Table of contents

How to check your 2025 NECO results on the official NECO website

How to check your 2025 NECO results on your phone

How to check your 2025 NECO results offline

What to do if your result is not showing

On Tuesday, the National Examinations Council (NECO) released the 2025 Senior Secondary Certificate Examination (SSCE) External results, with 72% of candidates passing.

NECO Registrar and Chief Executive, Professor Dantani Ibrahim Wushishi announced that a total of 96,979 candidates registered for the exams, comprising 51,823 males and 45,156 females, and were tested across 16 subjects.

The exams took place from November 26 to December 13, 2025, while marking ran from January 5 to January 21, 2026, creating a 52-day gap between the final paper and the release of results.

According to NECO, 93,425 candidates sat for the English Language exam, and 78.32% earned credit or higher. Mathematics saw 93,330 candidates, with 91.35% passing with a credit or higher. Overall, 68,166 candidates achieved five credits, including English and Mathematics, while 82,082 earned five credits or more without those two subjects, indicating strong performance.

Malpractice remains a major challenge. 9,016 candidates were booked for malpractice during the 2025 NECO, a 31.7% jump from 2024. Five supervisors were recommended for blacklisting, and four centres in Niger, Yobe, and Kano were flagged for full centre malpractice.

If you are a candidate, here is how you can check NECO results on the website, your phone, and offline

How to check your 2025 NECO results on the official NECO website

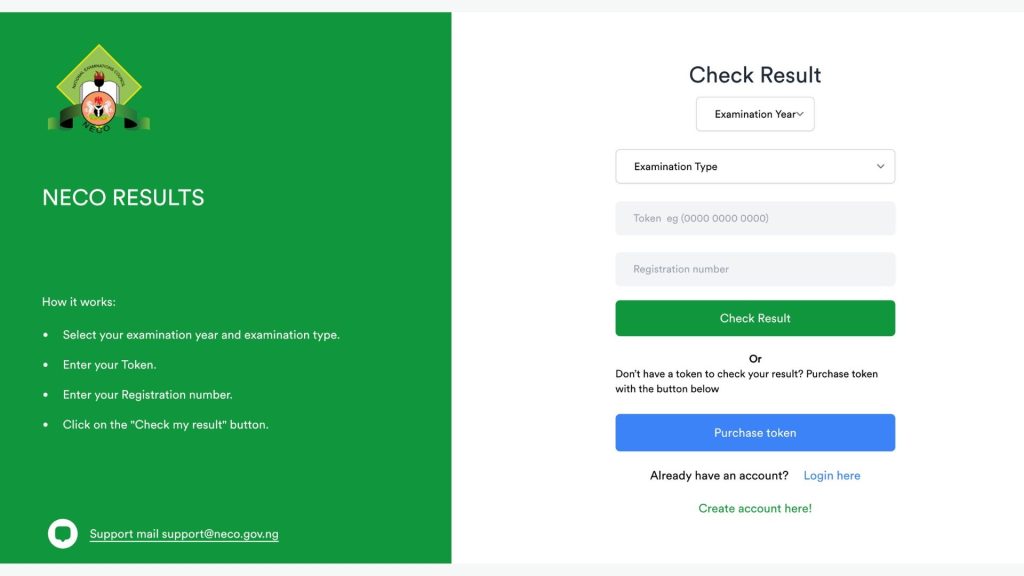

Image source: NECO portal

You can check your result on the NECO portal at results.neco.gov.ng. The site uses a token system with a 12-digit alphanumeric code instead of scratch cards. When you check your result via the portal, you can view your full electronic certificate, including your passport photo and all your subject grades.

