Bitcoin Price Analysis: Why Experts Warn BTC Could Drop Below $107K

TLDR:

- Bitcoin trades at $113,449, down 2.52% in 24h, with $40.1B daily volume, per CoinGecko.

- Short-term holders accumulated Bitcoin above $107K, increasing exposure to deeper losses if price breaks down.

- Analysts warn $107K breach could trigger heavy liquidations across multiple exchanges from leveraged long positions.

- Strong support seen near $111K–$112K, but failure to hold could deepen market pessimism into late August.

Bitcoin’s price is sliding into a dangerous zone. Traders are watching closely as leveraged positions build and short-term holders take risks. Market sentiment has weakened in recent days, setting the stage for volatile swings.

Analysts warn that a key level near $107K could decide the next move. A sharp break lower could trigger fresh waves of liquidations.

Short-Term Bitcoin Holders Push Risk Higher

Data shared by Alphractal showed that short-term holders have been buying Bitcoin at elevated prices this cycle.

Their realized price now stands above $107,000, a level described as critical for avoiding deeper losses. Unlike previous cycles, these investors entered late and heavily leveraged, especially on long trades.

This behavior has expanded their exposure to downside pressure. A fall below the $107K mark would put them underwater with little margin to recover.

Analysts argue that liquidation pools are stacked below this point across several exchanges. Such conditions make the market fragile and prone to sudden downside spikes.

Alphractal described the recent push to $124K as a bull trap designed to capture liquidity. Traders who chased the move higher are now facing mounting losses as the price retreats. The data suggests many may not withstand further downside pressure if support fails.

BTC Support Levels and Liquidation Pressure

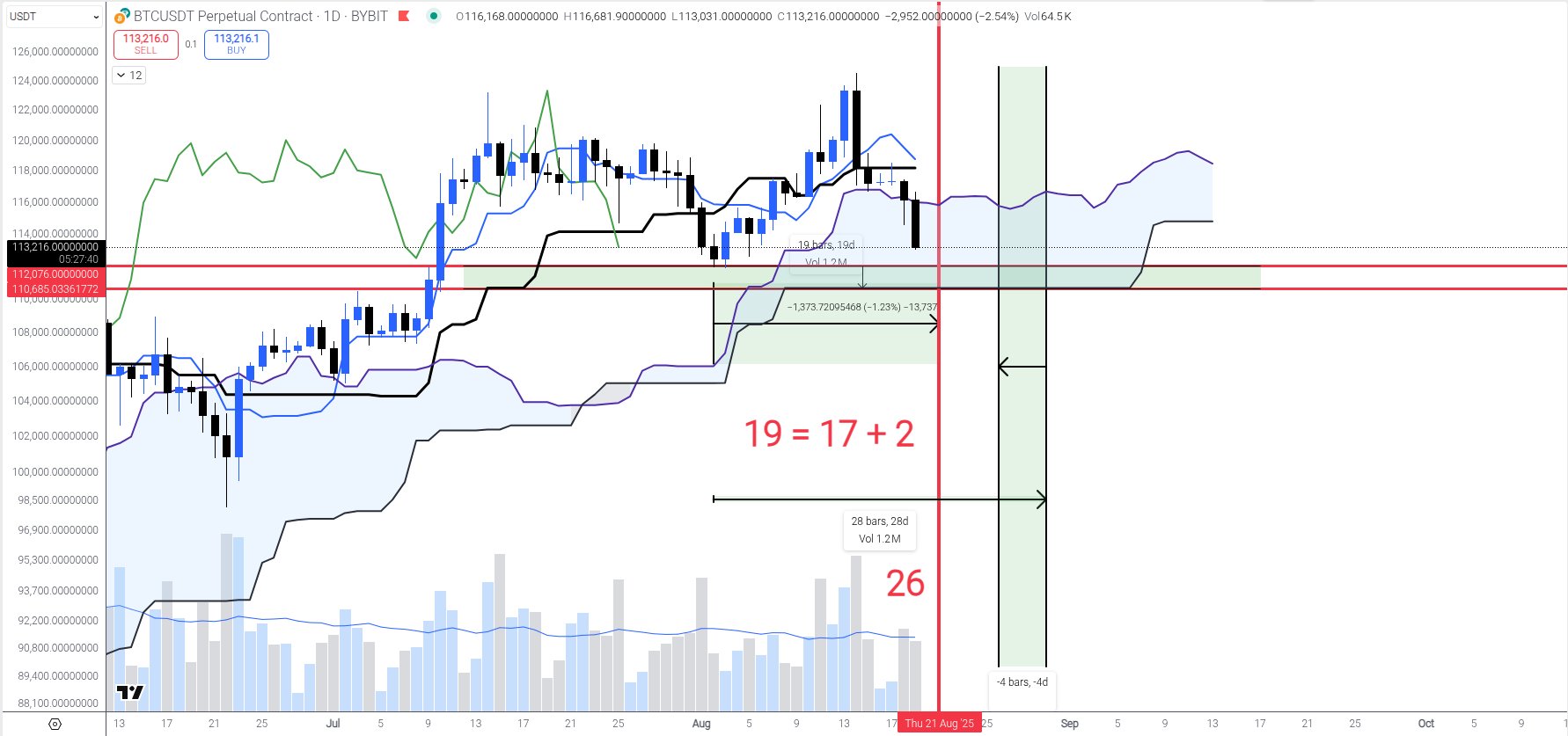

Chart analysis from Dr Cat pointed to a cluster of strong support between $110,688 and $112,076.

Key technical lines such as the daily SSB and the three-day Kijun Sen fall in this range. According to his outlook, Bitcoin needs to retest this zone quickly to form a possible local bottom.

If that move happens before August 21, or later between August 26 and 30, traders could reassess the setup. But the timing is critical. A delayed or deeper breakdown may weaken confidence in broader technical structures.

At the same time, TheKingfisher reported that nearly 78.5% of liquidation levels are concentrated on the short side. This imbalance creates a tug-of-war between bearish sentiment and liquidity grabs by larger players.

Price could swing sharply in either direction as leverage builds.

CoinGecko data at press time showed Bitcoin trading at $113,449 with $40.1 billion in 24-hour volume. The price has dropped 2.52% in the past day and nearly 5% over the past week. Traders now wait to see if support around $111K holds, or if the feared $107K test comes next.

The post Bitcoin Price Analysis: Why Experts Warn BTC Could Drop Below $107K appeared first on Blockonomi.

You May Also Like

Michael Saylor’s Strategy follows Metaplanet, adding 6,269 BTC worth $729 million

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth