Amazon (AMZN) Stock: Rises 1.17% as Deal Brings Peacock Content to Prime Video

TLDRs;

- Amazon shares rose 1.17% after striking a deal with NBCUniversal to bring Peacock Premium Plus to Prime Video.

- Peacock subscriptions will be available for $16.99/month directly through Amazon’s Prime Video and Fire TV platforms.

- The deal adds live sports like Sunday Night Football, Premier League, and the Olympics to Prime Video’s lineup.

- Analysts say the move strengthens Amazon’s aggregator strategy while boosting NBCUniversal’s Peacock distribution reach.

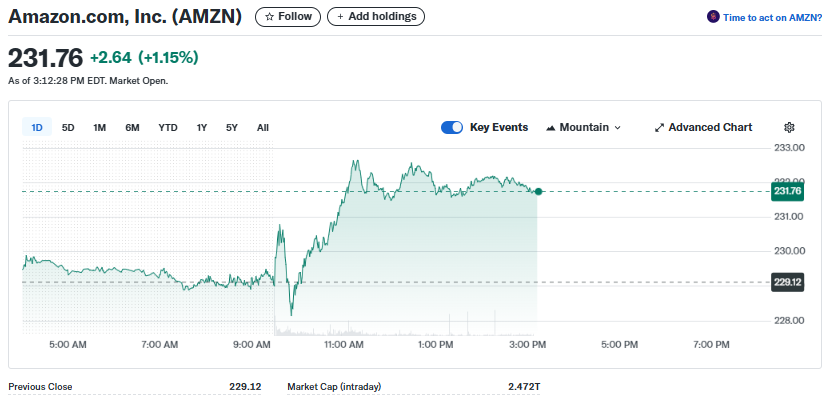

Amazon.com Inc. (AMZN) shares rose 1.17% on Thursday after the company struck a new deal with Comcast’s NBCUniversal to bring the ad-free version of Peacock to Prime Video.

The agreement marks a significant expansion of Prime Video’s content library while offering NBCUniversal a broader audience reach.

Amazon.com, Inc. (AMZN)

Amazon.com, Inc. (AMZN)

New Distribution Agreement With NBCUniversal

Under the terms of the deal, Prime Video customers in the U.S. can subscribe to Peacock Premium Plus, the ad-free tier , directly through Amazon for $16.99 per month or $169.99 annually.

Peacock will also be available via Amazon’s Fire TV platform, while Universal Pictures’ films can be rented or purchased through Prime Video. Additionally, Prime Video content will remain accessible on Comcast’s Xfinity X1 devices, ensuring a two-way distribution relationship between the companies.

NBCUniversal emphasized that this deal marks the first time its streaming platform has been included as part of a bundled digital channel package. The move aligns with broader industry trends where streaming platforms increasingly rely on partnerships to boost distribution and subscriptions amid fierce competition.

Sports and Entertainment Drive Demand

For Amazon, the integration of Peacock adds significant value to its Prime Video ecosystem. Peacock carries high-demand live sports, including NBC’s “Sunday Night Football,” Premier League soccer, and the Olympic Games, which are expected to attract new subscribers.

In addition to live sports, Prime Video customers will gain access to NBCUniversal’s vast library of shows, films, and exclusive content.

NBCUniversal, which has recently invested heavily in sports rights and live event broadcasting, views the Amazon partnership as a way to accelerate Peacock’s subscriber growth.

While Peacock has built momentum in recent quarters, it still trails larger rivals like Netflix and Disney+. This distribution pact could help close that gap by exposing Peacock to Amazon’s massive Prime membership base.

Strategic Benefits for Both Companies

Executives from both sides highlighted the mutual benefits of the deal. Mike Hopkins, head of Prime Video and

Amazon MGM Studios, said the agreement reflects Amazon’s commitment to offering customers “the fastest and easiest way to find all their entertainment and sports in one place.”

Meanwhile, Comcast president Mike Cavanagh stressed that millions of Amazon users will now have seamless access to NBCUniversal’s most popular content, strengthening the company’s long-term streaming strategy.

Beyond direct subscriber growth, the partnership highlights Amazon’s evolving role as more than just a content creator. By positioning Prime Video as a one-stop shop for streaming, including third-party services such as Peacock, HBO Max, and Fox One, Amazon is expanding its role as a central aggregator in the streaming landscape.

Market Reaction and Future Outlook

Following the announcement, Amazon’s stock climbed 1.17% as investors viewed the deal as a positive step in strengthening the company’s media arm.

Conversely, Comcast (NASDAQ: CMCSA) shares fell 0.92%, though analysts note that NBCUniversal stands to benefit from long-term subscriber gains.

The deal may also set the stage for future partnerships. Industry insiders suggest that NBCUniversal could explore additional bundling opportunities, leveraging its sports content and entertainment library to negotiate with other distributors. For Amazon, the agreement further solidifies Prime Video’s positioning in the crowded streaming market by expanding both original and licensed offerings.

The post Amazon (AMZN) Stock: Rises 1.17% as Deal Brings Peacock Content to Prime Video appeared first on CoinCentral.

You May Also Like

HitPaw API is Integrated by Comfy for Professional Image and Video Enhancement to Global Creators

Journalist gives brutal review of Melania movie: 'Not a single person in the theater'