Altcoin season is loading: 3 crypto tokens that could surprise traders

Altcoins are rallying in response to XRP all-time high on Friday. The altcoin hit a peak above $3.66, before retracing to $3.42 at the time of writing. Altcoins in the top 50 cryptocurrencies ranked by market capitalization eye higher returns in July 2025.

The three altcoins that could surprise traders with higher returns in the coming week are Pi Network (PI), Hyperliquid (HYPE), and Official Trump (TRUMP).

Table of Contents

- Altcoin season or not, watch these three tokens

- Bitcoin dominance declines: Altcoin season coming?

- Pi Network, Hyperliquid, Official Trump price analysis

- Expert commentary

Altcoin season or not, watch these three tokens

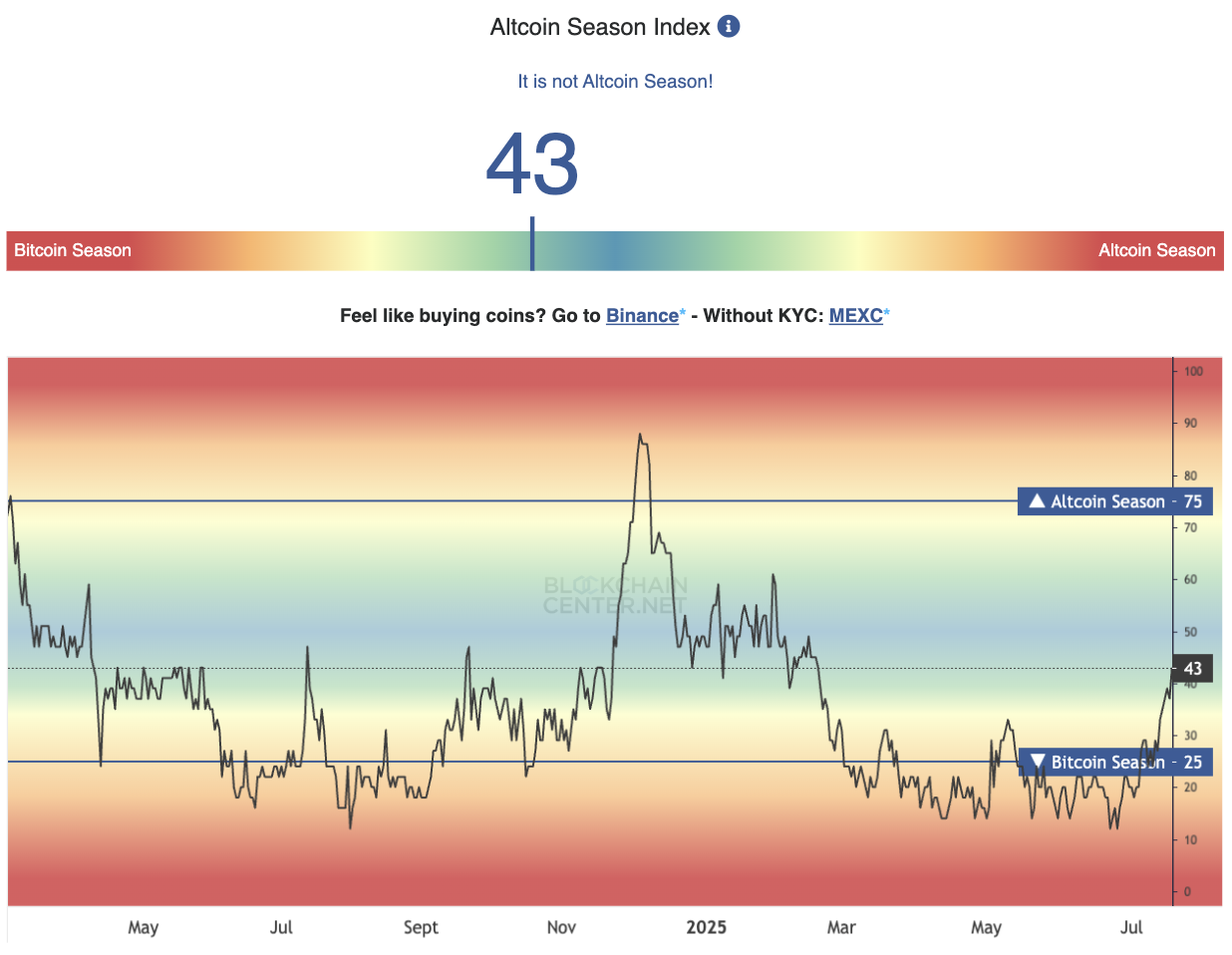

Altcoin season refers to the period when 75% of tokens ranked among the top 50 cryptocurrencies by market capitalization outperform Bitcoin (BTC) for over 90 days. The altcoin season index tracker helps determine whether it is the altcoin season or not. Market participants can decide whether to deploy capital, take profits in Bitcoin or hold on to altcoins.

