From L1 to DePIN, we have selected 8 of the latest potential airdrop projects.From L1 to DePIN, we have selected 8 of the latest potential airdrop projects.

Zero-cost interaction: 8 selected latest potential airdrop projects

3 min read

Author: Atoms Research

Compiled by: Tim, PANews

Selected 8 latest testnet projects, they have:

- Potential/Confirmed Airdrops

- Zero-cost interaction

Let's look at the full list of projects:

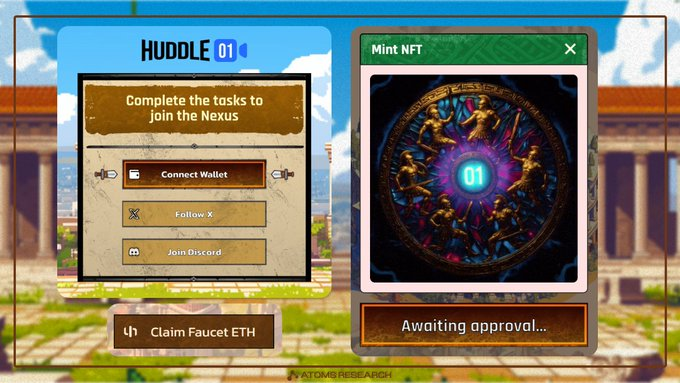

1.Huddle01

- Huddle01 is a needs-first DePIN project dedicated to accelerating digital connectivity in cyberspace.

- Financing: Invested by Balaji Srinivasan, Stani Kulechov and others, totaling US$7 million.

Interaction Guide

- Join the official Discord channel

- Enter the official website and connect your wallet

- Click "Claim Faucet ETH" to claim the test tokens

- After completing the first transaction, you will receive the "Landing NFT"

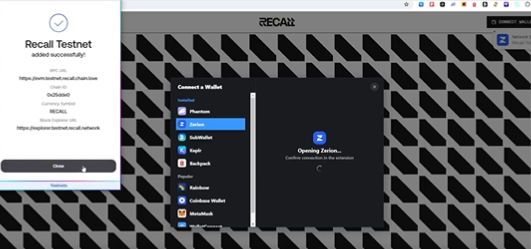

2. Recall

- Recall is a decentralized platform for testing, validating, and upgrading AI agents, enabling machine-verifiable decision-making.

- Funding: $30 million raised from Multicoin Capital, Coinbase Ventures, and others.

Interaction Guide

- Go to the faucet to get test tokens

- Purchase points on the official website

- After connecting your wallet, click “Create Bucke”

- Insert JSON with metadata (use ChatGPT for other schemes)

3. Irys

- Irys is a provenance layer that allows users to extend permanent data and accurately trace its origin.

- Financing: $8.9 million from Framework Ventures, OpenSea Ventures and other institutions.

Interaction Guide

- Enter the official website and connect your wallet

- Go to the faucet to get test coins

- Go back to the game room and start playing games. You can get test tokens for each game.

4. RISE

- RISE is Ethereum's second-layer scaling solution, featuring instant transactions, high scalability, and complete decentralization.

- Financing status: $3.2 million has been raised, with investors including Ethereum founder Vitalik Buterin, Polygon co-founder Sandeep Nailwal, Aave founder Stani Kulechov and other well-known figures.

Interaction Guide

- Go to the faucet to get the test coins

- Go to the official website and add the network to your wallet

- Go to the website to exchange tokens and add liquidity pools

- In addition, there are other ecological protocols that can be used for lending and minting NFTs, which readers need to explore on their own.

5. Somnia

- Somnia Network is a Layer 1 blockchain with a particular focus on enhancing the Metaverse and Web3 experience.

Interaction Guide

- Enter the website and connect your wallet

- Click and complete the "Netherak Demons" quest:

- Follow Netherak Demons account on X platform

- Retweet the official announcement of Netherak Demons

- Join the Netherak Demons Discord server

- Once completed go back and click on the "Somnia Yapstorm" quest

- Publish Somnia related content to share the weekly prize pool of 5000USDC + 100000 Somnia points

6. Seismic

- Seismic gives developers access to novel token onboarding models, consumer payment flows, a real-world asset RWA marketplace, and more

- Financing: $7 million raised, with investors including a16z, Polychain Capital and others.

Interaction Guide

- Go to the faucet to get the test coins

- Enter the official website and connect your wallet

- Select “Seismic Network” and click “Deploy”

- Join the Discord group, active people can get status

7. Seal

- Seal is a decentralized key management (DSM) service built based on the access control policies defined and verified by Sui.