What you need

- A NECO result checking token with a 12-digit code

- Your 10-digit registration number

- An internet connection

Method 1: Get your token from NECO

- Log in or create an account using your email and phone number

- Go to Purchase Token

- Pay through Remita using debit card, USSD, or bank transfer

- The token costs ₦1,000, though some vendors may add a fee

Method 2: Authorised third-party vendors

If the NECO site is slow, you can buy tokens from:

- BuyCard.ng for about ₦1,300

- E PinMall for about ₦1,500

- Cegital Inc for instant display and email delivery

How to check your result

- Go to https://results.neco.gov.ng/

- Select 2025 as your exam year

- Choose your exam type, either SSCE INTERNAL or SSCE EXTERNAL

- Enter your 12-digit token, which is case sensitive and can be used up to five times

- Enter your 10-digit registration number

- Click Check Result

Key things to know

- A single token works for the same result up to 5 times

- For official school or admission checks, you may need to use the NECO eVerify Platform

- Token prices usually range from ₦1,300 to ₦1,500 when you buy from vendors

Save your result

- Click Print to download a PDF

- Save it on your phone or computer for school and admission use

This online system lets you get your result without visiting any NECO office, so you can access it faster and with less stress.

How to check your 2025 NECO results on your phone

You can check your NECO result on your phone using a mobile browser or by SMS. The mobile browser option works with 3G, 4G, or 5G internet. The SMS option works without data and is useful in areas with weak network coverage.

Mobile browser method

- Open Google Chrome or Safari and go to results.neco.gov.ng

- Log in or use the Check Result option if you already bought a token

- Enter 2025, your exam type, your 12-digit token, and your 10-digit registration number

- When your result shows, use Save as PDF from your browser to store it on your phone

SMS method

- Open your phone’s messaging app and type your details in this specific format: NECO*ExamNo*PIN*ExamYear.

Example: NECO*12345678AB*686442341122*2025

- Note: Ensure there are no spaces between the details.

- Send to Shortcode: Send the message to the official NECO result-checking number: 32327.

- Wait for Response: You will receive a text message with your subject results and grades shortly after you send.

Important Requirements:

- Token (PIN) Still Needed: You must have already purchased a result-checking token from the NECO Results Portal to use this method.

- Airtime Balance: Ensure you have at least ₦50 in airtime on your phone, as SMS charges apply.

- Network Support: This service is typically available for major Nigerian networks, including MTN, Glo, and Airtel.

How to check your 2025 NECO results offline

You can also get your 2025 NECO result offline through your school or a NECO office. This is useful if you need official checks, name fixes, or if you wrote the SSCE Internal.

If you wrote SSCE Internal

- Go to the secondary school where you registered

- The school exam officer or principal collects the Master List from the NECO state office

- You can ask for a stamped and signed result slip from this list, which you can use for school clearance

If you need corrections or attestation

- Visit the nearest NECO office for name or date of birth issues, or for Attestation of Results

- In Lagos, go to 175 Ikorodu Rd, Onipanu or the zonal office in Lekki Phase I, Lagos

- Take your ID, your exam registration slip, and proof of payment for any service fees

How to get your original certificate

- Schools release original certificates one to two years after the exam

- Go back to your school to sign and collect it if you wrote the SSCE Internal

- If you wrote the SSCE External, collect it from the NECO state office where you took the exam

All offline and special service fees must be paid through payments.neco.gov.ng before NECO will process your request.

What to do if your NECO result is not showing

If your result does not appear on the portal, the message you see tells you what went wrong. Use it to know what to fix.

Common errors and what to do

- No CA3: Your school did not upload your third-year Continuous Assessment.

You must contact your school. The school has to pay the Late CAS 3 Upload fee of ₦40,000 and submit your records to the NECO state office so your result can be unlocked. - Invalid token: This happens when you type the token wrong, use it more than five times, or buy it from an unverified seller.

Check the digits again. If it still fails, you need to buy a new token from the official portal. Avoid cyber café sellers who may resell used tokens. - Result not found or wrong details: This means your registration number, exam year, or exam type does not match NECO records.

Check your exam slip. Use SSCE External for Nov or Dec exams and SSCE Internal for June or July exams. - Withheld or held: This means NECO is checking for exam malpractice linked to you or your centre.

You must wait for the NECO Special Committee on Malpractice. If you are cleared, your result will come out after some weeks. If not, it is cancelled. - Centre derecognition: Four centres in 2025 were derecognised, so results from those centres can be held or cancelled.

You need to talk to your school or visit the NECO state office to find out whether you must resit.

If the error does not clear, you should contact NECO through their official support channels for help.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Crucial Fed Rate Cut: October Probability Surges to 94%