VanEck Debuts First U.S.-Based Avalanche ETF as AVAX Stays Under Pressure

- VanEck launched the first Avalanche ETF on January 26, offering direct AVAX exposure and staking rewards.

- AVAX is trading below $12, posting a weekly decline of nearly 7%.

Asset Manager VanEck launched the first U.S.-listed Avalanche ETF on January 26, and the product began trading on Nasdaq under the ticker VAVX, offering direct exposure to AVAX along with staking rewards. Despite this, AVAX continued under pressure, trading below $12 and experiencing a weekly fall of almost 7%.

During the period of VanEck Avalanche ETF from January 26, 2026, to February 28, 2026, VanEck will waive the entire Fee for the first $500 million of the assets. If the Trust’s assets exceed $500 million before February 28, 2026, the Fee charged on assets over $500 million will be 0.20%, as per the document.

In addition, the fund can stake up to 70% of its AVAX holdings, which could lock a meaningful portion of supply and reduce tokens available on the open market if demand holds up.

AVAX Price Analysis

With that, AVAX price is currently trading at $11.77, with 1.11% up today. Despite the modest daily bounce, the 24-hour trading volume is declining more than 20%, as it is down nearly 8% over the past month, as of writing.

Then, the open interest climbed 10.43% to $492 million, which indicates that traders are opening new positions despite slowing trading volume, as per Coinglass data. Which is a phase that could lead to a sharper price move once AVAX breaks out of its current range.

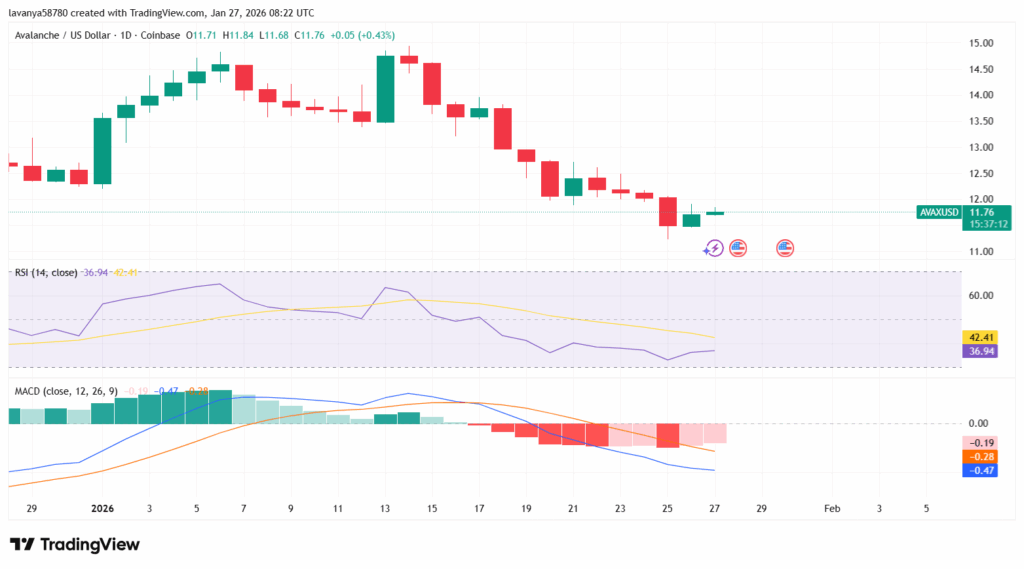

AVAX is trading around the $11.50-$12.00 support zone, and the overall trend is staying bearish as prices continue to create lower highs and lower lows.

Source: TradingView

Source: TradingView

Further indicators, RSI (Relative Strength Index), which is sitting at 39, a neutral zone, indicate a weak momentum. Meanwhile, MACD (Moving Average Convergence and Divergence) is showing strong selling pressure, as confirmed by the MACD line being below the signal line.

The price has immediate support at $11, with a further pullback potentially exposing the $10; while on the upside, a clear push above $13.00 might allow the price to stretch beyond the $14.00-$15.00 range.

Highlighted Crypto News Today:

US Wall Street Indexes Close Higher as Crypto Market Maintains its Trade Price

You May Also Like

Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps

USD/INR edges lower as Indian Rupee gains on improving equity inflows