Interaction Guide

- Installing the wallet

- Go to the faucet to get the test coins

- Go to the Seal website and connect your wallet

- Click “Try It” and sign the transaction

- Select "staketab" to download the file

- Return to the website and select Subscription Example

- Fill in all fields and create the service

8. MultipliFi

- MultipliFi is a multi-chain yield protocol that aims to solve two major industry pain points: the limited variety of cryptocurrencies that support interest-bearing, and the widespread problem of low yields.

Interaction Guide

- The Multipli mainnet testing phase is invitation-only

- The minimum account balance requirement is $1,000 (total amount of Ethereum, Arbitrum, BSC, Base, Matic, Optimism multi-chain assets)

- Support Join the waiting list to get the qualification to participate

- Visit the official website to submit your email address and receive notification when a spot opens up

Market Opportunity

L1 Price(L1)

$0.0024

$0.0024$0.0024

USD

L1 (L1) Live Price Chart

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

You May Also Like

Victra Named 2025 Recipient of Verizon’s Best Build Compliance Award

Verizon Recognizes Victra for Industry-Leading Excellence in Store Design and Brand Compliance. RALEIGH, N.C., Feb. 3, 2026 /PRNewswire/ — Verizon has named Victra

Share

AI Journal2026/02/03 20:49

Stablecoins could face yield compression after Fed’s rate cut

The post Stablecoins could face yield compression after Fed’s rate cut appeared on BitcoinEthereumNews.com. The Federal Reserve reduced its policy rate by 25 basis points to 4.00%–4.25%, the first rate cut this year. The move, framed as a response to weakening labor data, signals the start of a cautious easing cycle. Projections show two more cuts possible before year-end, with further reductions likely in 2026. Inflation remains above target, but Chairman Jerome Powell emphasized risk management over immediate price control, prioritizing stability in employment conditions. Stablecoins will be quickly affected by this. Issuers like Tether and Circle have generated large profits by holding reserves in short-term Treasuries during the high-rate environment of the past two years. That income stream now begins to erode. DeFi protocols that offered tokenized Treasury exposure face the same squeeze, with returns set to fall further if the Fed continues cutting into next year. A multi-cut easing cycle could substantially reduce stablecoin profitability, forcing issuers and protocols to adapt. The decline in dollar yields also alters the balance between holding stablecoins passively and seeking higher returns in risk assets. Bitcoin benefits most from this reallocation. As nominal rates move lower and inflation remains sticky, real yields decline, making non-yielding assets more attractive. The weaker dollar and improving risk appetite amplify the effect, positioning Bitcoin as a relative winner of the Fed’s shift. The September cut is modest, but it could bring significant changes to the crypto market. Stablecoin models built on Treasury income face structural headwinds after the rate cut, while Bitcoin and other high-beta assets stand to gain from falling real yields and increased liquidity. The Fed has opened an easing cycle, and crypto’s internal capital flows will move with it. The post Stablecoins could face yield compression after Fed’s rate cut appeared first on CryptoSlate. Source: https://cryptoslate.com/insights/stablecoins-could-face-yield-compression-after-feds-rate-cut/

Share

BitcoinEthereumNews2025/09/18 19:31

Wormhole Jumps 11% on Revised Tokenomics and Reserve Initiative

The post Wormhole Jumps 11% on Revised Tokenomics and Reserve Initiative appeared on BitcoinEthereumNews.com. Cross-chain bridge Wormhole plans to launch a reserve funded by both on-chain and off-chain revenues. Wormhole, a cross-chain bridge connecting over 40 blockchain networks, unveiled a tokenomics overhaul on Wednesday, hinting at updated staking incentives, a strategic reserve for the W token, and a smoother unlock schedule. The price of W jumped 11% on the news to $0.096, though the token is still down 92% since its debut in April 2024. W Chart In a blog post, Wormhole said it’s planning to set up a “Wormhole Reserve” that will accumulate on-chain and off-chain revenues “to support the growth of the Wormhole ecosystem.” The protocol also said it plans to target a 4% base yield for governance stakers, replacing the current variable APY system, noting that “yield will come from a combination of the existing token supply and protocol revenues.” It’s unclear whether Wormhole will draw from the reserve to fund this target. Wormhole did not immediately respond to The Defiant’s request for comment. Wormhole emphasized that the maximum supply of 10 billion W tokens will remain the same, while large annual token unlocks will be replaced by a bi-weekly distribution beginning Oct. 3 to eliminate “moments of concentrated market pressure.” Data from CoinGecko shows there are over 4.7 billion W tokens in circulation, meaning that more than half the supply is yet to be unlocked, with portions of that supply to be released over the next 4.5 years. Source: https://thedefiant.io/news/defi/wormhole-jumps-11-on-revised-tokenomics-and-reserve-initiative

Share

BitcoinEthereumNews2025/09/18 01:31