Ethereum Set To Dominate Stablecoin Boom As Wall Street Token Of Choice, VanEck Says

Ethereum (ETH) is poised to win the stablecoin boom as it becomes the blockchain of choice for Wall Street institutions entering the digital dollar era.

That’s according to VanEck CEO Jan van Eck, who told Fox News Business in an interview that big financial institutions are likely to turn to Ethereum to handle stablecoin transactions.

“Every bank and every financial services company has to have a way of taking in stablecoins,” van Eck said, warning that institutions risk losing customers if they fall behind. “It’s going to be Ethereum.”

He dubbed Ethereum the “Wall Street token,” adding that professional-grade, enterprise-ready infrastructure will likely favor ETH over other chains, or chains with “Ethereum kind of methodology.”

The adoption of stablecoins by banks and financial institutions has accelerated after US President Donald Trump signed the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act into law earlier this year.

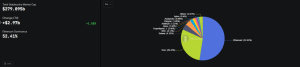

Ethereum is already the most popular chain for stablecoin issuance. According to data from DeFiLlama, the stablecoin market cap stands at around $279.095 billion as of 3:00 a.m. EST.

Stablecoin issuance by chain (Source: DeFiLlama)

Over half of that supply is on the Ethereum blockchain, while the second biggest stablecoin issuance is on Tron with its 29.32% share of the market.

Banks Will Have To Change With The Times Or Risk Being Replaced

The VanEck CEO warned that banks will need to adopt the new stablecoin technology or risk being replaced.

“Companies have to employ technology to enable stablecoin usage over the next 12 months,” he said. “If I want to send you stablecoins, your bank will need to figure it out or you will find some other institution to do that.”

No financial institution will turn customers away who want to transact with digital dollars, he added.

Institutions are already looking into how to join the stablecoin race. In a May 14 report by Fireblocks, the enterprise-grade digital asset platform, 90% of the institutional players that were surveyed said they are exploring the use of stablecoins in their operations.

“The stablecoin race has become a matter of avoiding obsolescence as customer demand accelerates and use cases mature,” Fireblocks wrote in its report.

VanEck Spot Ethereum ETF Soars

The VanEck CEO also spoke about the company’s spot Ethereum ETF (exchange-traded fund), the VanEck Ethereum ETF (ETHV).

Yahoo Finance data shows the ETF’s shares have spiked more than 95% over the last six months, and 25% in just the past month.

ETHV share price chart (Source: Yahoo Finance)

Van Eck replied that the ETF’s performance is due to the stablecoin race heating up and Ethereum’s positioning as a top choice for stablecoin issuers.

VanEck’s ETH ETF is not the only fund centered around the altcoin that is performing well. Data from Farside Investors shows that the ETH funds have attracted more than ten times more inflows than their Bitcoin counterparts over the past five days.

During that period, the spot ETH ETFs saw over $1.8 billion in net inflows. Meanwhile, spot BTC ETFs only saw $171 million inflows since Aug. 21.

BlackRock’s ETHA product led the charge, with investors pouring in over $1.24 billion into the investment product over the five-day period.

ETHA is the largest US spot ETH ETF in terms of cumulative inflows, with around $13.057 billion. This is far more than the next biggest fund, Fidelity’s FETH, which has seen $2.864 billion in cumulative inflows since the funds launched last year.

ETHV’s cumulative inflows are a fraction of that and stand at $193 million.

You May Also Like

HitPaw API is Integrated by Comfy for Professional Image and Video Enhancement to Global Creators

Journalist gives brutal review of Melania movie: 'Not a single person in the theater'