👨🏿🚀TechCabal Daily – IP-oh no

Good morning.

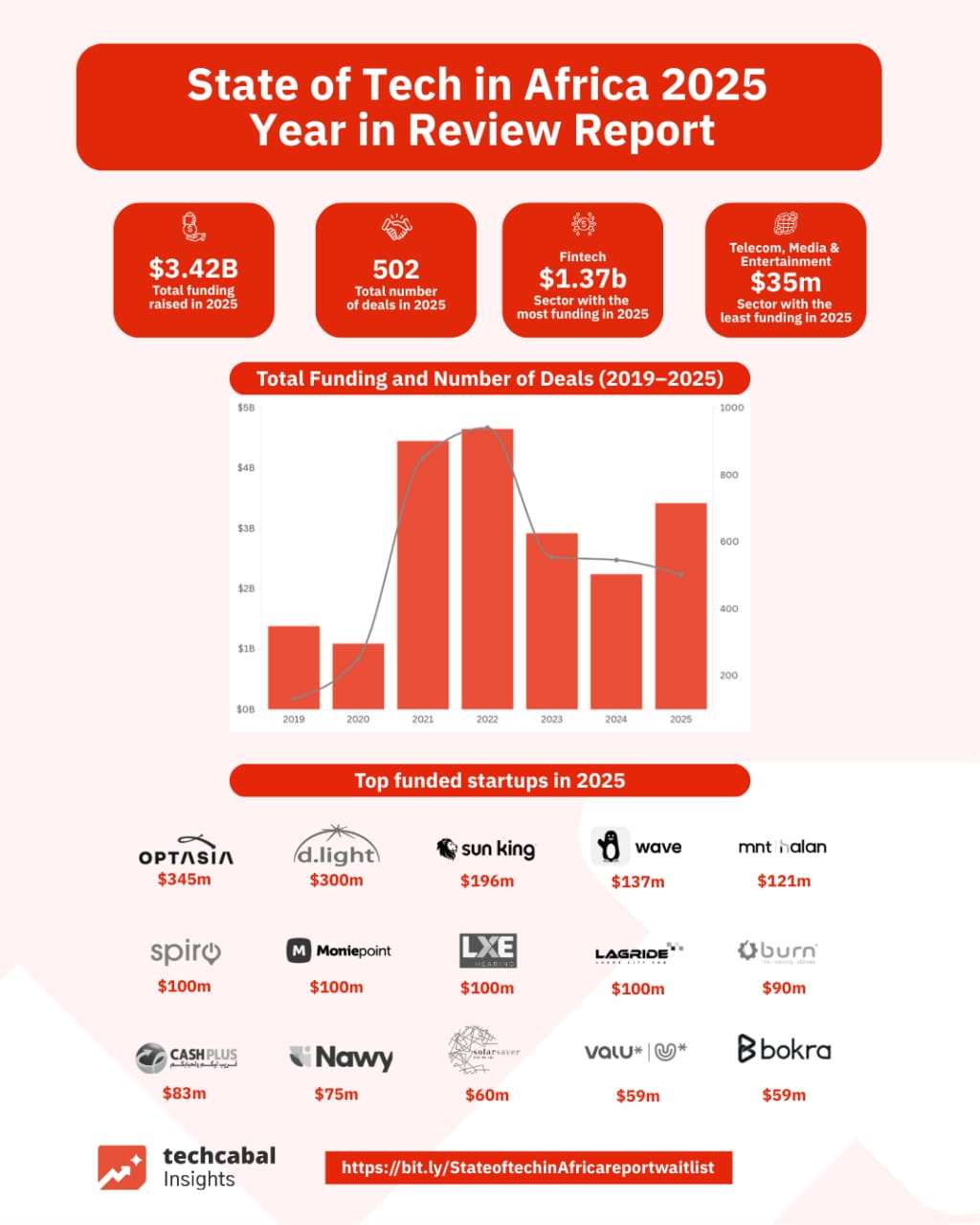

Over the last seven years, African startups have raised $20.16 billion across 3,779 deals, yet 2025 marked a turning point. Startups raised $3.42 billion across 502 deals last year, including seven mega deals exceeding $100 million, proving the ecosystem is showing signs of recovery.

In 2025, the TechCabal Insights team tracked 67 M&A deals across the continent; over 70 were strategic partnerships, and about 50 deals were market expansion plays, all signalling consolidation, capital discipline, and industry resilience. Be the first to understand what these signals mean for the African tech ecosystem.

Join the waitlist to receive the State of Tech in Africa 2025: A Year in Review report; get early access by clicking this link.

- Kenya’s first IPO in 11 years

- Sentech investigated for monopolistic behaviour

- Podcasts could get regulated in South Africa

- South Africa blows hot about spam calls—again

- World Wide Web 3

- Events

Companies

Kenya finally breaks the IPO drought; Pipeline Company goes public

Treasury Cabinet Secretary John Mbadi. IMAGE | NMG

Treasury Cabinet Secretary John Mbadi. IMAGE | NMG

If it feels like Nairobi’s capital markets just cleared their throat after a very long silence, you’re not imagining it.

