Crypto ETFs: Ether Domination Continues as Bitcoin Trails With Modest Gains

Ether ETFs extended their inflow streak to five consecutive days, pulling in $309 million, while bitcoin ETFs managed another $81 million inflow despite a small outflow from Bitwise.

Ether ETFs Extend Winning Streak With $309 Million Inflow as Bitcoin Adds $81 Million

Momentum remains firmly on ether’s side. For the fifth straight day, investors piled into ether exchange-traded funds (ETFs), with $309.48 million in fresh inflows. The streak, now stretching across a full trading week, highlights ether’s growing magnetism for institutional and retail investors alike.

Blackrock’s ETHA was once again the undisputed leader, capturing $262.63 million of the total. Fidelity’s FETH added $20.52 million, while Grayscale’s Ether Mini Trust (+$15.05 million) and flagship ETHE (+$5.65 million) also contributed.

Vaneck’s ETHV and 21Shares’ TETH rounded out the day with gains of $3.35 million and $2.28 million. Crucially, no ether fund saw outflows. With trading volume at $2.23 billion, net assets rose to $30.17 billion, crossing another psychological milestone for ether products.

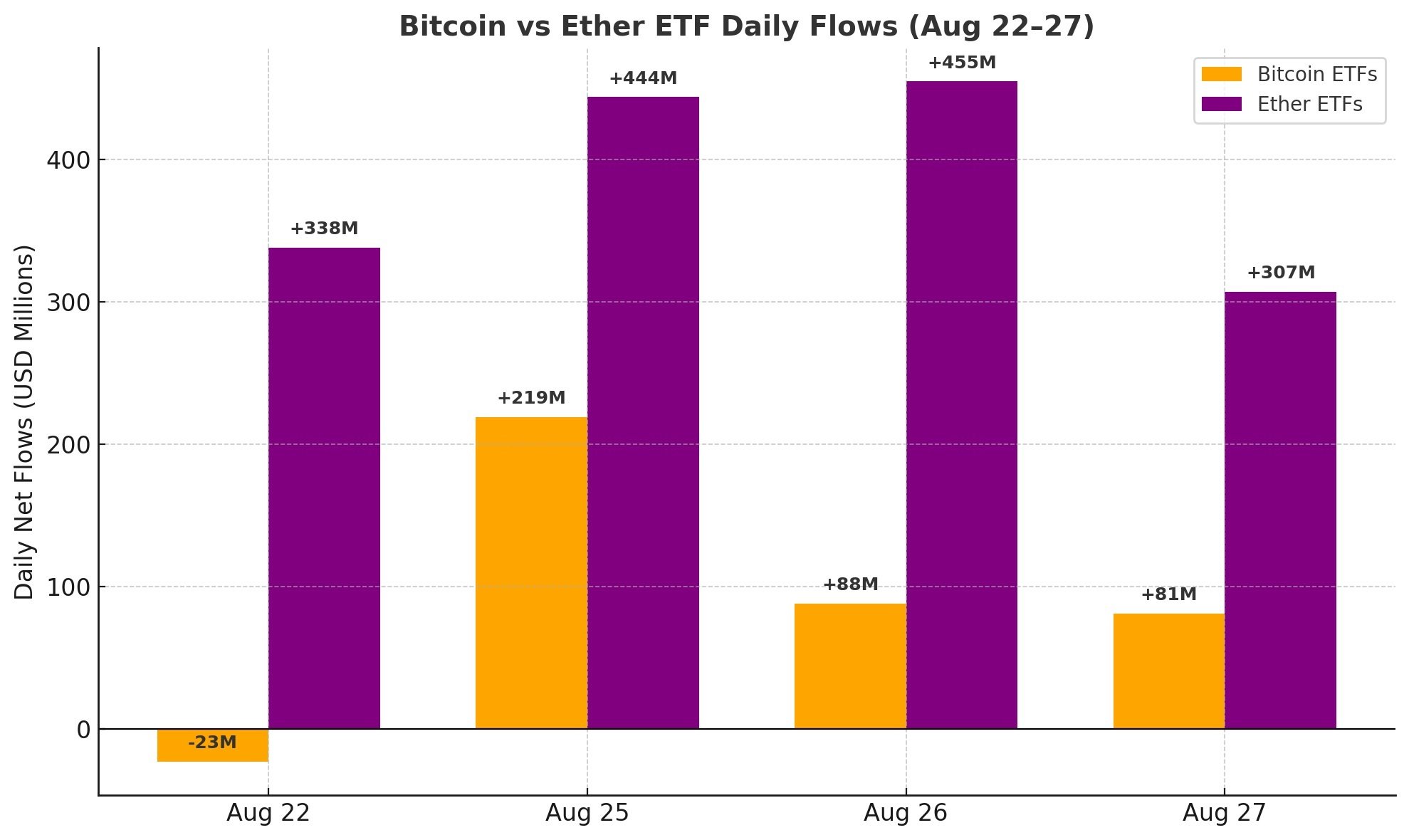

Ether vs Bitcoin ETF Flows (August 22 – 27)

Ether vs Bitcoin ETF Flows (August 22 – 27)

Bitcoin ETFs also made progress, though at a gentler pace. Flows totaled $81.25 million, spearheaded by Blackrock’s IBIT (+$50.87 million). Fidelity’s FBTC (+$14.65 million), Invesco’s BTCO (+$6.71 million), Franklin’s EZBC (+$6.48 million), and Ark 21Shares’ ARKB (+$5.58 million) all chipped in.

However, Bitwise’s BITB slipped with a $3.05 million outflow, tempering the day’s gains. Total trading stood at $2.81 billion, with bitcoin ETF net assets at $144.57 billion.

Ether’s streak of consecutive inflows now dwarfs bitcoin’s stop-start recovery. The contrast underscores a shifting investor preference that is beginning to define late August’s ETF flows.

You May Also Like

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise

Market Records Largest Long-Term Bitcoin Supply Release In History, Here’s What It Means For BTC