LivLive vs Solana And HYPE: Why This Explosive New Crypto Presale Is Becoming the Market’s Hottest Early-Stage Investment

Imagine waking up to a crypto market where established giants like Solana and Hyperliquid dominate headlines, yet a fresh contender surges ahead with unprecedented momentum. In this volatile landscape, investors are scrambling to identify the top crypto to buy before the next bull run ignites. While Solana battles network fluctuations and Hyperliquid navigates DeFi trading highs, LivLive emerges as the explosive new crypto presale capturing attention for its real-world utility and sky-high potential returns.

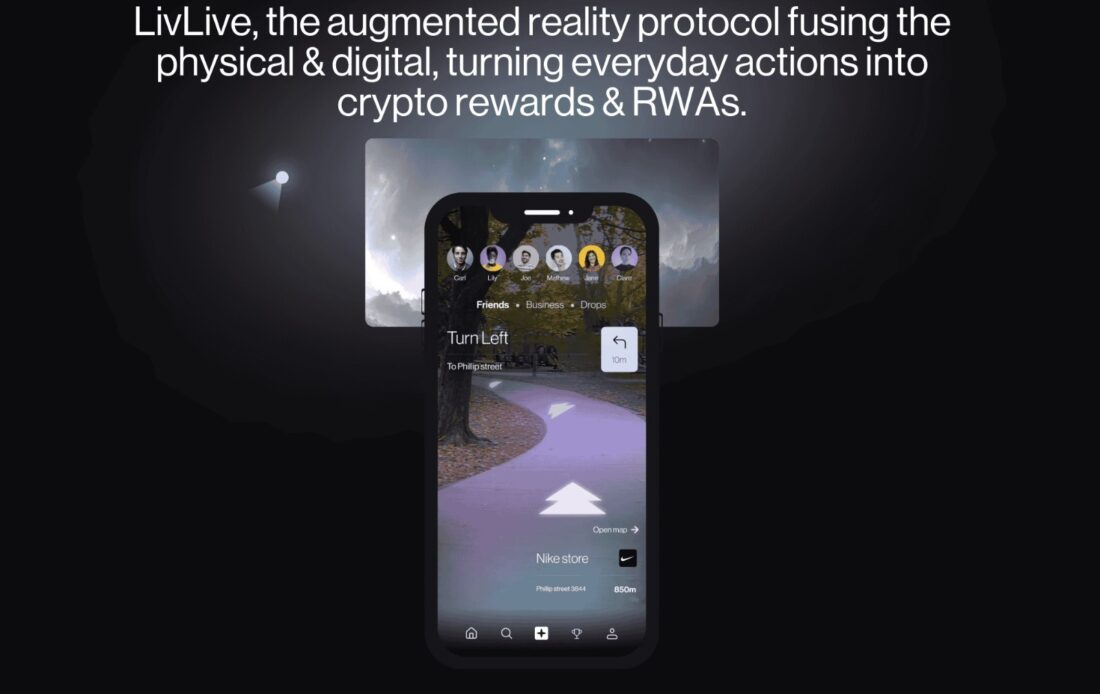

LivLive stands out in this crowded field by blending augmented reality with blockchain to create a loyalty ecosystem that rewards genuine engagement. As the best crypto presale on the horizon, it has already raised over $2.2 million toward its $15 million soft cap, drawing in early backers eager for massive gains. With features like verifiable actions turning everyday interactions into tokenized value, LivLive positions itself as a game-changer, outpacing traditional projects by fostering authentic connections between users, brands, and communities.

LivLive: Surging Ahead in Presale Power

LivLive’s presale is shattering expectations, with funds pouring in at a rapid pace that signals strong market confidence. At the current presale price of $0.02, investors are locking in positions before the inevitable climb to the launch price of $0.25. This new crypto presale isn’t just about hype—it’s built on a foundation where real-world actions are verified and converted into tokenized value through $LIVE, turning steps, scans, and reviews into economic assets that build lasting wealth for participants.

