Spot Bitcoin ETFs Ingest $562M in Daily Inflows—Is This a Bullish Rebound or Just a Blip?

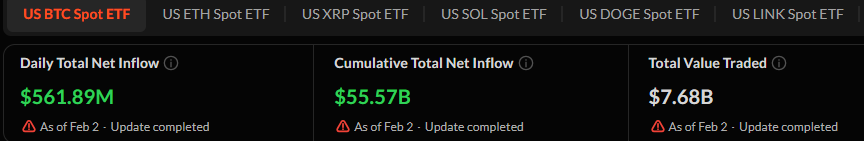

U.S. spot Bitcoin exchange-traded funds experienced a significant turnaround in investor flows on February 2, as almost $562 million in net daily flows were attracted after weeks of steep net outflows, according to data compiled by SoSoValue.

Spot Bitcoin ETFs Feb 2 Source: Sosovalue

Spot Bitcoin ETFs Feb 2 Source: Sosovalue

The rebound was one of the largest single-day inflows since the beginning of January and drove cumulative net inflows in all U.S. Bitcoin spot ETFs to 55.57 billion.

This inflow has raised concerns about whether institutional demand is coming back or it is just short-term positioning in a weak market background.

After January Redemptions, Bitcoin ETF Flows Show Signs of Life

The inflow recovery came after a challenging period of Bitcoin-linked investment products.

During the last two weeks of January, spot ETFs have been hit with successive heavy redemptions, with net outflows of $817.87 million on January 29 and 509.70 million on January 30.

Those sell-offs were accompanied by declining crypto prices, declining exchange volumes, and a more risk-off sentiment that also burdened equities.

Major stock indexes have been moving down since October, and the trading in both conventional and crypto markets has been very thin with reduced exposure.

Despite Monday’s inflow surge, total net assets held by the U.S. Bitcoin spot ETFs fell to $100.38 billion, down sharply from highs above $125 billion seen in mid-January.

The decline reflects Bitcoin’s price drawdown rather than a collapse in ETF participation.

Trading activity rebounded alongside inflows as the total daily traded value across spot Bitcoin ETFs reached $7.68 billion, up from subdued levels earlier in the week, suggesting active repositioning rather than passive inflows.

Bitcoin ETF Demand Persists Through Market Pullback

BlackRock’s iShares Bitcoin Trust remained the dominant fund by size, holding $60.17 billion in net assets.

IBIT recorded $141.99 million in daily inflows, equivalent to roughly 1,810 BTC, even as its shares closed down nearly 7% and traded at a slight discount to net asset value.

Fidelity’s FBTC led the day in inflows, attracting $153.35 million, or about 1,960 BTC. The fund’s cumulative inflows climbed to $11.43 billion, with total net assets of $15.18 billion.

Grayscale’s legacy Bitcoin Trust, GBTC, saw no new inflows and remained burdened by cumulative net outflows of $25.70 billion.

Other issuers also posted positive flows as Bitwise’s BITB added $96.5 million, ARK Invest and 21Shares’ ARKB brought in $65.07 million, and VanEck’s HODL gained $24.34 million. Smaller funds largely reported flat activity.

Modest Bitcoin Bounce Fails to Ease Bearish On-Chain Data

The rebound came as Bitcoin prices stabilized modestly after weeks of declines. Bitcoin traded around $78,900, up roughly 2.5% on the day, while Ethereum rose about 3% to $2,314.

Even so, Bitcoin remained more than 37% below its all-time high of $126,080 and down over 13% for the past month.

On-chain data has added to the cautious tone, with a CryptoQuant analyst reporting that the share of Bitcoin supply held at a loss has risen to around 44%, a level that historically appeared during early bear market phases rather than routine pullbacks.

Additional data showed Bitcoin trading below the realized price of medium-term holders, a pattern that in past cycles aligned with extended periods of consolidation and downside risk.

Analysts at Galaxy Digital echoed those concerns, as the research lead, Alex Thorn, said Bitcoin could still test lower levels near $70,000 or even its realized price around $56,000 if catalysts remain scarce.

Thorn noted that Bitcoin has lost key moving-average support and that accumulation by large buyers appears limited, even as long-term holder selling has slowed.

You May Also Like

Cathie Wood's Ark Bets Big On Solana Treasury Play: Makes $162M Investment In Brera Holdings As Stock Explodes 225%

A Reality Check Pi Holders Might Not Want to Hear