Bitcoin Drops Below $87,000 as Bears Target $84,000 Support Break

Bitcoin Magazine

Bitcoin Drops Below $87,000 as Bears Target $84,000 Support Break

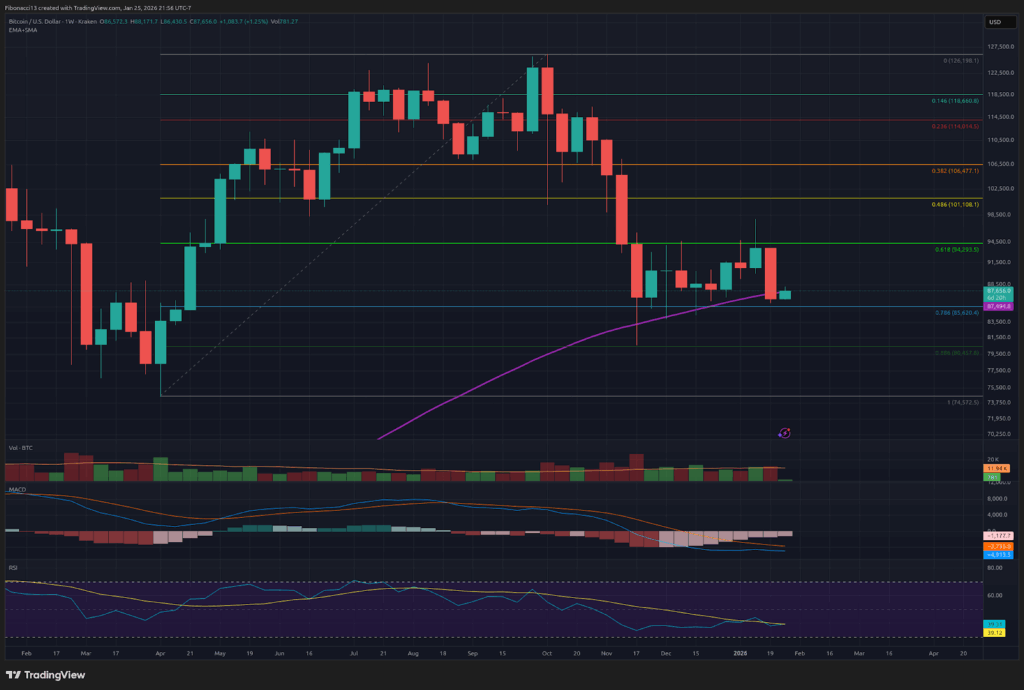

Bitcoin Price Weekly Outlook

What a disastrous weekly close for Bitcoin, that about sums it up. After tapping $98,000 resistance the week prior, the bitcoin price just went straight down last week to close near the lows at $86,588. The bulls have been corralled back into their pens and will need a lot of help to break out once again. The bears will look to continue their momentum into this week to break down the $84,000 support level once and for all, and take the price down to the low $70,000 area. Bulls must defend $84,000 like never before to avoid a breakdown this week.

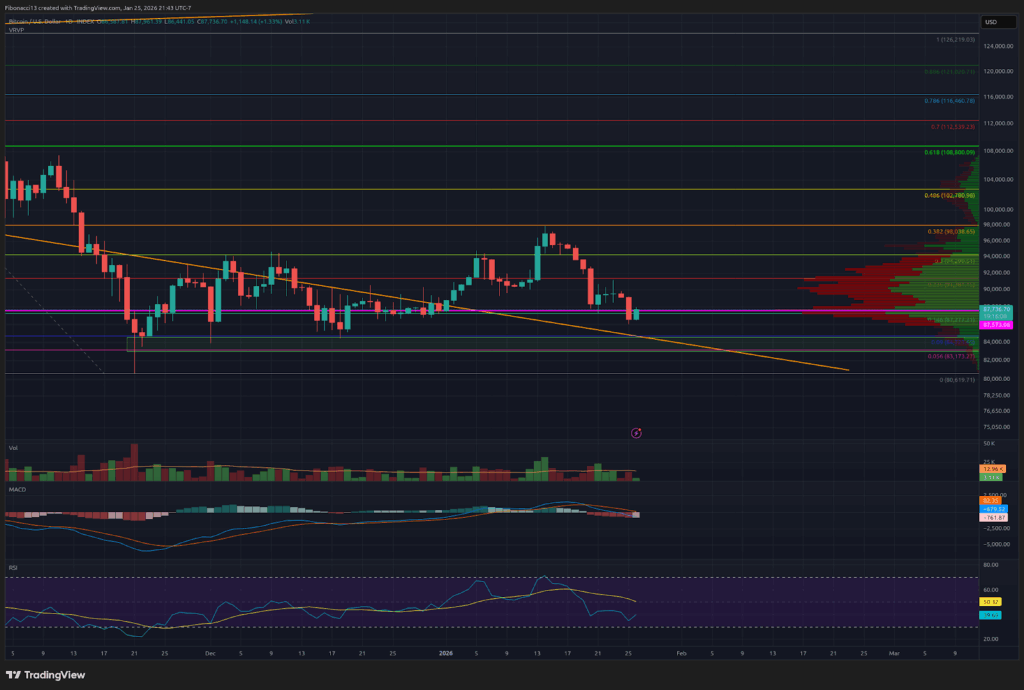

Key Support and Resistance Levels Now

The bears are back in town. $87,000 support has been lost, and $84,000 may not hold another test. If the bears can manage to get a daily close or two below $84,000, the price should accelerate down to the $72,000 to $68,000 support zone. We likely see a bounce from down there, but if it eventually gives wa,y we will look to the 0.618 Fibonacci retracement level at $58,000.

