Ethereum Faces $6B Liquidation Risk if Price Falls Below $4,200: Will ETH Price Decline Further?

The post Ethereum Faces $6B Liquidation Risk if Price Falls Below $4,200: Will ETH Price Decline Further? appeared first on Coinpedia Fintech News

In the past few hours, Ethereum’s price has had a hard time attracting buying demand. Because of this, on-chain data now shows that more traders are starting to sell. As selling pressure grows and key price levels are lost, there’s a higher risk of large liquidations. This could lead to a bigger drop in Ethereum’s price.

Ethereum Faces $6 Billion Risk

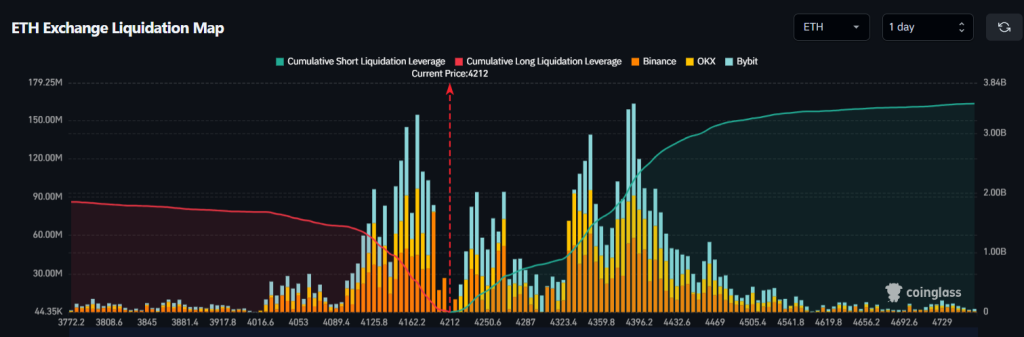

In the past 24 hours, Ethereum’s price has dropped sharply as selling pressure increased after it lost key support levels. According to data from Coinglass, over $117 million worth of Ethereum trades were liquidated. Out of this, buyers lost about $72.24 million, while sellers had to close around $44.7 million in short positions.

Lately, Ethereum has struggled to break above certain resistance levels, which has added more downward pressure. Coinglass also reports that about $6 billion in long (buy) positions could be at risk if Ethereum falls to $4,200.

ETH Liquidation: Coinglass

ETH Liquidation: Coinglass

A heatmap of liquidation points shows a large cluster of trades that could be forced to close if prices keep falling. This could lead to even more selling, as traders scramble to exit their positions.

Right now, more traders are betting that Ethereum will go down than up. Because of this, market makers might try to push prices higher, possibly up to $4,500, to trigger stop-losses or liquidate short positions. At the moment, Ethereum’s long/short ratio is 0.8447, meaning about 54% of traders are expecting the price to drop further soon.

Also read: Ripple CTO Says MicroStrategy “Won’t Turn Out Well” If Bitcoin Price Falls

At the same time, demand for ETH remains strong from companies that hold large amounts of it in their treasuries. The biggest one, BitMine, announced yesterday that it increased its ETH holdings by $1.7 billion over the past week, bringing the total to $6.6 billion.

That means they added over 373,000 ETH coins, growing their stash from 1.15 million to 1.52 million. This kind of large-scale buying creates strong upward pressure on the price, which is a positive sign for Ethereum.

What’s Next for ETH Price?

ETH continued to fall after dropping below the key support level at $4,400. This likely means that short-term traders are taking profits. As of writing, ETH price trades at $4,205, declining over 2% in the last 24 hours.

ETH/USD Price Chart: TradingView

ETH/USD Price Chart: TradingView

The next important level to watch is $4,143. If ETH bounces strongly from this level, it could mean that buyers are stepping in and trying to turn it into a new support zone. In that case, the ETH/USDT pair might rise again, potentially reaching $4,777. If it breaks above $4,777, there’s a good chance it could climb to $5,000.

However, if ETH falls below $4,143 and stays there, it could signal a deeper pullback. The price might then drop to around $3,800, and possibly even down to the 50-day moving average at $3,556.

You May Also Like

Michael Saylor’s Strategy follows Metaplanet, adding 6,269 BTC worth $729 million

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth