XRP in 2025: Legal Clarity + New Tech Catalysts Put Utility (and Price) Back in Focus

BitcoinWorld

XRP in 2025: Legal Clarity + New Tech Catalysts Put Utility (and Price) Back in Focus

After nearly five years of regulatory overhang, XRP enters the final stretch of 2025 with clearer rules, fresh utility, and renewed market attention. The SEC’s lawsuit against Ripple is now officially closed, cementing a split ruling that keeps secondary-market XRP sales outside securities laws while restricting certain institutional sales and imposing a $125 million penalty. That legal clarity coincides with two major product pushes: the RLUSD dollar stablecoin and the XRPL EVM sidechain—both designed to broaden how developers, fintechs, and institutions actually use the XRP ecosystem.

Key takeaways

-

Case closed: The SEC and Ripple dismissed their appeals in August 2025; Judge Torres’s 2023 split ruling stands, plus a $125M penalty and injunction around institutional sales. Secondary-market XRP trading retains non-security status.

-

Tech catalysts: The XRPL EVM sidechain (live since June 30, 2025) brings Ethereum-compatible smart contracts to the XRP stack. Earlier, the XLS-30 AMM added native automated market making to XRPL.

-

Stablecoin push: Ripple’s RLUSD (on XRPL and Ethereum) is fully backed and redeemable 1:1 for USD; it’s integrating into DeFi rails including Aave’s Horizon RWA market.

-

ETF path opens wider: U.S. exchanges are seeking generic listing standards for crypto ETPs, which could speed up approvals for products beyond BTC/ETH—potentially including XRP.

What changed for XRP legally, and why it matters

The long-running SEC v. Ripple case ended in August 2025, with both parties dismissing appeals. The outcome preserved Judge Analisa Torres’s earlier findings: programmatic (exchange) sales of XRP are not securities, while certain institutional sales remain restricted under securities laws. Ripple agreed to a $125 million penalty and a permanent injunction governing institutional offerings. In practical terms, this removes the cloud over secondary-market XRP trading, a prerequisite for broader institutional access and compliant product development.

Market reaction was swift: XRP rallied above $3.25 in the days after the finalization, reflecting both relief and a repricing of legal risk. While price action remains volatile, the legal chapter’s closure allows coverage, custody, and market-making desks to operate with more confidence.

Two technology catalysts you shouldn’t ignore

1) XRPL EVM sidechain: Ethereum-compatible apps meet XRP rails

On June 30, 2025, Ripple and partners launched the XRPL EVM sidechain mainnet, enabling full Ethereum-compatible smart contracts within the XRP ecosystem. Developers can deploy Solidity dApps and bridge assets to/from XRPL—opening doors for DeFi, tokenized assets, and payments applications that use XRP for settlement. Early data points show brisk developer engagement, and cross-chain connectivity via Axelar links the sidechain to dozens of networks.

Why it matters for XRP: Bringing EVM programmability to the XRP world doesn’t just add features—it pulls in Ethereum-native builders and liquidity while keeping XRPL’s speed and low fees for final settlement. For exchanges, PSPs, and fintechs building on-chain finance, this reduces integration friction and can increase XRP’s transactional demand over time.

2) XLS-30 AMM on XRPL: Native liquidity without third-party DEX risk

The XLS-30 AMM—enabled on mainnet in 2024—brought native automated market making to XRPL. With AMMs at the protocol layer, XRPL can source liquidity on demand for token swaps and cross-currency payments, a capability that aligns with Ripple’s longstanding “on-demand liquidity” mission. For payment corridors, this can reduce slippage and improve FX execution across long-tail currency pairs.

Stablecoin strategy: RLUSD’s role in the XRP economy

Ripple’s RLUSD is a USD-backed stablecoin issued natively on XRPL and Ethereum. It is fully backed by cash and cash equivalents and is redeemable 1:1 for USD (availability varies by jurisdiction). In 2025, RLUSD integrated with Aave’s Horizon RWA platform to plug into institutional-grade borrowing/lending tied to tokenized real-world assets. As stablecoin liquidity deepens on XRPL and EVM rails, payments, settlement, and DeFi use cases can scale without forcing users into off-network stablecoins.

By mid-2025, RLUSD’s market footprint surpassed $500 million—evidence that enterprise-grade stablecoins can gain real traction when paired with robust compliance and distribution. More liquidity in RLUSD can indirectly support XRP by spurring network activity and deepening FX/AMM pools, even if holding RLUSD is distinct from holding XRP.

