MTN, Airtel restore services in Uganda after 7 days of imposed shutdown

MTN and Airtel mobile money operations have now been restored in Uganda. This comes seven days after the Ugandan Communications Commission (UCC) imposed an internet blackout days before the general elections.

Although the East African country’s Communications Regulator, on Sunday, announced the restoration of public internet access nationwide, access to mobile money operations and social media was restricted.

Confirming the restoration of mobile money service, MTN Uganda, in a message to customers on Tuesday, said:

“Kindly note that Mobile Money services have been restored. Please proceed with your transactions and share your feedback.”

Following the conclusion of its election and declaration of the result on Saturday, citizens were hopeful of internet access. With the UCC restoring access to essential services, mobile money operations and social media access were still restricted.

In the public announcement on Sunday, the UCC’s Executive Director, Mr Nyombi Thembo, noted that only access to web browsing, access to news websites, educational resources, government portals, financial services, and email were restored.

“In line with the directive issued to all licensed mobile network operators and internet service providers, social media platforms, and messaging over-the-top, or if you may, OTT applications remain temporarily restricted to continue safeguarding against misuse that could threaten public order,” he said.

The restriction on mobile money services caused significant financial distress and the inability to meet daily needs for users, which also led to frustration and increased outrage.

With the confirmation of mobile money services, users can now deposit, make withdrawals and perform other operations on both telecom operators’ services.

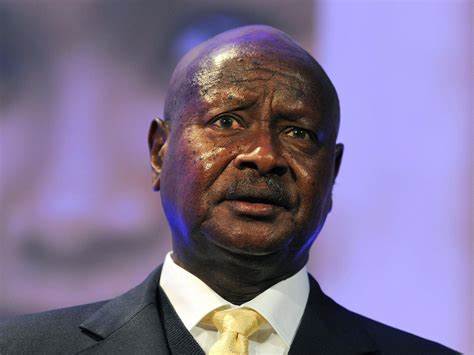

Uganda President, Yoweri Museveni

Uganda President, Yoweri Museveni

Recall that Ugandan President Yoweri Museve was declared the winner of Thursday’s election, extending his four decades in power by another five years. He gained 72% of the vote, against Bobi Wine’s 25%.

Also Read: Internet returns to Uganda but MTN and Airtel mobile money remain unavailable.

MTN Uganda’s clarification

Before its earlier statement that UCC restricted access to mobile money operations, MTN had clarified that the Bank of Uganda (BoU) was responsible for blocking access to the financial service.

On Monday, the telecoms operator noted in response to multiple customers’ frustration that “That is unfortunate,” it said, noting that “mobile money restrictions are still in place as per UCC directive.”

While correcting on Tuesday, the company clarified that “the mobile money restrictions were issued by the Central Bank, not the UCC. We apologise for the earlier misinformation.”

MTN Uganda CEO, Sylvia Mulinge

MTN Uganda CEO, Sylvia Mulinge

In addition, the operator explained that subscribers whose data subscription expired during the internet shutdown phase will be restored. In response to multiple customers’ complaints on X over the inability to use their mobile data, MTN, in clarification of the compensation measure, noted that:

“Please note that our technical team is currently analysing the data to determine the appropriate compensation for each affected customer. We expect this process to be completed within one week.”

However, while access to mobile money operations has now been restored, access to social media applications such as WhatsApp, TikTok and Facebook remains ‘officially’ restricted.

The post MTN, Airtel restore services in Uganda after 7 days of imposed shutdown first appeared on Technext.

You May Also Like

The Surprising 2025 Decline In Online Interest Despite Market Turmoil

Cryptos Signal Divergence Ahead of Fed Rate Decision