Metaplanet Plunges 8% As UBS Joins Morgan Stanley In Shorting Bitcoin Treasury Giant

Metaplanet shares plunged 8% after UBS reopened a short position, joining Morgan Stanley in betting against Asia’s largest Bitcoin holder.

UBS had closed an earlier short but re-entered with a 73.1 million share position, underscoring mounting pressure from Wall Street as a weak Bitcoin price and Metaplanet’s sliding share price threaten to undermine both its business model and its ability to raise funds for more purchases.

Investment banks including Jefferies and JPMorgan also remain short, though some peers like Goldman Sachs and Citigroup have recently cut back their positions. When investors short a stock, they are betting that its share price will drop.

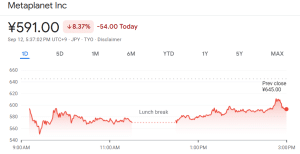

Metaplanet’s share price is now down more than 31% over the past month, according to Google Finance.

Metaplanet share price (Source: Google Finance)

Bitcoin is down almost 3% in the past month.

Morgan Stanley Is The Biggest Short

Morgan Stanley MUFG has the largest short position on the Bitcoin stacking company, holding nearly 20 million Metaplanet shares in its position. One of the firm’s trading desks had reduced its short position slightly, but another one of the trading desks added a lot more shares, according to a post by Vincent on X.

While UBS re-opened its short position, Jefferies upped its position by nearly 2 million shares.

Some other banks are closing out their short positions on Metaplanet.

Goldman Sachs reduced its short position’s size by more than 6 million shares. Similarly, JP Morgan and Citigroup slashed their order sizes by 4 million and 9 million shares, respectively. Barclays also trimmed 4.5 million shares.

“The cost to borrow Metaplanet (3350) for shorting has surged to an annualized 54%, indicating that available shares to lend are extremely scarce and that shorting has become very expensive,” Vincent said.

Metaplanet Premium Continues To Collapse Along With Other DATs

Metaplanet is ranked as the sixth-largest Bitcoin holder globally with 20,136 BTC on its balance sheet, according to data from Bitcoin Treasuries.

Top ten largest corporate BTC holders (Source: Bitcoin Treasuries)

It holds more BTC in its reserves than CleanSpark, crypto exchange Coinbase, and Elon Musk’s electric vehicle manufacturer Tesla.

Metaplanet aims to grow its Bitcoin stash to 30K BTC by the end of this year.

However, while Bitcoin’s price has traded flat over the past week, Metaplanet’s share price has slid more than 15%. This has put pressure on the company’s “Bitcoin premium,” which is the difference between the company’s capitalization and the value of the Bitcoin that it holds on its balance sheets.

Back in June, investors were paying over eight times the value of the Bitcoin Metaplanet owns to purchase the company’s shares. That’s now fallen to only two times the value. Analysts have warned that this drop in premium could put the company’s Bitcoin accumulation strategy at risk.

Metaplanet is not alone in its premium struggles. Other digital asset treasury (DAT) firms are also at risk. Michael Saylor’s Strategy (formerly MicroStrategy), the largest Bitcoin holder globally with 638,460 BTC on its balance sheet, has seen its share price drop more than 9% in the last month.

Overseas Investor Payments For $1.44 Billion Raise Due Tomorrow

Despite the declining premiums, Metaplanet has turned to offshore investors to raise more capital and grow its Bitcoin reserves. The company has recently said that it will issue 385 million shares via an international offering to raise roughly 205 billion yen ($1.44 billion).

Payments for those shares is due tomorrow, with delivery set for Sept. 17.

Of the $1.44 billion the company is looking to raise, around $1.25 billion of the proceeds will go toward buying more Bitcoin between September and October this year. The remaining $138.7 million is earmarked for expanding the company’s Bitcoin income-generation business.

You May Also Like

Propel to Report Q4 and Full Year 2025 Financial Results and Announces Dividend Increase

CME Group to launch options on XRP and SOL futures