On Monday, the Kenya Pipeline Company (KPC), a state-owned corporation which builds, owns, and operates pipelines and storage facilities to transport refined petroleum products, listed on the Nairobi Securities Exchange (NSE).

The Kenyan government offered 65% of its shares—about 11.8 billion shares—to the public to buy into one of the country’s most visible, debt-free businesses. The offer will be broadly allocated to different groups, including Kenyan retail investors (20%), institutional investors (20%), foreign investors (20%), East Africa Community investors (20%), oil marketing companies (15%), and KPC employees (5%).

The listing, a breath of fresh air, comes after an 11-year initial public offering (IPO) drought for the NSE.

What’s different this time? Kenya’s Treasury, the government arm responsible for public finances, sold its shares at KES 9 ($0.070) each, aiming for a valuation of KES 163.6 billion ($835 million). The offer period runs for one month, longer than past IPOs, with trading on the NSE to begin on March 9. This is the largest IPO in Kenya since Safaricom in 2008 and is seen as a crucial test for investor confidence in the exchange.

It is also Kenya’s first fully electronic IPO, meaning there are no paper forms or queues.

Why now, after all this time? Kenya owes heavy debts. The government previously tried other means to raise cash, but now that it has sold off 15% of its Safaricom stake to South Africa’s Vodacom for KES 204 billion ($1.5 billion), it needs another cash cow. That’s where the KPC comes in.

Eyebrows are raised: Despite the significance of the event, critics have said that the IPO open day felt rushed, with an information memorandum that appears unfinished, inconsistent, and oddly sloppy. That sloppiness complicates the story. Is this a carefully planned IPO listing or a deal accelerated by fiscal pressure? The need for cash is real, and the asset is strong, as it reported KES 10 billion ($77.5 million) in pre-tax profit in the 2024 financial year.

Your 2026 demands disciplined financial operations

Fincra powers the payments infrastructure businesses rely on to collect, pay, and settle across local and major African currencies with confidence. Get started.

Streaming

South Africa’s Communications Regulator is investigating Sentech over broadcasting anti-competitive behaviour

Image source: Meme Arsenal.

Image source: Meme Arsenal.

The Independent Communications Authority of South Africa (ICASA), the country’s communications regulator, has just taken a major step to tighten control over Sentech, the state-owned company that carries TV and radio signals nationwide.

The regulator has published draft rules that would declare Sentech as a company with significant market power across terrestrial television, FM radio, and AM radio, and propose rules that would force it to be more transparent and accountable in pricing and service.

What is Sentec, and why does it have so much power? Sentech sits at the centre of South Africa’s broadcast ecosystem. It runs the towers, the transmitters, the infrastructure that makes free-to-air TV and radio possible. Its portfolio spans terrestrial television, FM radio and AM radio. For most broadcasters, there is no credible alternative supplier, and that is dominance by structure.

The complaints that just won’t go away: According to media reports, broadcasters have been grumbling for years, but lately it has become louder. The SABC and e.tv owner, eMedia, argue that Sentech’s fees are high and impossible to challenge, a dispute so serious that it’s in arbitration.

What changes now? The draft regulations aim to level the playing field. Sentech would have to submit reference offers that detail its prices, service standards, and dispute-resolution mechanisms, all publicly available for scrutiny. Its tariffs must be cost-based, and Icasa will have final say in conflicts. Non-compliance could attract fines of up to R5 million ($305,000).

These rules recognise Sentech’s outsized power while trying to give some breathing room for broadcasters that have long felt trapped by a monopolistic system.

Get access to logistics providers across Africa

The Logistics Marketplace connects health buyers – governments, partners, humanitarian organisations & manufacturers with logistics providers across Africa. Backed by Global Fund & Gates Foundation, join for free with Access Code WELCOME2026!

Regulation

South Africa might be coming for your podcasts

Image source: TechCabal.

Image source: TechCabal.

If you thought podcasts were still the Wild West of media, the South African government would like a word.

The Department of Communications and Digital Technologies is once again flirting with the idea of regulating podcast content, as it finalises a long-delayed white paper on Audio and Audiovisual Media Services and Online Safety. In simple terms, podcasts sit outside South Africa’s broadcasting laws, and the government is considering bringing them in.

State of play: According to Communications Minister Solly Malatsi, podcast content does not fall under the Electronic Communications Act, nor is it regulated by the Independent Communications Authority of South Africa (ICASA). That gap is now under review. The government’s argument is not that podcasters have misbehaved, but that the laws governing media are old. Very old. The Broadcasting Act dates back to 1999. The Electronic Communications Act was written in 2005. Podcasts, YouTube, and streaming barely existed in that world.

