Pokemon Trading Cards Enter the Tokenization Boom

Blockchain marketplaces now let collectors trade tokenized versions of the cards instantly, bypassing the usual frictions of grading and shipping.

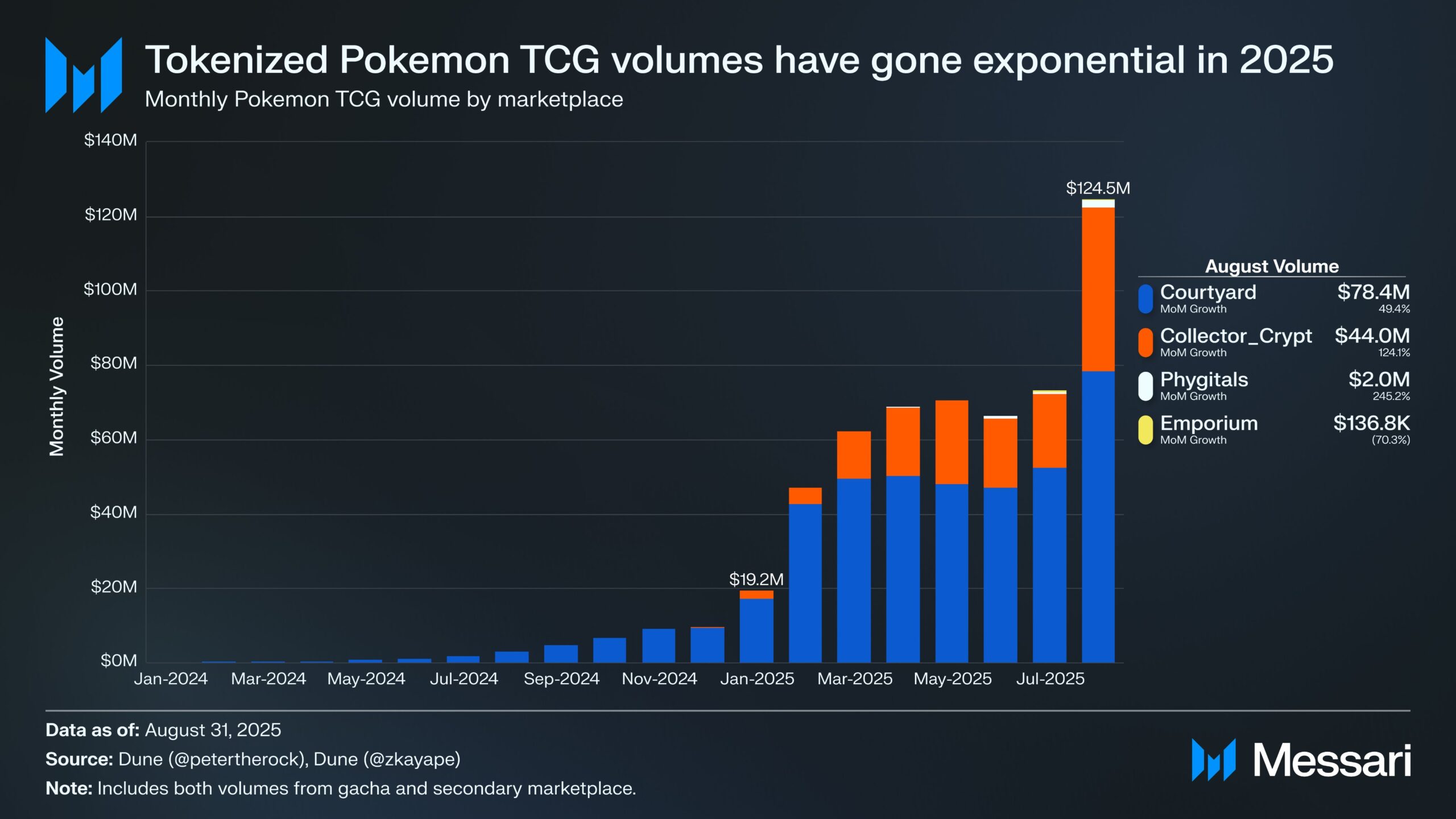

The market is already heating up. Messari data shows over $124 million in tokenized Pokémon card trades in August, a 5x jump since January. Courtyard led the pack with nearly $80 million, while Solana-based Collector Crypt cleared $44 million.

Collector Crypt has emerged as a breakout player. By issuing NFTs that represent physical cards, the platform offers instant liquidity—and crypto traders have taken notice.

Its CARDS token soared 10x in a week, giving the project a valuation near $500 million. Gamified features like a “Gacha machine” added another $16 million in sales in just seven days.

READ MORE:

U.S. Job Growth Misses Forecast, Fed Cut Bets Near 90%

Analysts say this surge signals how tokenization can thrive outside traditional markets like gold or Treasuries. Bitwise’s Danny Nelson compared the trend to Polymarket’s rise, arguing that collectibles with massive demand but little financial infrastructure are the perfect proving ground.

For Pokémon fans and crypto investors alike, the experiment could redefine what it means to collect—and trade—cultural assets in the digital era.

The information provided in this article is for informational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Pokemon Trading Cards Enter the Tokenization Boom appeared first on Coindoo.

You May Also Like

Trump calls US Olympian 'a real loser' for saying he represents what’s 'good about the US'

Fed Decides On Interest Rates Today—Here’s What To Watch For