid staking hub, suffered an exploit in November. The attack originated from a vulnerability inside the Balancer protocol. Attackers used this weakness to drain funds, not only from Beets but across connected liquidity paths.

After the exploit, Sonic Labs decided to secure remaining funds and paused exposed contracts. Blockchain tracking firms followed the stolen tokens across multiple wallets and chains. A portion of the assets remained visible and reachable, which made recovery possible.

How the Tokens Were Recovered and Distributed

Sonic Labs ran a multi-phase recovery plan. The team traced transactions, contacted wallet holders directly through on-chain messages, and worked with centralized exchanges to freeze flagged funds.

Also, legal coordination across jurisdictions supported these actions. Community reports also helped identify wallets linked to the exploit. Meanwhile, recovered tokens were sent back through a claims portal.

Through the portal, users submitted proof of loss tied to on-chain data. Each claim went through several checks. The final payouts were handled by a smart contract that calculated each user’s share based on verified losses and all transfers were executed on-chain.

S Token Price Action and Key Levels

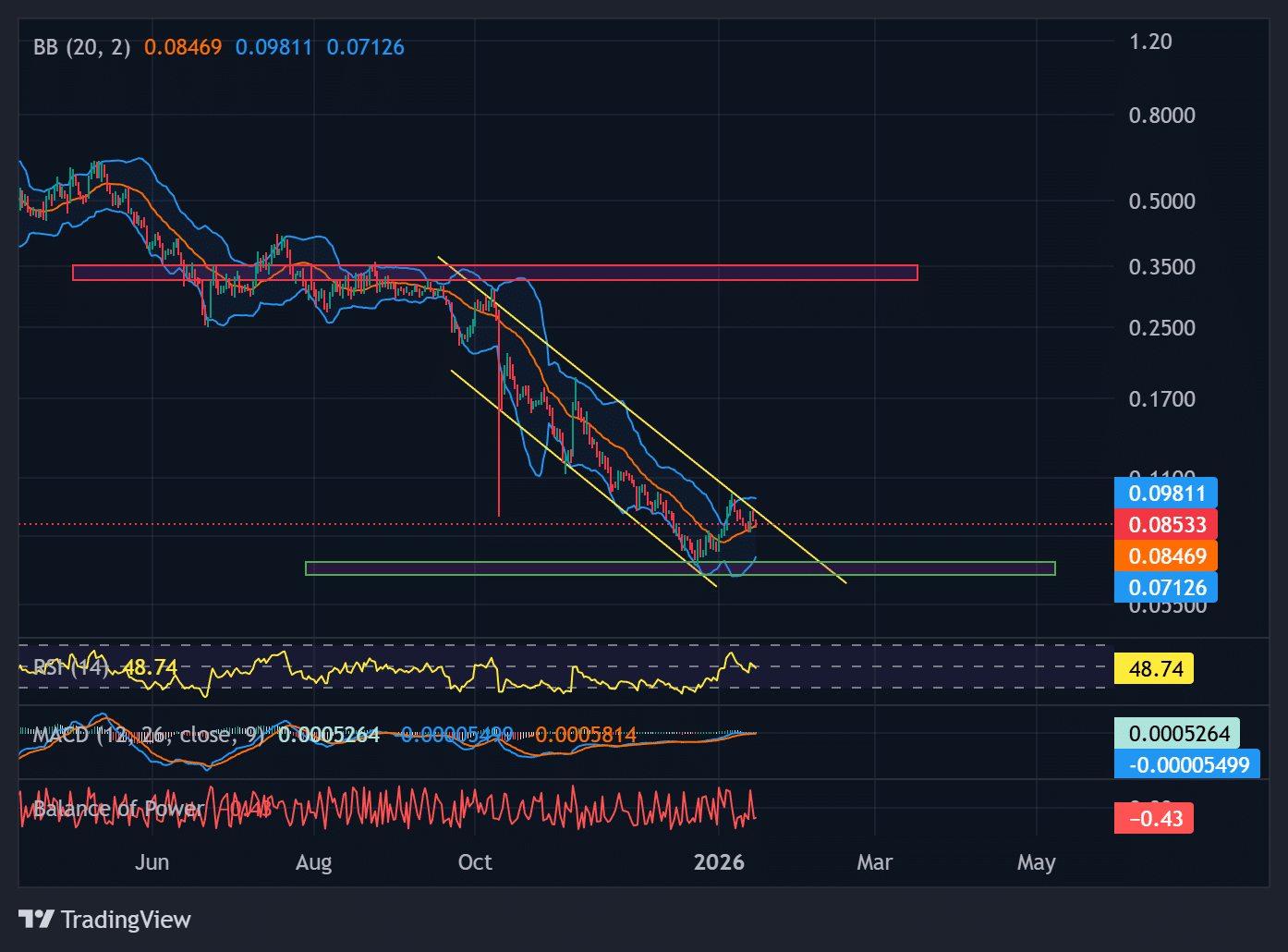

S trades at $0.08522, down 5.6% over the past 24 hours. Price recently bounced from the $0.071-$0.075 zone, which has acted as strong demand. This area forms the lower Bollinger Band and a very important region of support.

The short-term trend remains inside a falling channel. As long as price stays below $0.098-$0.10, rallies are corrective. A clean break and daily close above this zone would open a move toward $0.12.

S token price chart | Source: TradingView

Failure to hold above $0.08 puts pressure back on the $0.075 support. A loss of that level would expose $0.071 as the next pullback target. Momentum indicators remain neutral, with RSI near 49 and no clear trend shift yet.

nextThe post Sonic Recovers 5.8M S Tokens from Hack as Prices Struggle appeared first on Coinspeaker.

You May Also Like

Steak ’n Shake $0.21 Bitcoin Bonus for Employees Faces Backlash

Highlights: Steak ’n Shake will give workers a $0.21 Bitcoin bonus for each hour worked. Employees may earn about $800 in two years, but critics c

China’s Ban on Nvidia Chips for State Firms Sends Stock Tumbling