Lawmakers say the goal is modernisation, not censorship. Any limits on speech, Malatsi insists, would only apply where the Constitution already allows it. Separately, the Justice Department is working on new hate speech and hate crime regulations, adding another layer to the conversation about online content.

What changes if podcasts are regulated? Potentially a lot. The proposed policy would bring digital audio and video content closer to traditional broadcasters, meaning podcasts on platforms like YouTube could fall under complaint mechanisms similar to radio and TV. South Africa already leans heavily on self-regulation through bodies such as the Press Council and the Broadcasting Complaints Commission. One proposal is to expand that system to include podcasts.

The bigger picture is about control and consistency. As streaming platforms face licence requirements and local content quotas, podcasts are the last major media format operating largely on trust. Whether regulation cleans up the ecosystem or causes a fringe on digital creativity is the real question. For now, podcasters should know this: the government is listening.

Regulation

South Africa is cracking down on spam calls

Image source: MyBroadBand.

Image source: MyBroadBand.

In 2019, South Africans were one of the most spammed people on the continent. Random telemarketing calls and auto-responders that have no business with the receiver were common. At the time, South Africans received 31 spam calls monthly—at least one a day, according to Truecaller, the global caller identity platform. By 2021, that number declined to 13.2 monthly, but recent tests suggest that the average South African is still spammed more than 80% of the time, for every phone call received.

The country’s Information Regulator says it has had enough of that.

State of play: The watchdog is stepping up its crackdown on unsolicited telemarketing, escalating several spam call complaints to its Enforcement Committee, the body that can recommend enforcement notices, fines, and even jail time. Under the Protection of Personal Information Act (POPIA), offenders who ignore enforcement notices risk fines of up to R10 million ($610,000) or a stint behind bars.

This is not a new warning. The regulator has rules, guidance notes, and amended regulations in place. The problem, according to spokesperson Nomzamo Zondi, is compliance. Despite a landmark fine issued in 2024, some telemarketers continue to treat POPIA like a suggestion rather than the law.

The poster child is FT Rams Consulting, the first company to receive an enforcement notice for unlawful direct marketing. After ignoring repeated opt-out requests, failing to prove compliance, and then skipping payment of its R100,000 ($610) fine, the regulator is now heading to court. Chairperson Pansy Tlakula has made it clear that patience has run out, according to local publication MyBroadBand.

What changes now is posture. The regulator plans to intensify monitoring and targeted assessments in 2026, focusing on companies that flout consent rules. More cases are already queued for escalation, with outcomes promised publicly.

The bigger picture: South Africa is moving from warnings to consequences. If POPIA’s direct marketing rules are enforced as written, spam calls could finally become risky business. For consumers, that might mean fewer interruptions. For marketers, it means one last reminder that consent is not optional anymore.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| Bitcoin | $91,564 |

– 1.09% |

+ 4.07% |

| Ether | $3,167 |

– 1.15% |

+ 6.67% |

| RollX | $0.1505 |

+ 9.02% |

+ 49.19% |

| Solana | $132.89 |

– 0.23% |

+ 6.24% |

* Data as of 06.50 AM WAT, January 20, 2026.

Events

- Africa Tech Summit Nairobi is returning for its eighth edition in February 2026, and this time, payments infrastructure is getting top billing. Fincra, a pan-African fintech company, has been announced as the headline supporter of the event, which will hold on February 11–12, 2026, at the Sarit Expo Centre, Nairobi, Kenya. The summit will bring together over 2,000 delegates across fintech, AI, climate tech, and startups to discuss how Africa builds interoperable payment rails for cross-border trade and digital commerce. Get your tickets here.

- Ag Safari is hosting a deep-dive event on “How African Agtechs Can Get Working Capital in 2026,” bringing together leading investors and operators to unpack what it really takes to fund and scale agtech in a tougher funding climate. Featuring Melanie Keita, co-founder and CEO of Melanin Kapital, and Reginald Seleu, Investment Associate at Sahel Capital, the session will explore why African agtechs raised over $169 million across 87 deals in 2025, what this means for founders, and how to build asset-backed, resilient models investors now want to see. It’s a must-attend for founders and investors figuring out how to navigate a tougher fundraising climate and keep ventures liquid through lean seasons. Register here to attend on January 22.

- Don’t agree with your tax bill? Nigeria’s new law gives you 30 days to object

- How Levvy Box turns Lagos traffic into a mobile advertising goldmine Ask An Investor: Why Shell Foundation and 500 Global built an accelerator for Africa’s climate startups

Written by: Emmanuel Nwosu and Opeyemi Kareem

Edited by: Emmanuel Nwosu & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

You May Also Like

YouTube Advertising Formats: A Complete Guide for Marketers

Scott Melker Sees Bitcoin Upside Despite Growing Caution in Price Forecasts