Bitcoin Bear Market Alert: Will BTC Price Drop to $55K Next?

The post Bitcoin Bear Market Alert: Will BTC Price Drop to $55K Next? appeared first on Coinpedia Fintech News

Bitcoin is once again testing investor confidence. After falling below $66,000 and triggering about $177 million in long liquidations, BTC quickly bounced back above $69,000, forcing nearly $140 million in short positions to close. This sharp move in both directions shows that the market is being driven more by leveraged trades than steady buying or selling.

At the time of writing, Bitcoin is trading around $68,752. However, market mood remains weak. The Bitcoin Fear and Greed Index has dropped to 9, which signals Extreme Fear. Even though the price looks stable, many traders are hesitant and unsure about the next move.

Bitcoin Key Price Levels to Watch

Right now, price movement is focused on important support and resistance zones.

On the downside, the $63,000–$65,000 range is an important support area. If selling pressure increases, Bitcoin could revisit this zone. A break below it may lead to further downside.

On the upside, the $69,000–$71,000 range is acting as strong resistance. If buyers manage to push the price above this level and hold it, Bitcoin could aim for higher levels. If not, the price may pull back again before trying another move up. Data from Glassnode shows that although Bitcoin has been moving between $65,000 and $73,000 recently, traders in the options market expect a bigger price swing soon. This suggests the current calm may not last long.

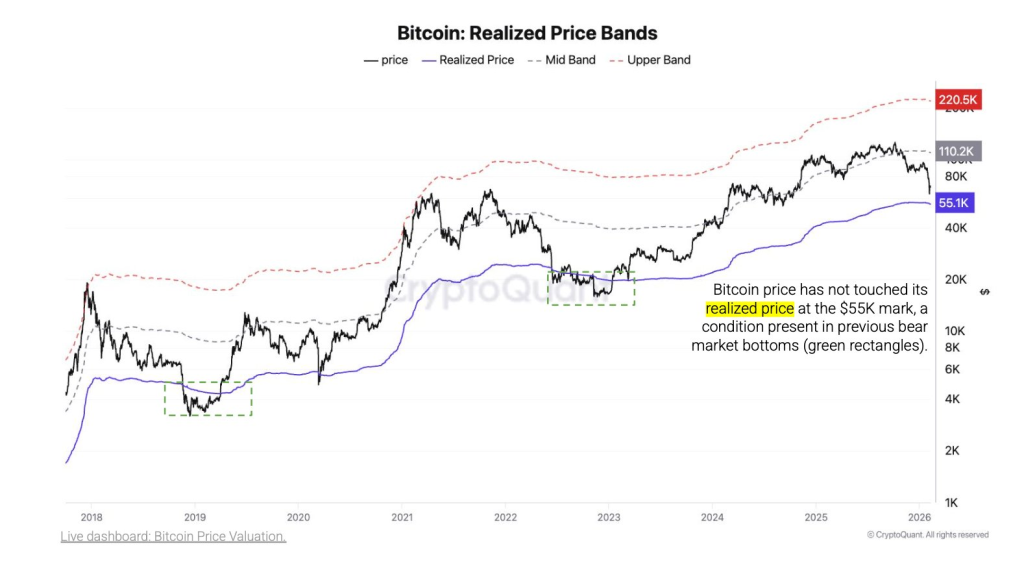

Why $55,000 Is Important for Bitcoin Price?

According to CryptoQuant, Bitcoin’s realized price is close to $55,000. The realized price represents the average price at which coins last moved on-chain. In previous bear markets, Bitcoin often dropped 24% to 30% below this level before forming a strong bottom.

- Also Read :

- X Promises Crypto and Stock Trading via Smart Cashtags: When Is It Going Live?

- ,

For now, Bitcoin is still well above $55,000. This means the market has not seen full panic selling yet. On-chain data also shows that more than half of the Bitcoin supply is still in profit. Long-term holders are not selling heavily, which suggests the market has not reached a deep crisis point.

Historically, major bottoms do not form in one sudden crash. They usually take several months of sideways movement and repeated testing of support levels.

What Happens Next for BTC?

If selling pressure increases, Bitcoin could move toward the $55,000 level, or even the low $50,000 range. On the other hand, if buyers push the price above $70,000 and hold it, confidence could slowly return.

For now, Bitcoin remains in a sensitive phase. Fear is high, volatility is building, and price is moving between key support and resistance levels. The next few months will likely decide whether this is the start of a deeper correction or the early stage of recovery.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Sharp liquidations can widen price swings and increase short-term risk, especially for traders using leverage. Long-term holders are usually less affected unless volatility triggers broader panic selling. For new investors, sudden moves can create emotional decision-making and poor entry timing.

When options traders price in higher implied volatility, it signals expectations of a significant breakout or breakdown. This often attracts short-term speculators and hedgers, which can amplify momentum once a key level is breached. Increased derivatives positioning can also accelerate moves in either direction.

Sustained spot buying, rising trading volume, and improving funding rates would indicate healthier demand. A shift in sentiment from fear toward neutral or greed typically supports steadier upward trends. Stability above major resistance for several weeks would further strengthen confidence.

Market makers, short-term traders, and hedged institutional participants often benefit from rapid price swings. Volatility creates more trading opportunities and spreads. However, investors without risk management strategies may face higher losses during sharp reversals.

You May Also Like

Shaanxi Province issued its first digital RMB science and technology innovation bond, amounting to 300 million yuan.

Microsoft plans to invest $4 billion in building a second AI data center in Wisconsin