Best Cryptocurrencies to Buy With $1,000 Before 2027

The post Best Cryptocurrencies to Buy With $1,000 Before 2027 appeared first on Coinpedia Fintech News

While the largest top cryptocurrencies in the industry are finding stable ground, a clear pattern of capital rotation is emerging. Investors who have watched the market for years are starting to look beyond the established altcoins. They are seeking new crypto protocols that offer new utility and room for growth. This movement suggests that the next wave of the bull market may not be led by assets that dominated the past.

Binance Coin (BNB)

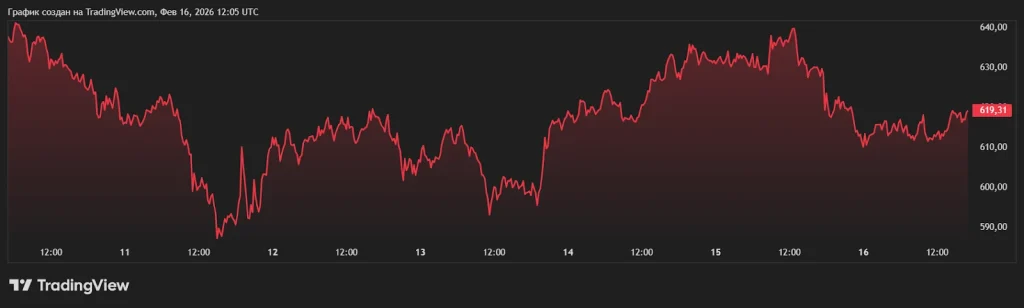

As of mid-February 2026, Binance Coin (BNB) is trading at approximately $620. With a market capitalization of over $90 billion, it remains one of the most stable and liquid assets in the crypto space.

The coin serves as the primary utility token for the Binance ecosystem, offering trading fee discounts and access to the Binance Launchpad. Its deflationary model, which involves quarterly token burns, continues to reduce the total supply.

However, BNB faces significant technical hurdles on its path to higher valuation. The token is currently testing a heavy resistance zone at $600, a level that has acted as a psychological and technical ceiling for several months.

Solana (SOL)

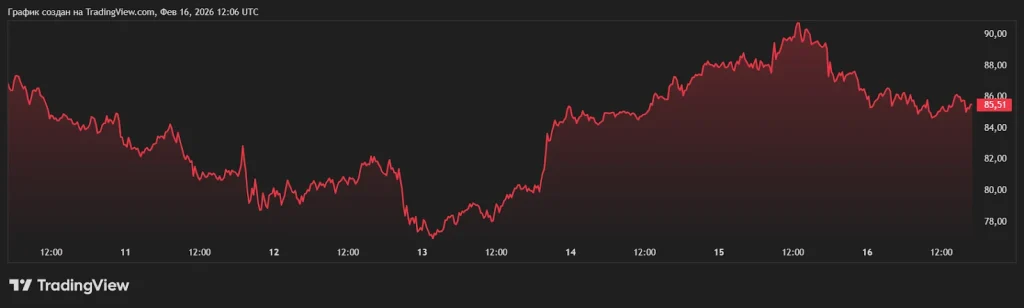

Solana (SOL) is currently priced at roughly $85, following a period of consolidation. It holds a market cap of approximately $45 billion, solidifying its position as a leading smart contract platform. Known for its high speed and low transaction costs, Solana has become a favorite for retail traders and developers building decentralized applications. Recent institutional interest through spot ETFs has helped stabilize the price after past volatility.

Despite its popularity, Solana is struggling to break through key resistance levels. The most immediate barrier is at $95, which has rejected multiple recovery attempts. A more significant resistance zone sits at $120, where long-term holders often take profits.

Additionally, the network faces structural challenges regarding value capture, as a large portion of ecosystem fees goes to applications rather than the protocol itself. These factors have led some analysts to look for newer projects with lower market caps and clearer upside potential.

Mutuum Finance (MUTM)

As capital rotates out of larger caps, Mutuum Finance (MUTM) is emerging as a top destination. This non-custodial Ethereum protocol allows users to borrow, lend, and earn yield without middlemen, currently priced at $0.04 in its 7th distribution phase.

The protocol offers highly competitive terms, including LTV (Loan-to-Value) ratios up to 80% on top-tier assets and dynamic APYs designed to provide sustainable, market-leading returns for liquidity providers.

The project’s fundamentals are exceptionally strong, having raised over $20.5 million from more than 19,000 individual holders. Since its early 2025 debut at $0.01, the token has already achieved a 300% surge, with a fixed supply of 4 billion tokens and a confirmed $0.06 launch price. This verifiable on-chain distribution ensures a clear path to value for early participants.

Why Analysts See High Potential in MUTM

Experts believe Mutuum Finance (MUTM) is strategically positioned to outperform established giants like BNB and Solana in terms of percentage returns due to its early-stage status and concentrated utility.

While BNB and SOL are pillars of the market, their massive market caps naturally limit their room for exponential growth; for instance, a $1,000 investment in BNB would require the project to hit a $160 billion valuation just to double. In contrast, MUTM operates as a low-cap entry with a significantly higher ceiling for appreciation.

A direct investment comparison highlights these distinct risk-reward profiles. A $1,000 position in BNB or SOL is likely to provide steady, slow growth as part of a balanced, mature portfolio. However, the same $1,000 invested in MUTM at the current price of $0.04 secures 25,000 tokens. As long as the protocol captures even a modest fraction of the DeFi lending market and reaches a price of $0.40, that initial investment would grow to $10,000.

V1 Protocol Launch and Verified Security

The technical engine of Mutuum Finance is already operational. The V1 protocol is live on the Sepolia testnet, where users can explore supply and borrowing flows. This beta version allows participants to interact with liquidity pools and receive mtTokens. These tokens act as yield-bearing receipts. Their value increases over time as interest is collected within the system, allowing users to earn passive profits without selling their original assets.

Security is the top priority for the Mutuum Finance’s team. The project has successfully completed a manual code audit with Halborn Security. It also holds a high 90/100 trust score from CertiK. These layers of protection ensure the integrity of the borrowing and liquidation logic.

Additionally, an active $50,000 bug bounty program encourages independent review of the code. By linking token value directly to platform usage through its buy-and-distribute mechanism highlighted in the official roadmap, Mutuum Finance offers a sustainable growth model for the years ahead.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

You May Also Like

Michigan’s Stalled Reserve Bill Advances After 7 Months

Nevada’s Legal Clash with Financial Prediction Platform Intensifies