SUI Partners with River: Is RIVER Price Set to Exceed $45 or Enter a Cool-Off Period?

The post SUI Partners with River: Is RIVER Price Set to Exceed $45 or Enter a Cool-Off Period? appeared first on Coinpedia Fintech News

The RIVER price has entered the spotlight after a sharp rally pushed the token into one of January’s top-performing mid-cap moves. Driven by new exchange listings, rising derivatives activity, and growing interest in its cross-chain stablecoin model, RIVER is drawing attention far beyond its 205th market-cap rank on CoinMarketCap.

RIVER Price Reaction Fueled by New Exchange Listings

The latest surge in the RIVER price followed its January 20 listing on Coinone with a KRW trading pair. Historically, exchange listings do have the power to attract aggressive speculative volume, and RIVER was no exception, it received, too. Immediately after the listing, price momentum accelerated, pushing daily volumes sharply higher and lifting market confidence.

Adding to this momentum, speculation around potential listings on larger global exchanges has further increased demand. While unconfirmed, these rumors have amplified trading interest, contributing to the rapid expansion seen in RIVER price USD action over recent sessions.

Omni-Stablecoin Vision Strengthens RIVER Crypto Narrative

Beyond listings, fundamentals have played a central role. RIVER crypto is developing a chain-abstraction stablecoin system designed to connect assets, liquidity, and yield across multiple blockchains. Its planned deployment of satUSD across more than 15 chains by 2026 positions the project within the growing narrative of chain abstraction.

A recent integration announcement with the SUI crypto ecosystem has significantly increased RIVER’s visibility in this regard. By enabling liquidity teleportation into Sui through satUSD, RIVER reinforces its Omni-CDP model, which aims to remove reliance on traditional bridges. This development strengthens the long-term RIVER price forecast narratives too, as utility-driven adoption expands.

Technical Breakout Defines the RIVER Price Chart

From a technical perspective, the RIVER price chart reflects sustained strength since early January. Following a short-term golden cross between the 20-day and 50-day EMAs, RIVER price today has climbed from near $7 to around $33.8, marking gains exceeding 350%.

Price has also respected an ascending channel on the daily timeframe, recently testing its upper boundary. A continuation of momentum could open a move toward the $37 zone. However, failure to break higher may lead to a retracement toward the $25 support area, where renewed buying interest could shape the next leg of the RIVER price prediction for Q1.

Momentum Indicators and Derivatives Signal Strength, Not Euphoria

Momentum indicators broadly support the recent rally, though some caution is warranted. The RSI has moved above 70, suggesting the RIVER price may require consolidation. At the same time, the CMF remains positive, indicating capital inflows are still present rather than exiting.

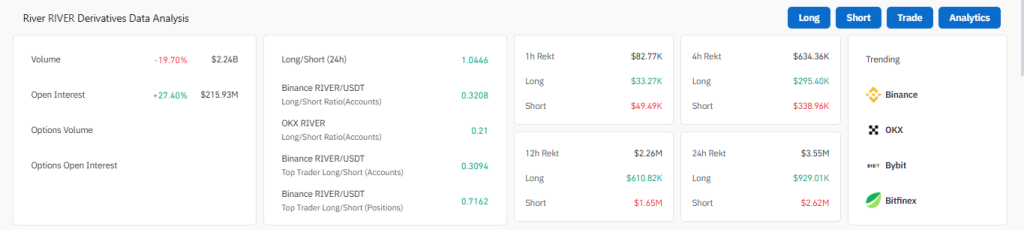

In derivatives markets, open interest has climbed roughly 27% to over $215 million, while volumes remain elevated. The long/short ratio flipping above 1 reflects dominant short liquidations, reinforcing the bullish bias without signaling excessive leverage buildup yet.

You May Also Like

The Channel Factories We’ve Been Waiting For

Will XRP Price Increase In September 2025?