Little Pepe could produce more millionaires in the next 100 days

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Little Pepe fuses meme culture with Layer-2 tech, eyeing exponential gains in the next 100 days.

Table of Contents

- Shiba Inu and Pepe Coin: Massive wins, but slowing momentum

- Enter Little Pepe: The memecoin with real infrastructure

- Confidence metrics and a $777k giveaway prepare for a historic launch

- Little Pepe interest surges past legacy memecoins

- Why LILPEPE could outperform Shiba Inu + Pepe Coin

- A 100-day roadmap to explosion

- Final take: The window is closing fast

- Little Pepe merges memes with a Layer-2 chain, aiming to outpace SHIB and PEPE with real infrastructure.

- With its Layer-2 chain, launchpad, and CEX catalysts, it targets exponential growth in 2025.

- LILPEPE’s ecosystem demand and Tier-1 listings could create more millionaires than SHIB and PEPE.

When Shiba Inu and Pepe Coin launched, they turned a few hundred early believers into multi-millionaires almost overnight. But the memecoin market is no longer the Wild West. It’s crowded, competitive, and riddled with scams. And yet, every once in a while, a new contender shows up with all the raw ingredients for exponential gains.

That coin today is Little Pepe (LILPEPE), a project that’s merging the nostalgic culture of internet memes with the cutting-edge speed and scalability of a Layer-2 blockchain. It’s bringing the added benefit of infrastructure and innovation that older memecoins lacked. And in the next 100 days, it may produce more millionaires than Shiba Inu and Pepe coin did combined.

Shiba Inu and Pepe Coin: Massive wins, but slowing momentum

SHIB’s rise in 2021 was meteoric. In months, it turned small investments into life-changing wealth. But its glory days were powered almost entirely by hype. Without a strong technological backbone, its rally died down quickly. SHIB is still fighting to reclaim previous highs, even with ecosystem developments like Shibarium.

Pepe Coin followed a similar trajectory in 2023. It leveraged internet meme culture brilliantly but offered little in the way of infrastructure or long-term growth engines. PEPE still commands a strong community today. However, it lacks the broader ecosystem that keeps demand going beyond short-term pumps.

This leaves memecoin investors searching for something different — a project that combines the virality of SHIB/PEPE and the structural advantages for long-term sustainability.

Enter Little Pepe: The memecoin with real infrastructure

Little Pepe offers just that: memetic energy and innovation, and this gives it an added advantage over Shiba Inu and Pepe Coin. LILPEPE is built on Pepe Chain, a high-speed Layer-2 blockchain optimized for meme culture.

Unlike most memecoins with no real tech, Little Pepe runs on infrastructure that enables low-fee, lightning-fast transactions while supporting other meme projects.

Key features:

- Layer-2 blockchain foundation for scalability and low costs.

- Sniper bot resistance protects early buyers from predatory trading.

- Zero-tax trading, ensuring full liquidity flow for users.

- Meme Launchpad: A built-in incubator for new meme coins launching on Pepe Chain.

Now in Stage 11 at $0.002 per token, Little Pepe has already raised over $20 million of its $22.325 million target. About half of the total presale allocation is already sold, and each stage’s price bump has been met with accelerated buying pressure. This is a clear sign that retail investors and whales alike are positioning early.

Confidence metrics and a $777k giveaway prepare for a historic launch

Confidence in the project isn’t just coming from buyers. Little Pepe is already listed on CoinMarketCap, ensuring global visibility before it even hits exchanges. On the security front, the project has completed its Certik audit.

Momentum is set to spike even higher with Tier-1 CEX listings scheduled immediately after the presale wraps. Adding to the frenzy is the $777,000 giveaway that has become a magnet for viral attention across X (formerly Twitter), Telegram, and Reddit.

