Kraken to Offer Easy DeFi Experience Powered by Ink, Up to 8% APY

Kraken rolled out DeFi Earn on Jan. 26, offering users a straightforward way to access decentralized finance yields directly in the Kraken app.

According to official communication from a thread on X and Kraken’s DeFi Earn landing page, users deposit cash or stablecoins, which convert to USDC if needed, then select one of three vault strategies: Balanced, High, or Advanced, offering up to 8% APY. The system automatically allocates funds to lending protocols and rewards accrue without further input.

Notably, the feature relies on embedded wallet infrastructure from Privy, eliminating the need for seed phrases or manual transaction signatures. Vaults are built by Veda Labs on the Ink Network—Kraken’s Ethereum Layer 2 (L2)—with risk oversight from Chaos Labs and Sentora.

Rewards come from actual borrower demand on known DeFi platforms like Aave, Morpho, Tydro, and Sky Ecosystem, a FAQ section in the landing page explains. There are no token subsidies or temporary boosts. Kraken charges a 25% fee on rewards only. Moreover, withdrawals are typically instant, though brief delays can occur if protocol liquidity is low.

DeFi Earn launches in 48 states of the US, Canada, and the European Economic Area, with more regions planned.

Kraken Moves Into DeFi

The product fits into Kraken’s broader push to combine traditional and decentralized finance. In November 2025, the exchange introduced Auto Earn for simple passive yields on crypto holdings with no lock-ups, as covered by Coinspeaker. Earlier moves include commission-free stock and ETF trading in select US states in April 2025 and the Krak Card for unified crypto banking in December.

Kraken also continues development on its own blockchain, Ink, originally announced for expanded DeFi access.

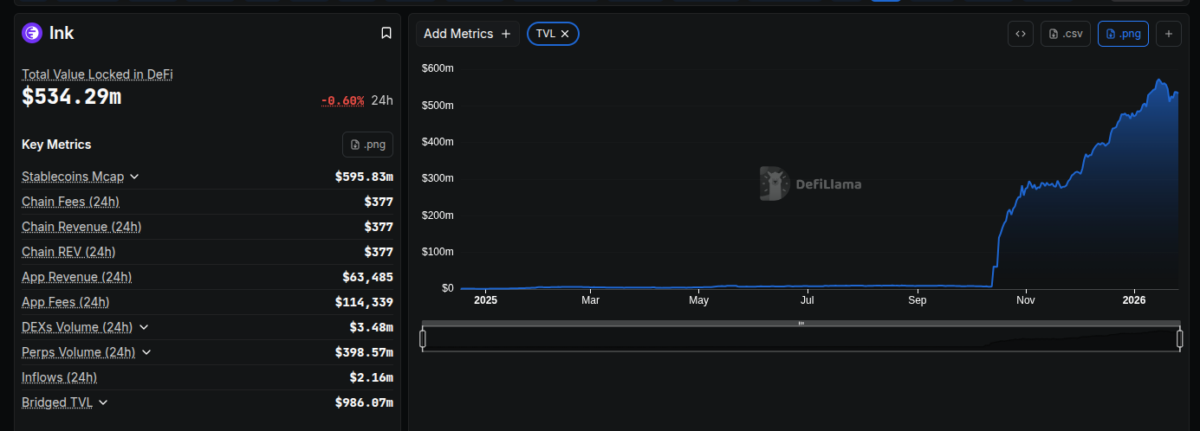

Data from DefiLlama shows the L2 is already ranking 14th by TVL, featuring side by side with leading L1 blockchains like Sui, which ranks 13th. Ink currently goes with $534 million in total value locked and has $595 million in stablecoin market cap, with a 43% dominance by Circle’s USDC.

Ink DeFi data as of January 26, 2026 | Source: DeFiLlama

Overall, the ecosystem went through significant growth in early October last year, backed by Kraken’s user base and market share. This new product could boost this growth even more with easier onboarding and a better user experience.

nextThe post Kraken to Offer Easy DeFi Experience Powered by Ink, Up to 8% APY appeared first on Coinspeaker.

You May Also Like

Tom Lee’s BitMine Hits 7-Month Stock Low as Ethereum Paper Losses Reach $8 Billion

Headwind Helps Best Wallet Token