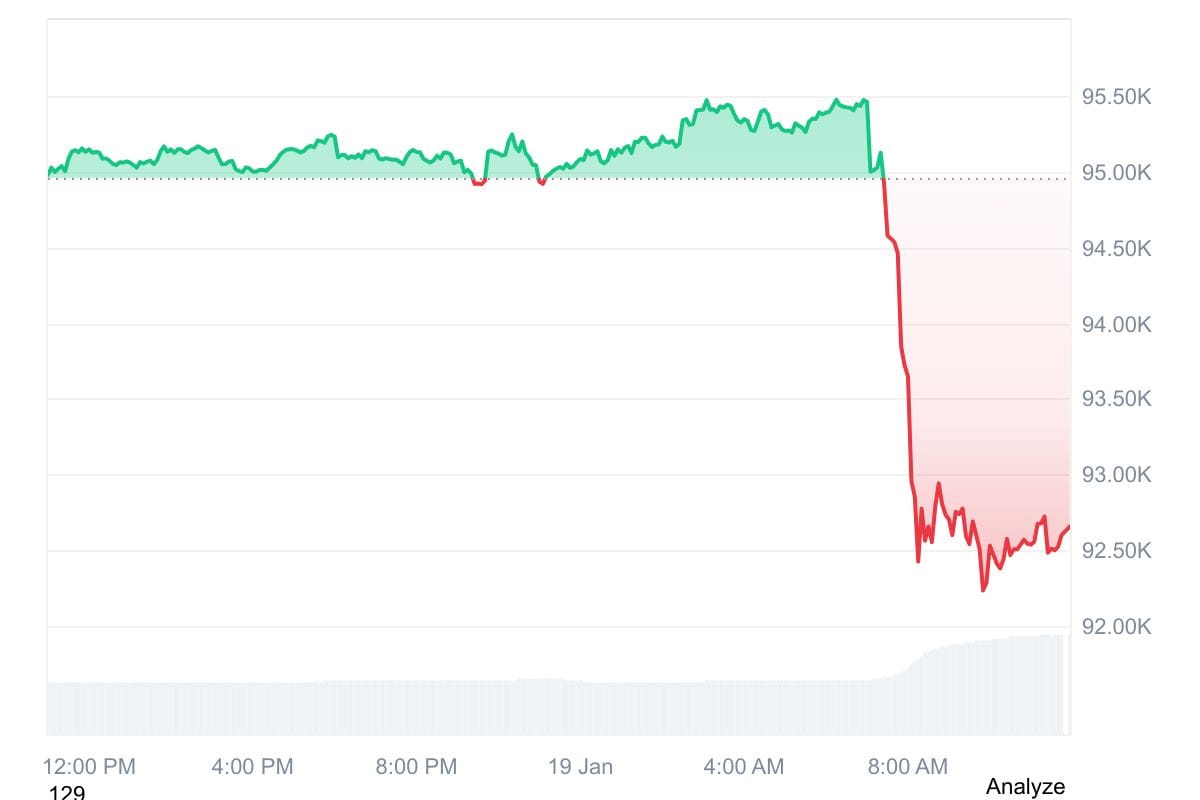

Bitcoin Drops to $92.5K as Trump Tariff Threat Triggers $525M Liquidation

Bitcoin dropped to $92,500 in Asian trading Monday – a 2.6% decline in 24 hours – erasing weekend gains and triggering $525 million in long liquidations within 60 minutes across crypto markets, according to Coinglass data, as President Donald Trump's tariff threats against eight European nations rattled risk assets globally.

Meanwhile, while Ethereum fell 2.2% to $3,240 over the same period. The selloff came after Trump announced Saturday he would impose 10% tariffs on Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland starting February 1, escalating to 25% by June 1 unless those countries agree to U.S. acquisition of Greenland.

Bitcoin had climbed near $98,000 by Thursday before consolidating around $95,000 through the weekend. The Monday morning plunge wiped out those gains as traders unwound leveraged positions amid broader risk-off sentiment.

Trump cited national security and what he called the "Golden Dome" defense system as justification for acquiring Greenland, a Danish autonomous territory. He said the system requires Greenland's inclusion to function at maximum efficiency due to "angles, metes, and bounds" related to missile defense architecture.

The eight targeted countries issued a joint statement responding that "tariff threats undermine transatlantic relations and risk a dangerous downward spiral." German Foreign Minister Johann Wadephul told ARD television he doesn't believe a U.S.-EU trade agreement signed last year is possible under current circumstances.

French President Emmanuel Macron's aides said he would ask the European Union to activate its anti-coercion instrument against Washington if Trump proceeds with tariffs. The measure, never before used, allows the EU to restrict imports of goods and services into the 27-nation bloc with a combined population of 450 million.

Bloomberg reported EU member states are discussing retaliatory levies on $108 billion worth of U.S. goods.

Flight to safety

Gold hit a record $4,690.59 per ounce while silver reached $94.12 as investors fled to safe-haven assets. Asian equity markets dropped across Tokyo, Hong Kong, Shanghai, Sydney, Singapore, and Wellington, though Seoul and Taipei posted gains. European and U.S. futures declined.

The dollar weakened against major currencies, with the euro, sterling, and yen all rising. Charu Chanana, chief investment strategist at Saxo Markets, wrote that the key question is whether Trump's rhetoric translates to policy, which is why concrete dates matter.

"Even if the immediate tariff threat gets negotiated down, the structural risk is that fragmentation keeps rising, with more politicised trade, more conditional supply chains, and higher policy risk for companies and investors," Chanana said.

The tariff announcement follows Trump's threats against Iran last week and the U.S. ouster of Venezuelan president Nicolas Maduro, creating a series of geopolitical shocks that have driven safe-haven demand while pressuring risk assets including cryptocurrencies.

BTC's correlation with risk assets

Bitcoin's correlation with risk assets has strengthened over the past year as institutional adoption through spot ETFs increased. The cryptocurrency now tends to sell off alongside technology stocks and other growth-oriented investments during risk-off episodes rather than acting as an independent store of value.

The $525 million in liquidations primarily affected long positions betting on continued Bitcoin price appreciation. Liquidations occur when leveraged traders' collateral falls below maintenance requirements, forcing automatic position closures that can amplify price movements in thin liquidity conditions.

Crypto markets face additional uncertainty as Trump's tariff escalation threatens global trade flows and economic growth, potentially constraining risk appetite for digital assets. The February 1 implementation date provides a three-week window for negotiations, though Trump's statement indicated tariffs would remain until Greenland acquisition terms are reached.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For

U.S. regulator declares do-over on prediction markets, throwing out Biden era 'frolic'

Copy linkX (Twitter)LinkedInFacebookEmail