Little Pepe interest surges past legacy memecoins

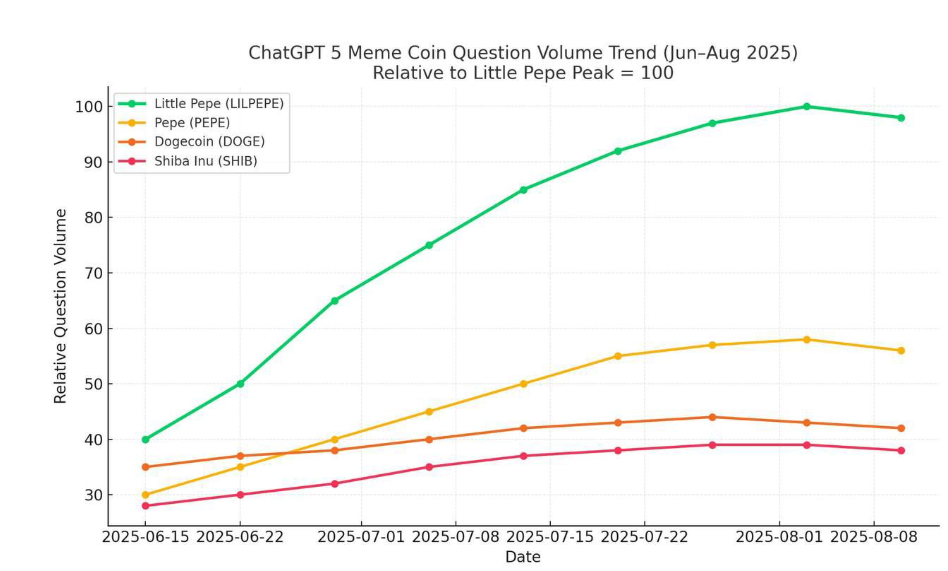

Little Pepe isn’t just keeping pace with the big players; it’s already outshining them in online buzz before even hitting exchanges. A chart showing ChatGPT 5 memecoin volume trend between June and August indicates that Little Pepe’s search interest surpassed PEPE, Dogecoin, and Shiba Inu, despite those coins having years of brand recognition.

What’s even more remarkable is the steep upward slope of Little Pepe’s trendline compared to the flatter patterns of older meme coins. That trajectory suggests momentum is not only strong but accelerating — a telltale sign of an incoming viral breakout. Charts like this don’t lie. They reveal where attention and excitement are converging. And in the meme coin market, attention is the fuel that powers the biggest moonshots.

Why LILPEPE could outperform Shiba Inu + Pepe Coin

Unlike SHIB and PEPE, LILPEPE goes a step further, giving it the power to outperform Shiba Inu and Pepe coin combined. Here’s why it could outpace both:

- Early infrastructure: Unlike Shiba Inu and Pepe Coin, which launched without infrastructure, Little Pepe comes ready with its Layer Two and launchpad.

- Ecosystem-driven demand: Every meme token launching on Pepe Chain will require LILPEPE liquidity and community exposure.

- Tier-1 exchange catalysts: Historical data shows memecoins can spike 10×–50× within weeks of hitting top-tier CEXs.

- Defensive trading mechanics: Bot resistance and zero-tax trading mean fairer distribution, sustaining price stability before explosive runs.

- MemeFi wave: The next bull cycle’s meme narrative is leaning towards coins with real infrastructure; Little Pepe is already ahead of that curve.

A 100-day roadmap to explosion

The Little Pepe team isn’t relying on hype alone. They have a clear and aggressive 100-day roadmap that could send the price skyrocketing after the presale:

- Top 2 CEX Listings at Launch: Instant liquidity and exposure to millions of traders.

- Launch of Pump Pad: Attracts new projects to the ecosystem, creating continuous token demand.

- Aggressive Social Campaigns and Marketing Blitz: Influencer partnerships and targeted ads.

Every step is aimed at maximizing visibility and demand during the critical launch window.

Final take: The window is closing fast

If SHIB and PEPE were “lightning in a bottle,” Little Pepe is lightning with a rocket strapped to it. It blends the viral DNA of classic memecoins with the infrastructure and tokenomics to sustain a rally long enough for early buyers to realize generational gains. With the presale halfway done and exchange listings on the horizon, the next 100 days could be transformative for those who get in early. Join the $777k Giveaway to be a winner. Secure LILPEPE Today Before the Price Jumps.

To learn more about Little Pepe, visit the website, Telegram, and X.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Over 60% of crypto press releases linked to high-risk or scam projects: Report

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse