Ethereum (ETH) Treads Water Below $3K: Will Bulls or Bears Take Control?

- Ethereum is currently holding at $2.9K.

- ETH’s trading volume has skyrocketed by 267%.

With the broader market sentiment being fear, the Fear and Greed Index value is holding at 29. The majority of the assets are charted in red, and a few green ones are there. Meanwhile, Bitcoin (BTC) is attempting to escape the bear market. Among the altcoins, the largest, Ethereum (ETH), registered a 0.51% loss in the last 24 hours.

In the early hours, the price of the asset was on the upside, trading at $2,942.78. Gradually, the bearish wave encountered the ETH market, pushing the price to a low of $2,785.90. With the brief drop in value, Ethereum currently trades at $2,912.57. The trading volume has skyrocketed by 267%, settling at $30.78 billion. The ETH market has witnessed $266.93 million in liquidation.

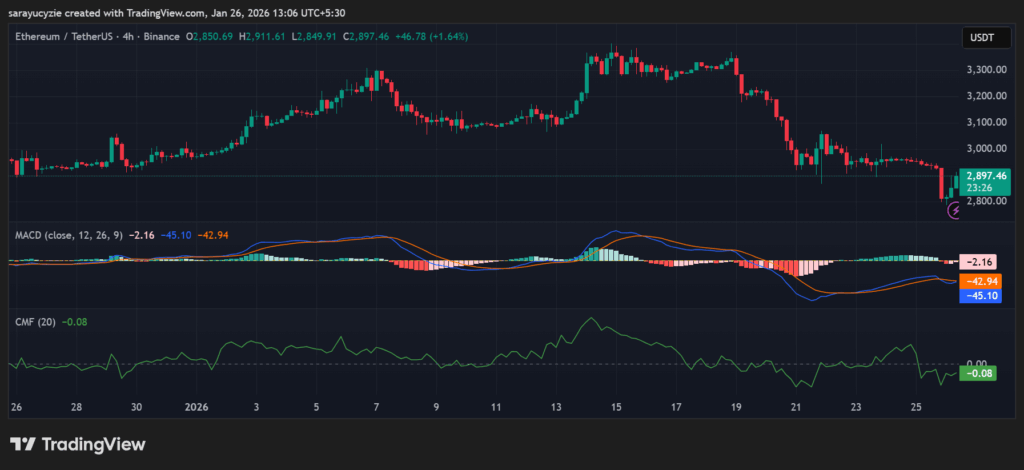

On the four-hour chart, with the ETH/USDT pair’s negative outlook, the price could fall toward a support at $2.8K. If the bears gained more traction, the price action would likely see severe losses, along with the death cross. Assuming the Ethereum bulls make a re-entry, the price might test the resistance at the $3K level. Notably, as the bullish pressure intensifies, the golden cross could pop up and send the asset’s price to revisit recent highs.

Momentum Weakens for Ethereum as Indicators Signal Bear Control

Both the MACD and signal lines of ETH cross below the zero line, pointing to bearish momentum. The short-term momentum has weakened, confirming a trend shift to the downside. Besides, Ethereum’s CMF indicator value of -0.08 hints at mild selling pressure. Capital is flowing out of the asset, not aggressively. If it moves further below, the downside pressure strengthens.

ETH chart (Source: TradingView)

ETH chart (Source: TradingView)

The daily RSI of Ethereum is positioned at 41.38, which indicates weak to neutral sentiment, and it may approach the oversold zone. Also, the price could either stabilise or drift lower unless buyers step in and push back above 50.

Moreover, the BBP reading staying at 48.74 suggests strong bearish pressure. The sellers are firmly in control, with the ETH price trading below, reflecting a downtrend. Until it starts rising toward zero, the bear dominance remains intact.

Top Updated Crypto News

Bitcoin (BTC) Volume Erupts 184%: Will It Face a Key $85K Bearish Test?

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

XRPL Validator Reveals Why He Just Vetoed New Amendment