After grinding above several resistance levels recently, the bulls are back where they started. Bulls must reclaim $88,000 first and foremost. From there, they will look to get above $91,400, then $94,000 once again. $98,000 has proven itself as strong resistance above here. In the unlikely event the bulls can push above $98,000, it should be a slow go up to $103,500.

Outlook For This Week

This week is make-or-break for the bulls. Failure to defend $84,000 this week will likely send the price down to new lows. There is a large slate of big companies reporting earnings this week, so if the results are very strong, it could help buoy the bitcoin price to sustain major support levels. Although correlations to stocks have been weak lately, there are no guarantees that bitcoin will benefit from any upward market movement. Odds are in the bears’ favor for a breakdown this week.

Market mood: Bearish – The bulls showed some strength in the prior week for a slight advantage, but the bears took full control last week, driving the price right back down to the lows.

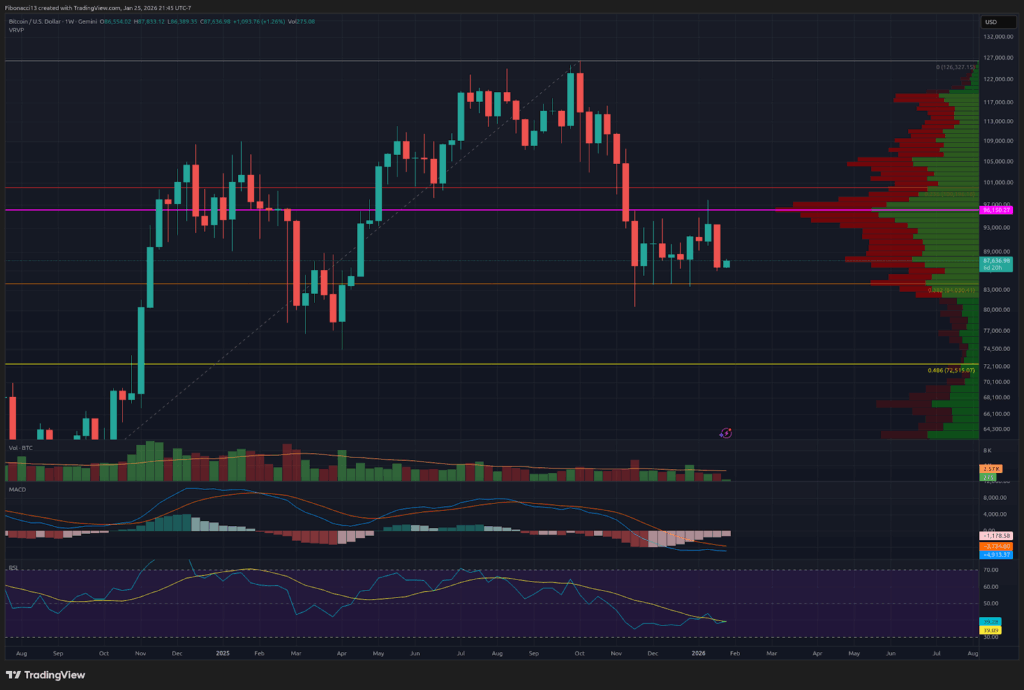

The next few weeks

The weekly chart was looking for a bounce recently, and it got one. The price action this past week, however, has put in a strong indication that this bounce may be over and new lows may be on the horizon as the price closed below the 100-week SMA. The MACD oscillator is firmly in bearish territory, and while it looked like it may see a bullish cross last week, the bears came out in force and prevented that bullish cross from taking place. The relative strength index has crossed back down below the 13 SMA and sits in a bearish posture once again.

Terminology Guide

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which the price should hold for the asset, at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level that is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

SMA: Simple Moving Average. Average price based on closing prices over the specified period. In the case of RSI, it is the average strength index value over the specified period.

Oscillators: Technical indicators that vary over time, but typically remain within a band between set levels. Thus, they oscillate between a low level (typically representing oversold conditions) and a high level (typically representing overbought conditions). E.G., Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD).

RSI Oscillator: The Relative Strength Index is a momentum oscillator that moves between 0 and 100. It measures the speed of the price and changes in the speed of the price movements. When RSI is over 70, it is considered to be overbought. When RSI is below 30, it is considered to be oversold.

MACD Oscillator: Moving Average Convergence-Divergence is a momentum oscillator that subtracts the difference between 2 moving averages to indicate trend as well as momentum.

Fibonacci Retracements and Extensions: Ratios based on what is known as the golden ratio, a universal ratio pertaining to growth and decay cycles in nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).

This post Bitcoin Drops Below $87,000 as Bears Target $84,000 Support Break first appeared on Bitcoin Magazine and is written by Ethan Greene - Feral Analysis and Juan Galt.

You May Also Like

Bitcoin Whales Sell 147,000 BTC Since August, Fastest Selloff Of Cycle

Travelzoo Q4 2025 Earnings Conference Call on February 19 at 11:00 AM ET