Strategy Acquires 22,305 BTC for $2.13B as Total Holdings Hit 709,715 Bitcoin

Strategy disclosed its third and largest Bitcoin BTC $90 368 24h volatility: 3.0% Market cap: $1.81 T Vol. 24h: $48.03 B acquisition of 2026 on January 19, purchasing 22,305 BTC for approximately $2.13 billion.

The company’s total holdings now stand at 709,715 BTC, representing roughly 3.38% of Bitcoin’s total 21 million supply.

The acquisition occurred between January 12 and January 19 at an average price of $95,284 per coin, according to the company’s SEC filing.

Executive Chairman Michael Saylor confirmed the purchase on X, sharing the company’s updated holdings. Saylor hinted at new Bitcoin accumulation on January 19 by posting his familiar “₿igger Orange” signal before the regulatory filing.

Bitcoin Treasury Expansion

The acquisition follows Strategy’s previous $1.25 billion purchase of 13,627 BTC disclosed on January 12. The company has added 37,218 BTC to its treasury in January 2026 alone, including an earlier 1,286 BTC purchase.

Top 100 public companies by Bitcoin treasury holdings as of January 20, 2026. | Source: BitcoinTreasuries.net

Strategy holds more Bitcoin than any other publicly traded company in the world. Its position is over 13 times larger than the second-largest corporate holder, MARA Holdings, which owns 53,250 BTC as of January 20.

Capital Raise Program

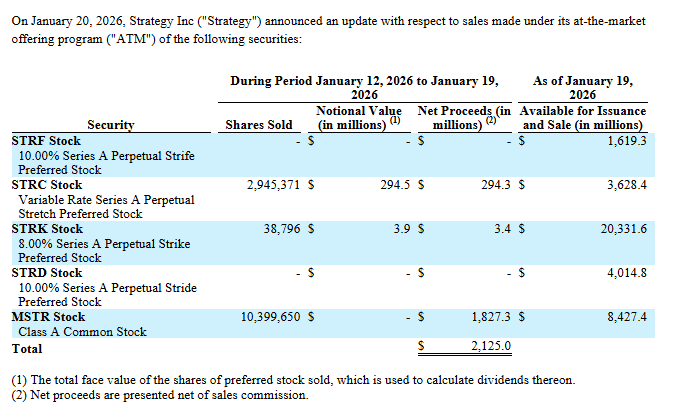

Strategy funded the purchase by selling company shares on the open market. The company raised $1.827 billion from common stock sales and $297.7 million from preferred share offerings.

The capital raise has exceeded Strategy’s original $42 billion target under its 21/21 Plan. Strategy reached the goal in approximately 13 months, ahead of the original three-year timeline.

Strategy’s ATM share sales breakdown for the week ending Jan. 19, 2026. | Source: SEC Form 8-K

The company can raise an additional $38 billion through future share sales, according to the filing. Strategy’s stock closed at $173.71 on January 17.

The stock has declined approximately 66% from its 2025 peak, and the company’s share count has grown from 77 million to roughly 267 million since 2021 as Strategy funds Bitcoin purchases through equity sales.

nextThe post Strategy Acquires 22,305 BTC for $2.13B as Total Holdings Hit 709,715 Bitcoin appeared first on Coinspeaker.

You May Also Like

The Channel Factories We’ve Been Waiting For

Will XRP Price Increase In September 2025?