Chainlink Slips Below $10 as Selling Pressure Continues

- Chainlink fell below the $10 level as selling pressure continued, with price down over 20% on the weekly chart.

- Technical indicators show LINK remains in a downtrend, with RSI near oversold and MACD staying in bearish territory.

Chainlink (LINK) is trading around $9.54, dropping 3.12% in the past 24 hours as the broader trend remains weak. During the session, LINK moved between a low of $9.04 and a high of $9.88, showing short-term volatility without a clear breakout. The token’s market cap stands near $6.76 billion, while 24-hour trading volume is around $1.31 billion, indicating steady participation from traders despite the downtrend.

Chainlink fell below the $10 support level, touching the lowest price point seen since September 2024, as sellers dominated both spot and futures markets. LINK’s price was down around 7.9% on the daily chart and about 20% on weekly charts, showing a sharp downturn in recent sessions. Heavy sell-offs in both spot and futures markets have contributed to the decline, pushing LINK to test deeper support zones.

LINK Extends Bearish Trend as Sellers Maintain Control

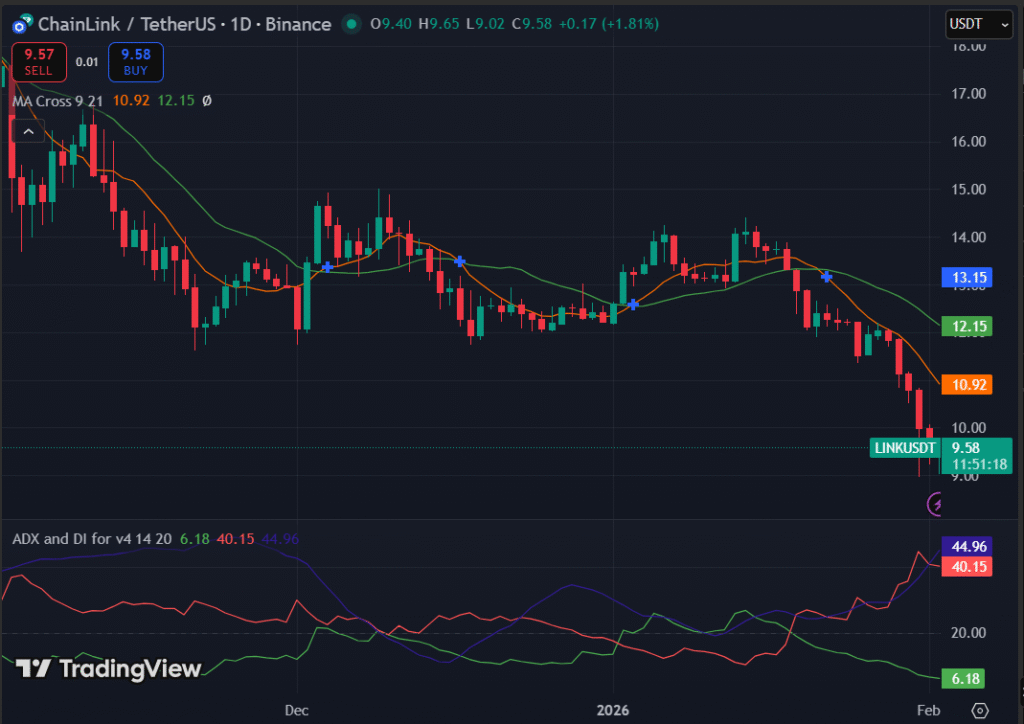

On the daily chart, LINK remains in a bearish market structure that has been in place since it topped near the $14–$15 zone earlier this year. Price is trading well below both the 9-day and 21-day moving averages, which continue to slope downward, showing that sellers are still in control. The RSI is near the low-30s, which places LINK in oversold territory and indicates that momentum has been strongly negative.

(Source: TradingView)

(Source: TradingView)

Zooming in, the MACD is below its signal line, and the histogram remains in negative territory, confirming that downside pressure persists.

(Source: TradingView)

(Source: TradingView)

Meanwhile, ADX reading indicates a strengthening trend, with the negative directional index staying above the positive one, which supports the view that sellers remain in control.

When checking on the Chainlink’s next price direction, the recent bounce attempts near short-term support around $9.50–$10 have been met with renewed selling, signaling resistance and limited upside participation.

So, the immediate support lies near $9.00, which has acted as a recent floor followed by a lower support zone around $8.50. On the upside, resistance is seen near $10.20–$10.50, which aligns with the moving average area where price has been rejected in recent sessions. Until then, LINK’s price action suggests the prevailing bearish momentum is likely to remain in place.

You May Also Like

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto

Market Records Largest Long-Term Bitcoin Supply Release In History, Here’s What It Means For BTC