Best Crypto to Buy Now: Bitcoin, Ethereum, Solana Top the List

TLDR

- Bitcoin dropped 45% from October 2025 peak of $126K to current range of $65K-$70K in February 2026

- Ethereum trades between $1,700-$2,000 with upcoming Pectra upgrade targeting 10,000+ TPS

- Solana fell from $294 all-time high to around $68 but maintains strong developer activity

- BNB holds $670-$860 range with quarterly token burns and Binance ecosystem revenue

- XRP trades at $1.35 following court victories and expanding institutional payment partnerships

The cryptocurrency market entered a correction phase in February 2026. Bitcoin fell from its October 2025 high above $126,000 to a current range of $65,000-$70,000. The total crypto market cap lost nearly $2 trillion in value.

Altcoins experienced steeper losses than Bitcoin. Many tokens dropped 20-30% in one week. Retail investors sold holdings while ETFs recorded outflows.

Bear markets historically create buying opportunities for long-term investors. Projects with strong fundamentals often survive downturns and grow in future cycles. Five cryptocurrencies show resilience during this market decline.

Bitcoin (BTC)

Bitcoin remains the largest cryptocurrency by market capitalization. The asset fell more than 45% from its cycle peak. Current prices range between $60,000 and $70,000.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The Bitcoin network maintains its 21 million coin supply cap. This fixed supply attracts institutional investors seeking digital gold properties. Spot Bitcoin ETFs absorbed millions of coins since their launch in early 2024.

Recent weeks brought ETF outflows as market sentiment turned negative. Many analysts expect institutional demand to return when conditions improve. The Bitcoin network’s security remains unmatched in the cryptocurrency sector.

Ethereum (ETH)