This verification process benefits investors by creating a transparent system where every engagement drives ecosystem growth, leading to sustained token demand and value appreciation over time. Brands, in turn, access an on-chain layer for measurable ROI, which strengthens the network’s appeal and draws more users, ultimately boosting $LIVE’s utility and scarcity. For early investors, this means holding a stake in a project poised for exponential expansion as adoption spreads across industries.

Early adopters also gain exclusive Token & NFT Packs that include long-term mining power, bonus tokens, and access to the $2.5 million Treasure Vault, providing multiple avenues for compounded returns. These packs empower holders to maximize earnings through quests and rewards, turning passive investment into active participation that amplifies profits. As the community owns 65% of the supply, this structure ensures that value flows back to those fueling the platform, setting LivLive apart as a resilient opportunity in the crypto presale space.

Unlocking Massive ROI Potential

Consider a $1,000 investment in this new crypto presale at $0.02 per $LIVE— that buys 50,000 tokens outright. Applying the limited-time BONUS200 code adds 200% more tokens, tripling the haul to 150,000. At launch price of $0.25, this stake jumps to $37,500, delivering a 37.5x return. Scaling to the predicted $1 post-launch, it balloons to $150,000, a staggering 150x gain. Analysts even forecast peaks of $5 to $10, potentially turning that initial outlay into $750,000 or more, highlighting why LivLive ranks as the top crypto to buy for explosive growth.

Solana: Navigating Market Pressures

Solana has seen its share of ups and downs in early 2026, with the token dipping to around $127 amid broader market liquidations nearing $350 million. Recent warnings highlight a 17% drop in stablecoin supply over the past month, signaling potential capital outflows that could pressure the network if trends persist.

Despite these challenges, Solana maintains robust activity, processing about 2.3 billion transactions in the last 30 days and leading in weekly revenue at $7.66 million. Institutional interest persists, with ETF inflows of $41 million and Morgan Stanley filing for spot SOL ETFs, though price volatility near $145 resistance underscores ongoing uncertainties in this established chain.

Hyperliquid: Leading Yet Volatile in Perps

Hyperliquid continues to dominate decentralized perpetuals trading, recording $40.7 billion in weekly volume and topping chains in fees, even as its HYPE token slides around 8% to $24 amid market weakness. The platform’s user base has surged to over 1.4 million, cementing its role in DeFi, but upcoming unstaking events worth over $80 million add layers of short-term risk.

Recent drama includes the Trove project rug pull, where a pivot from Hyperliquid to Solana caused a 95% token drop and investor backlash, illustrating the sector’s fragility. While Hyperliquid outperforms rivals like Aster and Lighter in open interest at $9.57 billion, these developments reflect the unpredictable nature of mature DeFi plays compared to emerging opportunities.

Embracing the Timeline of Crypto Opportunity

Based on the latest research into market dynamics, LivLive emerges as the best crypto presale, outshining Solana and Hyperliquid with its innovative blend of AR and real-world rewards. This new crypto presale offers unparalleled potential for early-stage investors, promising returns that could redefine portfolios in the coming months.

With presale stages advancing quickly, urgency mounts—secure $LIVE now using BONUS200 for that 200% token boost before the next price hike. Head to the LivLive website today and position yourself at the forefront of this transformative project, as delays could mean missing the market’s hottest entry point.

For More Information:

Website: http://www.livlive.com

X: https://x.com/livliveapp

Telegram Chat: https://t.me/livliveapp

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post LivLive vs Solana And HYPE: Why This Explosive New Crypto Presale Is Becoming the Market’s Hottest Early-Stage Investment appeared first on Live Bitcoin News.

You May Also Like

Forward Industries zet $4 miljard in om Solana bezit uit te breiden

Crucial Fed Rate Cut: October Probability Surges to 94%