While $2400 ETH Bleeds Digitap ($TAP) is the Best Crypto to Buy in 2026: $TAP Up 275%

Ethereum’s 25% plunge over the past month may just be the start of a sustained bearish trend. The once-hot Ethereum was trading at the key support level of $2,400 last week. However, the token plunged lower, breaking investor confidence and now putting the $2,000 level in play.

The Ethereum network itself remains solid, supported by still-strong metrics. However, the selloff is part of a broader trend of investors re-evaluating what they consider the best crypto to buy.

In this cautious climate, capital is rotating toward projects with superior real-life utility and upside potential. One altcoin that fits this profile is Digitap ($TAP), a crypto presale project with a live crypto-fiat hybrid fintech banking app.

Source: Digitap

Source: Digitap

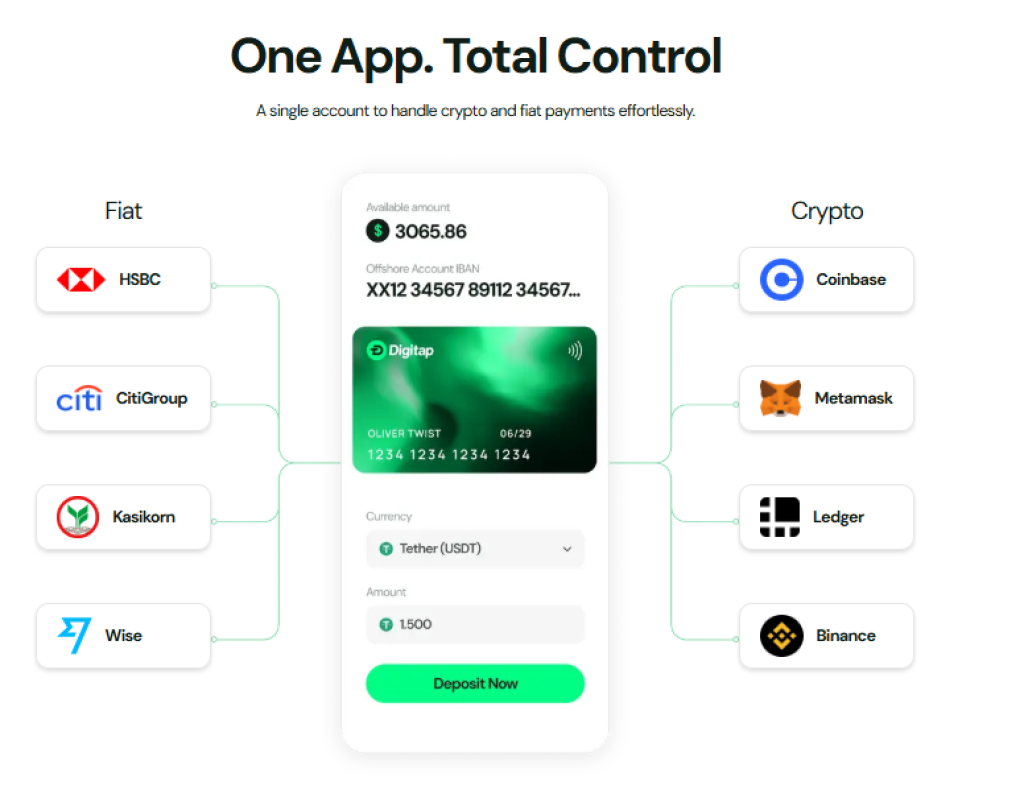

Digitap’s Omni-Bank App Turns Crypto Into Real Banking

Digitap markets itself as the world’s first “omni-bank.” This means users can manage both fiat and crypto assets seamlessly through a single interface. Key features include more than 20 foreign currency bank accounts, high-yield savings accounts, crypto wallet support for more than 100 tokens, global money transfers, and a Visa debit card.

Blending fiat and crypto offers many cost-saving advantages for users. For example, money remitters charge an average of 4.2% to move money across borders. Digitap’s AI-powered app scans for the cheapest available fiat or blockchain rail. The end result is often transfers completed within seconds at a cost of less than 1%.

Digitap also offers an optional no-KYC onboarding option for its base wallet tier. This means anyone worldwide can access basic banking features without identity checks. This lowers barriers to entry for the roughly 800 million unbanked adults worldwide who don’t have access to identification.

Digitap is making it clear in a short period of time that it can solve real-world problems. This strong fundamental utility is a key reason Digitap stands out in a risk-off environment. Digitap ranks among the top altcoins to buy as investors seek stability and growth amid a broader market that remains weak.

Source: Digitap

Source: Digitap

How $TAP’s Tiered Presale Delivered a 275% Bear-Market Gain

Digitap’s crypto presale of its native $TAP continues to defy the bear market. The fundraising event launched in late summer, just weeks before heavy selling pressure began. Digitap became a top crypto to buy because its presale is structured in tiers.

$TAP is offered for sale in incremental price stages. Once each round sells out or expires, the price of $TAP inches higher. Since the first stage, $TAP’s price has climbed from $0.0125 to $0.0467.

This roughly 275% paper profit helped many investors shield their portfolios from losses. Specifically, a roughly 10% allocation to $TAP would have nearly offset a 35% loss in a diversified altcoin portfolio.

Beyond acting as a near-term hedge against market weakness, Digitap’s token is built for long-term price appreciation. The total supply of $TAP is capped at 2 billion, with no further minting. In addition, 50% of the platform’s profits are allocated toward buybacks, burns, and funding stakers.

Each transaction on Digitap contributes to shrinking the token supply. If Digitap succeeds in its upcoming global marketing push, the pace of token burns could accelerate. This is why Digitap is a crypto to buy based on economics rather than hype.

Why Losing $2,400 Support Leaves Ethereum on the Back Foot

Ethereum continues to struggle to deliver short-term gains. Technically, the sharp selloff from $2,400 is a red flag. The inability to hold key support levels suggests sellers are in control. Coupled with a lack of near-term catalysts, the second-largest crypto by market cap could face further downside.

Still, Ethereum remains the dominant smart contract platform, and its market position is strong. Total value locked in decentralized finance has dipped from recent peaks but still stands near $60 billion, representing roughly 57% of all funds locked across blockchains. Active addresses also remain above recent averages.

At best, Ethereum may offer investors steady growth and potentially above-average market returns. However, it no longer delivers the level of excitement it once did. Digitap, by contrast, represents an appealing altcoin to buy for stronger short-term and long-term return potential.

Source: DefiLlama

Source: DefiLlama

Digitap’s Growth Story Backs Its Role as Best Crypto To Buy

Ethereum’s continued struggles show that the market is no longer rewarding legacy assets by default. Investors must adapt, as the best crypto to buy increasingly comes from projects representing the next wave of innovation.

While Ethereum may recover over the long term, Digitap offers the type of immediate growth narrative many investors seek during periods of market weakness. Digitap delivers practical utility for a global audience, and its token is directly linked to platform growth through investor-friendly tokenomics.

Digitap, despite its status as a crypto presale project, is not relying on hype or expensive marketing gimmicks. Its fintech banking app is already live and helping users worldwide manage their financial needs through a platform built for the future.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post While $2400 ETH Bleeds Digitap ($TAP) is the Best Crypto to Buy in 2026: $TAP Up 275% appeared first on CaptainAltcoin.

You May Also Like

Victra Named 2025 Recipient of Verizon’s Best Build Compliance Award

Stablecoins could face yield compression after Fed’s rate cut