Adoption: corridors, banks, and what’s actually live

Ripple has longstanding ties in Japan (via SBI Holdings) and across Southeast Asia (through Tranglo, in which Ripple holds a 40% stake). SBI Remit has already expanded XRP-powered remittances across key corridors in the Philippines, Vietnam, and Indonesia, citing speed and cost benefits. Meanwhile, SBI’s June 2025 investor materials explicitly reference XRP-based transfers and discussions around RLUSD distribution.

Why that matters now: Post-lawsuit clarity lowers institutional risk. Payment firms can adopt Ripple Payments and XRPL tooling without waiting on a final court outcome. In practice, this could increase corridor volumes, encourage bank pilots, and diversify on-chain liquidity sources (XRP, RLUSD, and fiat on/off-ramps).

ETF watch: A faster route for crypto funds could include XRP

Major U.S. exchanges have petitioned the SEC for generic listing standards for crypto ETPs—akin to how many commodity ETFs are listed today. If adopted, these rules would streamline approvals and reduce the bespoke, slow 19b-4 process. While not an XRP-specific decision, the pathway could enable XRP-based funds alongside other large-cap assets, expanding institutional access and retirement-account demand. Timing isn’t guaranteed, but the policy direction suggests broader ETF availability is getting closer.

Price snapshot and levels to watch

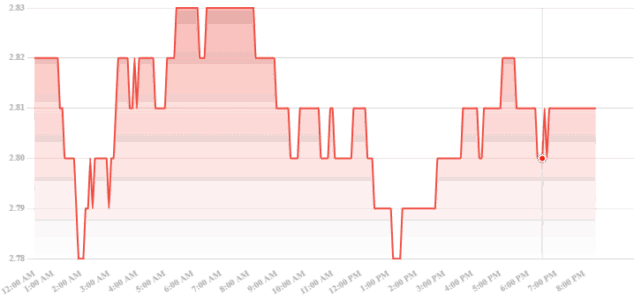

As of publication, XRP trades near $2.81 with intraday moves around the $2.77–$2.83 band. Traders are watching $2.80 as near-term support, with resistance seen into the low-$3s following the post-settlement bounce. Macro liquidity, ETF news flow, and on-chain adoption metrics will likely drive the next leg. (Not investment advice.)

Risks to the bull case

-

Regulatory drift: U.S. policy can change quickly. Even with the Ripple case concluded, future rulemaking or state actions could alter how institutions treat XRP.

-

Adoption-execution gap: Launching the EVM sidechain and stablecoin integrations is only step one; sustained developer and user adoption must follow to affect XRP demand.

-

Market structure: Broader crypto liquidity, BTC cycles, and ETF flows will influence XRP beta. Even strong fundamentals can be overshadowed in risk-off regimes.

-

Stablecoin competition: RLUSD must contend with deeply entrenched stablecoins. Its enterprise pitch will need continued exchange and protocol support to scale.

Bottom line

For the first time in years, XRP’s narrative is less about courtrooms and more about code and corridors. With legal clarity, a live EVM sidechain, protocol-level AMMs, and an enterprise-grade stablecoin, the ecosystem is better positioned to compete on utility—the metric that ultimately sustains network value beyond headlines. Watch for corridor volumes, EVM sidechain TVL/developer growth, and ETF policy milestones to determine whether 2025’s promise turns into durable momentum.

FAQ (for readers & rich results)

Is XRP still a security in the U.S.?

No—for secondary-market trading, courts reaffirmed that XRP is not a security. Certain institutional sales remain restricted, and Ripple paid a $125M penalty with a permanent injunction on those offerings. SEC

What is RLUSD and why should XRP holders care?

RLUSD is Ripple’s USD-backed stablecoin on XRPL and Ethereum. It can deepen on-chain liquidity for payments and DeFi. While holding RLUSD isn’t the same as holding XRP, more stablecoin liquidity can increase XRPL activity, indirectly benefiting the ecosystem. Ripple

What does the EVM sidechain actually enable?

It lets developers deploy Ethereum-compatible smart contracts while bridging to XRPL for fast, low-cost settlement—attracting builders and liquidity without abandoning XRP’s core payment strengths. Ripple

Could we see an XRP ETF?

Policy is evolving. If the SEC adopts generic listing standards for crypto ETPs, XRP-based funds could see a smoother pathway—though timing and eligibility aren’t guaranteed.

Outbound sources cited: SEC, Reuters, CoinDesk, XRPL.org/Ripple, Yahoo Finance, Investopedia (see inline citations).

This post XRP in 2025: Legal Clarity + New Tech Catalysts Put Utility (and Price) Back in Focus first appeared on BitcoinWorld and is written by Editorial Team

You May Also Like

XRP Ignites As Spot Volume Skyrockets

Cloud mining is gaining popularity around the world. LgMining’s efficient cloud mining platform helps you easily deploy digital assets and lead a new wave of crypto wealth.