The UAE Has Quietly Built Up a $453 Million Bitcoin Reserve: Arkham

Bitcoin Magazine

The UAE Has Quietly Built Up a $453 Million Bitcoin Reserve: Arkham

Arkham Intelligence says bitcoin mining operations linked to the UAE’s Royal Group are sitting on roughly $344 million in unrealized profit, excluding energy costs.

Arkham attributed about 6,782 BTC to wallets connected with UAE royal-linked mining activity, valuing the holdings at approximately $453.6 million at the time of analysis. The firm said the implied profit reflects the difference between current bitcoin prices and estimated production costs, though it noted the figure does not account for electricity and operational expenses.

Arkham’s onchain data also points to a steady pace of mining output.

Over the past seven days, the UAE-linked wallets produced around 4.2 BTC per day, suggesting ongoing industrial-scale operations. The analytics firm added that the UAE appears to be retaining most of its self-mined bitcoin, with the last recorded outflow from the wallets occurring roughly four months ago.

The findings underscore how the UAE has pursued a different path from many other governments with large bitcoin positions.

While countries such as the United States and the United Kingdom hold significant reserves largely tied to law enforcement seizures, Arkham said the UAE’s accumulation has been driven primarily by domestic mining activity.

The UAE’s mining push traces back to 2022, when Citadel Mining, an entity linked to Abu Dhabi’s royal family, established large-scale operations on Al Reem Island. That same year marked a broader regional effort to attract digital asset infrastructure, supported by capital from state-connected firms.

In 2023, Marathon Digital Holdings and Abu Dhabi-based Zero Two announced a joint venture aimed at developing 250 megawatts of immersion-cooled bitcoin mining capacity in the UAE. The project was one of the largest disclosed industrial mining deployments in the region, reflecting the country’s ambitions to become a hub for crypto infrastructure.

Arkham said its latest estimate revises down an earlier projection from August 2025, when the firm attributed roughly $700 million in mined bitcoin to the UAE during a period of higher prices. At that time, Arkham estimated the country had mined about 9,300 BTC and held roughly 6,300 BTC, ranking it among the top sovereign entities with verified onchain holdings.

Under the updated figures, the UAE’s holdings represent about 0.03% of bitcoin’s total supply, according to Arkham.

Abu Dhabi’s Bitcoin ETF exposure

Abu Dhabi’s sovereign wealth funds are also getting in on the fun. This week they disclosed a major increase in their exposure to BlackRock’s iShares Bitcoin Trust (IBIT), reporting ownership of 12.7 million shares worth about $630.6 million as of Dec. 31. That marks a 46% jump from the 8.7 million shares previously reported at the end of September.

Mubadala, which oversees a global portfolio across technology, healthcare, infrastructure, private equity, and public markets, manages more than $330 billion in assets. Its mandate is to generate long-term returns for the Abu Dhabi government while supporting economic diversification beyond oil.

Another Abu Dhabi-based firm, Al Warda Investments, also raised its IBIT position in Q4 2025 to 8.22 million shares, up from 7.96 million in Q3, continuing a shift toward public bitcoin ETF exposure that began earlier in the year.

Al Warda, part of the Abu Dhabi Investment Council under Mubadala, has traditionally focused on private investments, making its growing allocation to IBIT notable for the region. Together, Abu Dhabi investment vehicles held more than 20 million IBIT shares at the end of last year, with a combined value above $1.1 billion.

Arkham did note that the United States remains the largest sovereign bitcoin holder, with approximately 328,000 BTC valued at $22 billion, largely derived from seizures tied to cases such as the Bitfinex hack and Silk Road investigations.

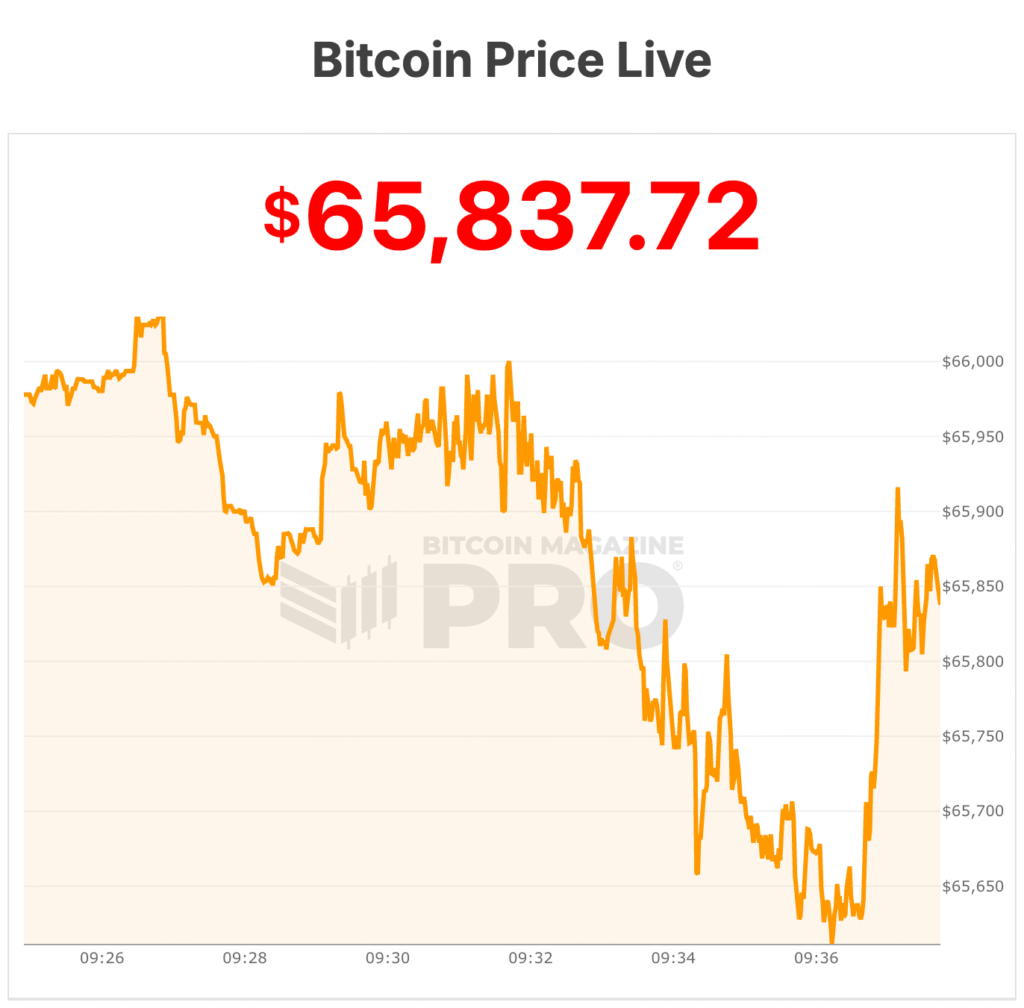

At time of writing, Bitcoin is trading right below $66,000.

This post The UAE Has Quietly Built Up a $453 Million Bitcoin Reserve: Arkham first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

The Next Bitcoin Story Of 2025

Moonshot MAGAX vs Shiba Inu: The AI-Powered Meme-to-Earn Revolution Challenging a Meme Coin Giant