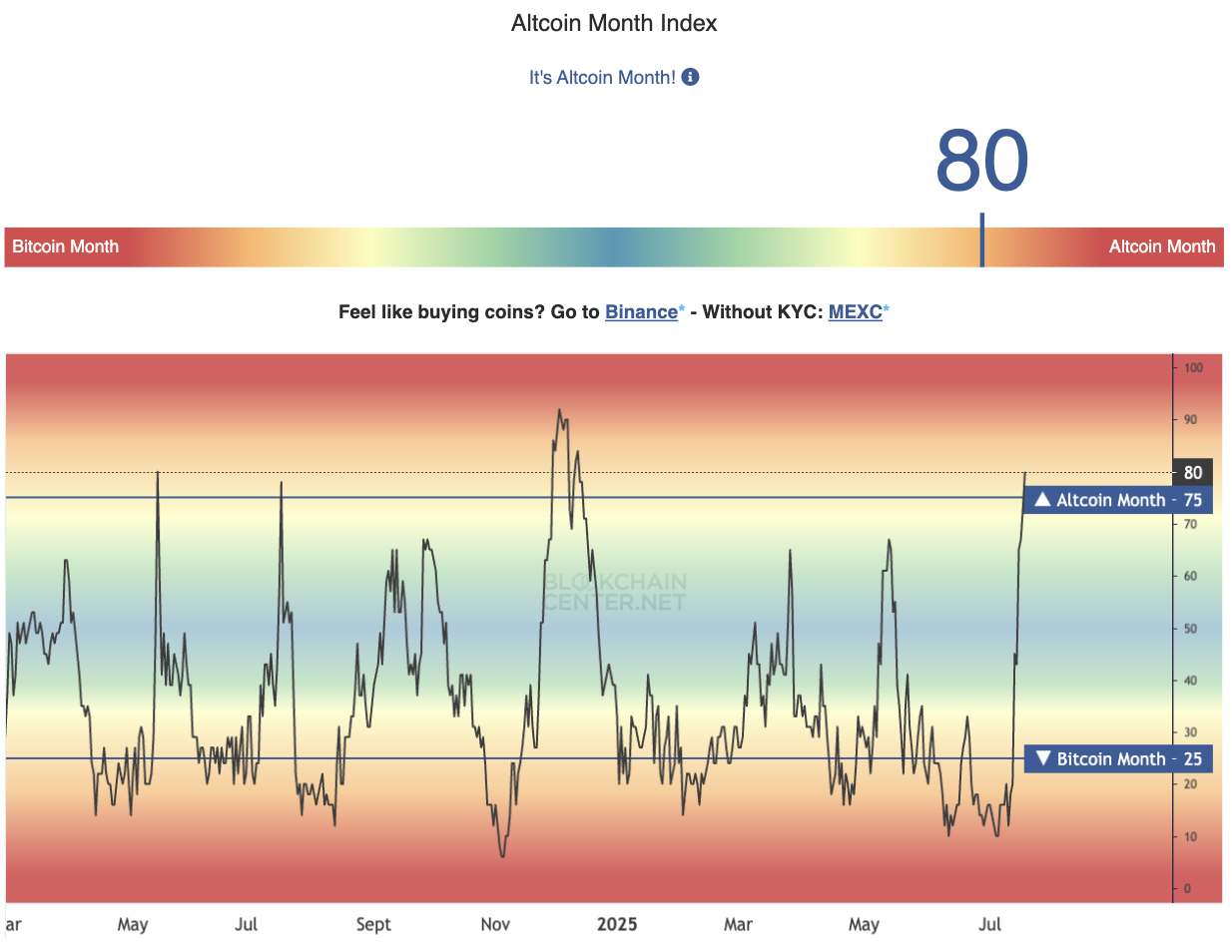

The index indicates that the altcoin season is still brewing; however, on the monthly timeframe, the value is 80 on a scale of 0 to 100, meaning it is an “altcoin month.”

With XRP hitting an all-time high this week, altcoins in the top 50 are observing notable gains, supporting the thesis that altcoin season is loading.

Pi Network, Hyperliquid, and Official Trump are yet to join the altcoin rally kicked off by Ethereum and XRP. These altcoins could surprise traders with gains and extend their climb in the coming week.

Bitcoin dominance declines: Altcoin season coming?

Bitcoin dominance, or the measure of Bitcoin’s share of the total crypto market cap, is down nearly 4% in the last three weeks. BTC dominance is 61.61% at the time of writing on Friday, down from 66% in the last week of June.

As Bitcoin dominance drops, market participants anticipate gains in altcoins. Capital rotation, profit-taking are the top two drivers of the alt season.

With BTC hitting a new all-time high above $123,000, large holders and dormant wallets from the Satoshi era are waking up for profit-taking. The rising selling pressure could push Bitcoin price lower and pave the way for altcoin gains.

Large holders are moving fast enough to increase exchange inflows 5x within a week, miners are following closely, shedding over 16,000 BTC in a single day, one of the largest single-day outflows in the last three months.

Altcoins are experiencing relative inactivity in terms of exchange inflows and profit-taking, indicating that traders may not be in a rush to sell their altcoins. This suggests a likelihood of an altcoin season in July 2025.

Pi Network, Hyperliquid, Official Trump price analysis

Pi Network is currently trading above $0.44, as seen in the PI/USDT daily price chart. PI could gain nearly 17% and test resistance at R1, $0.5281. If PI sees a daily candlestick close above $0.5281, the altcoin could target resistance at R2 at $0.6667.

The green histogram bars on MACD support a positive momentum in Pi Network’s price trend.

If there is a correction, PI could collect liquidity at support, at $0.40.

HYPE is rallying towards its two key resistances at $47 and $50 on Friday. The token could find support at the $42 level, as seen on the HYPE/USDT daily price chart.

The momentum indicators on the daily price chart support further gains in HYPE and the token could rally nearly 6% to test R1 in the coming week.

TRUMP is trading at $10.20 at the time of writing. The meme token is nearly 12% away from resistance at $11.45, a sticky level for the altcoin in the past few weeks. A daily candlestick close above $11.45 could see TRUMP test the $12.25 level as resistance.

TRUMP could collect liquidity at $9.27, one of the key support levels for the token.

Expert commentary

Werner Brönnimann, Investment Manager at globally regulated AMINA Bank told crypto.news:

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse