21Shares Files For Spot SEI ETF, Joining 92 Crypto ETF Pipeline

Crypto asset manager 21Shares has filed for a spot Sei (SEI) ETF (exchange-traded fund), joining a wave of 92 firms that Bloomberg says are rushing to launch crypto ETFs.

According to an S-1 registration statement filed with the Securities and Exchange Commission (SEC), the proposed SEI ETF will tap crypto price index provider CF Benchmarks to track the altcoin’s price using data from various crypto exchanges.

Coinbase Custody Trust Company would act as the proposed fund’s custodian. 21Shares also floated the idea of staking SEI to generate additional returns for investors. However, this addition is still being investigated to see if it would present “undue legal, regulatory or tax risk.”

The 21 Shares filing comes amid a surge in crypto ETF applications. Of at least 92 crypto ETFs that are currently awaiting SEC approval, Bloomberg Intelligence analyst James Seyffart said there are numerous filings for Solana (SOL) and XRP in particular.

VanEck, Bitwise, and Grayscale are among fund management titans that have submitted applications for ETFs linked to Cardano (ADA) and even meme coins such as Dogecoin (DOGE).

Bloomberg analysts Eric Balchunas says that 20 new crypto ETF filings have been added in just the past four months, on top of 72 previously reported.

“Pretty soon there will be more crypto ETF filings than stocks,” he joked.

21Shares is not alone in its pursuit of a spot SEI ETF. US digital asset investment firm Canary Capital applied for an ETF focused on SEI back in April. According to an April 30 statement from the SEI network, Canary’s ETF would offer both institutional and retail investors “direct exposure to staked SEI.”

Canary’s product will also provide investors with “passive income via staking rewards.”

Only Spot Bitcoin And Ethereum ETFs Approved So Far

Currently, the US SEC has only approved spot ETFs for crypto market leaders Bitcoin (BTC) and Ethereum (ETH).

21Shares was among the issuers whose spot Bitcoin and spot Ethereum ETF products received the regulatory nod from the SEC last year.

21Shares is in a partnership with Cathie Wood’s ARK Invest for the BTC product, called the ARK 21Shares Bitcoin ETF (ARKB). Under the agreement, 21Shares is the ETF’s sponsor, and essentially brings crypto infrastructure and product development experience to the table.

The two firms also had a partnership to issue the ARK 21Shares Ethereum ETF, but this partnership was ended and 21Shares subsequently rebranded the ETF to the 21Shares Ethereum ETF (TETH).

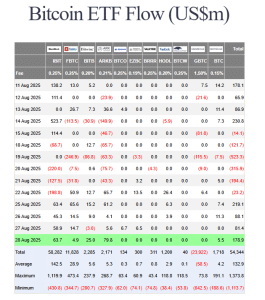

According to data from Farside Investors, ARKB has experienced over $2.17 billion in cumulative inflows since the SEC approved spot Bitcoin ETFs in January 2024.

Spot Bitcoin ETF inflows (Source: Farside Investors)

Meanwhile, TETH has seen much lower cumulative inflows of $35 million since the ETH products launched in July of last year.

The spot Bitcoin ETFs have seen the majority of the inflows since the BTC and ETH funds’ launches. However, this trend shifted in the last week, when spot Ethereum ETFs experienced ten times more inflows than their BTC counterparts. The ETH ETFs also extended their inflows streak to six days yesterday.

With both Bitcoin and Ethereum pulling in billions of dollars in such a short period of time via ETFs, firms are now racing to file for similar products for smaller-cap tokens in the hope of repeating this success.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

XRP Buyers Defend Most Major 200-Week Price Average: Can It Be Bottom of 2026?