Bitcoin Price Plunges to 6-Week Low as Liquidations Explode Amid Iran Strike Fears

Bitcoin’s price has taken another hit in the past hour or so, dumping to a new six-week low of just over $85,000 as of now.

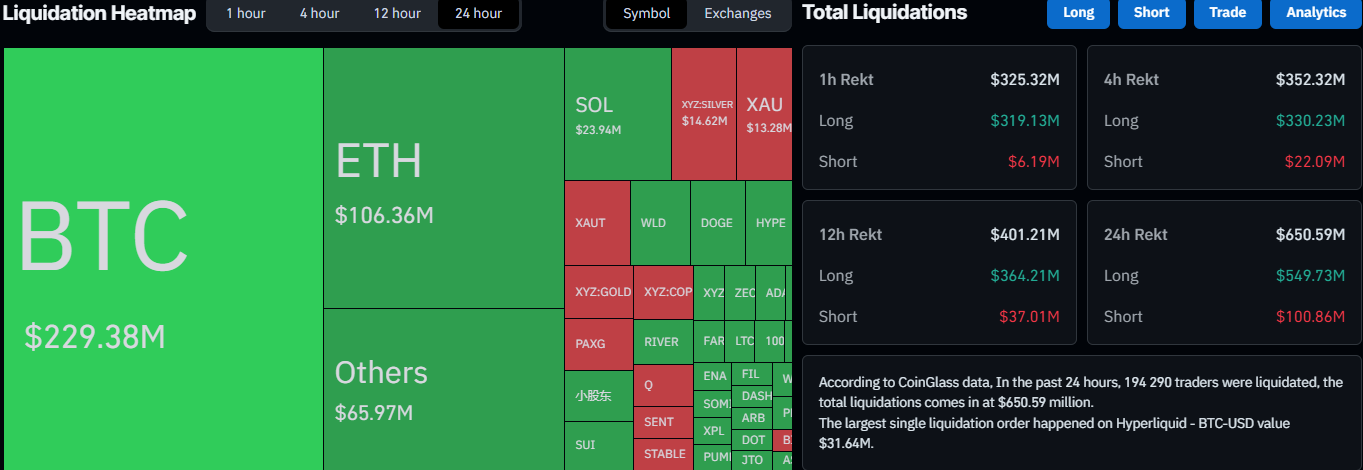

The altcoins have followed suit, and the liquidations are on the rise again. Data from CoinGlass shows that over $650 million worth of leveraged positions have been wiped out daily, with roughly half of those taking place in the past hour alone.

The number of wrecked trades has rocketed to over 190,000 as of press time. The single-largest liquidated position took place on Hyperliquid and was worth over $31 million.

Liquidation Data on CoinGlass

Liquidation Data on CoinGlass

Perhaps the most evident reason behind the latest calamity is the increasing fears about a potential attack against Iran by the United States. Reports from earlier today indicated that the POTUS has deployed the Abraham Lincoln Carrier Strike Group to the Middle East after warning that Iran’s time to make a deal is “running out.”

US crude oil jumped by over 2.5% at one point, while the global benchmark Brent neared $70 after a 2.3% increase. However, the precious metal market was hit hard in the past hour alone, with gold slumping from its latest all-time high above $5,500/oz to $5,300 within minutes.

BTC is down by 3% hourly, and many altcoins have produced even more painful declines. ETH is down to $2,800 after it was rejected at $3,000 yesterday. XRP has slumped by 3.5%, while SOL has dumped by 3.7%.

BTCUSD Jan 29. Source: TradingView

BTCUSD Jan 29. Source: TradingView

The post Bitcoin Price Plunges to 6-Week Low as Liquidations Explode Amid Iran Strike Fears appeared first on CryptoPotato.

You May Also Like

The Role of Technology in Effective Decision Processes

Sonitor Recognized as Best in KLAS for RTLS for the Second Time in Three Years