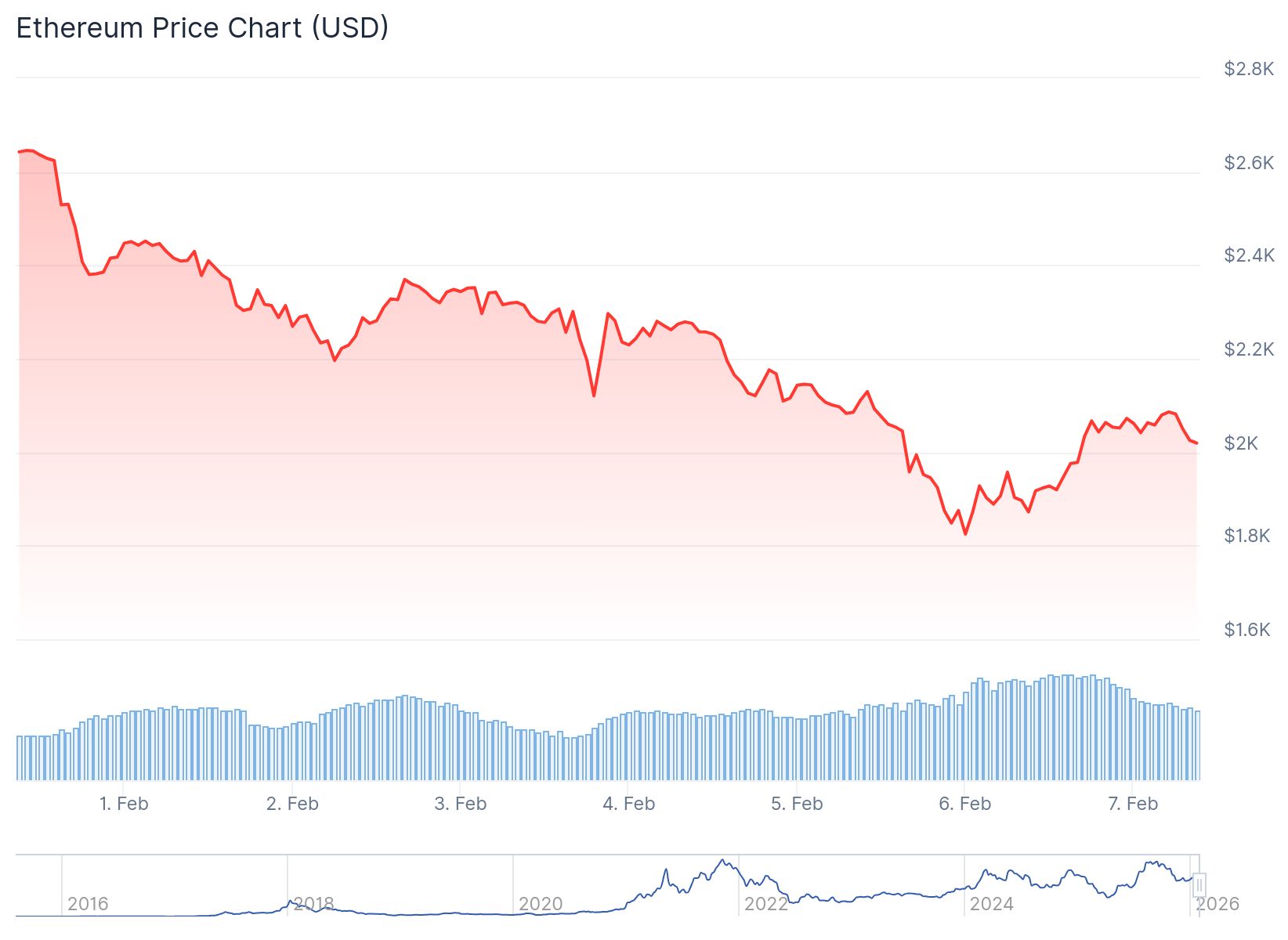

Ethereum trades between $1,700 and $2,000 after weak price performance this cycle. Network fundamentals improved despite negative price action. The upcoming Pectra upgrade will enhance staking and account abstraction features.

Ethereum (ETH) Price

Ethereum (ETH) Price

The upgrade could push network throughput toward 10,000 transactions per second. Layer-2 solutions will benefit from efficiency improvements. DeFi protocols on Ethereum continue to dominate total value locked across the sector.

Institutional investors stake ETH through approved ETFs. Real-world asset tokenization projects choose Ethereum for infrastructure. The network processes more transaction value than competing blockchains.

Solana (SOL)

Solana dropped from its all-time high of $294 to around $68. The network experienced outages in previous years that damaged its reputation. Recent leverage liquidations pushed prices down further.

The blockchain offers fast transaction speeds with fees under one cent. DeFi applications, memecoins, and consumer apps drive network activity. Developer engagement metrics remain strong across the ecosystem.

The Firedancer upgrade aims to fix reliability issues. On-chain activity shows consistent growth despite price declines. The network processes millions of transactions daily.

BNB

BNB trades in a range of $670 to $860 during the bear market. The token powers the BNB Chain ecosystem and Binance exchange. Quarterly token burns reduce total supply over time.

Binance remains the world’s largest cryptocurrency exchange by trading volume. The exchange generates real revenue that supports BNB utility. The token shows resilience during market downturns compared to other large-cap assets.

BNB Chain hosts numerous decentralized applications and protocols. The network offers low fees and fast confirmation times. Use cases continue expanding across the Binance ecosystem.

XRP

XRP currently trades around $1.35, well below previous highs. Ripple achieved court victories in legal battles over recent years. These wins brought more regulatory clarity to the token.

Ripple expanded partnerships with financial institutions for cross-border payments. The company launched a stablecoin initiative to compete in that market. XRP offers high liquidity and availability on major exchanges.

The token serves real-world payment use cases through RippleNet. Banks and payment providers test XRP for international money transfers. Potential U.S. regulatory clarity could change market perception of the asset.

The post Best Crypto to Buy Now: Bitcoin, Ethereum, Solana Top the List appeared first on CoinCentral.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

Trump's Epstein confession revealed in newly surfaced FBI files: 'Everyone knows'