Best Altcoins to Watch as Ethereum to Replace Wall Street Infrastructure

They believe that the market has yet to price in the fact that Ethereum is poised to be the next step for Wall Street. Chalom pointed out on a Milk Road podcast held on September 15th that Ethereum eliminates much of the friction for traditional finance firms.

Compared to day-long trades that carry counterparty risk, Ethereum instantly executes trades through atomic settlement. This removes the need to post collateral and eliminates rent-seeking by third parties mediating these agreements.

If true, this means we’re in for an altcoin season like we’ve never seen before once Wall Street catches up. In the meantime, we’ve identified three altcoins to keep an eye on: Snorter Bot ($SNORT), Bitcoin Hyper ($HYPER), and Ethereum ($ETH), obviously. Read on and we’ll tell you exactly why we think these are winners as Ethereum rises.

1. Snorter ($SNORT) – This Automatic Trading Bot for Telegram Helps You Sniff Out Altcoins

Snorter Token ($SNORT) is the presale token for Snorter Bot, a sniper bot for altcoins that combines an easy-to-use Telegram interface with powerful intelligence and trading capabilities.

Snorter Bot is designed to be mobile-first and easy to maintain. It automatically selects the top-performing altcoins without your input and runs them through a honeypot detection engine to identify rugpull indicators (with an 85% success rate during beta testing).

The best options are provided to you inside Telegram for you to review at your convenience. Once you find a coin you want to trade, you set buy and sell orders, which are executed on your behalf when the coin reaches the price point you’ve chosen.

Snorter initially supported the Solana blockchain, but it expanded to other networks after launch. The Snorter Bot developers have confirmed they are working on modules for Ethereum, BNB, Polygon, and Base.

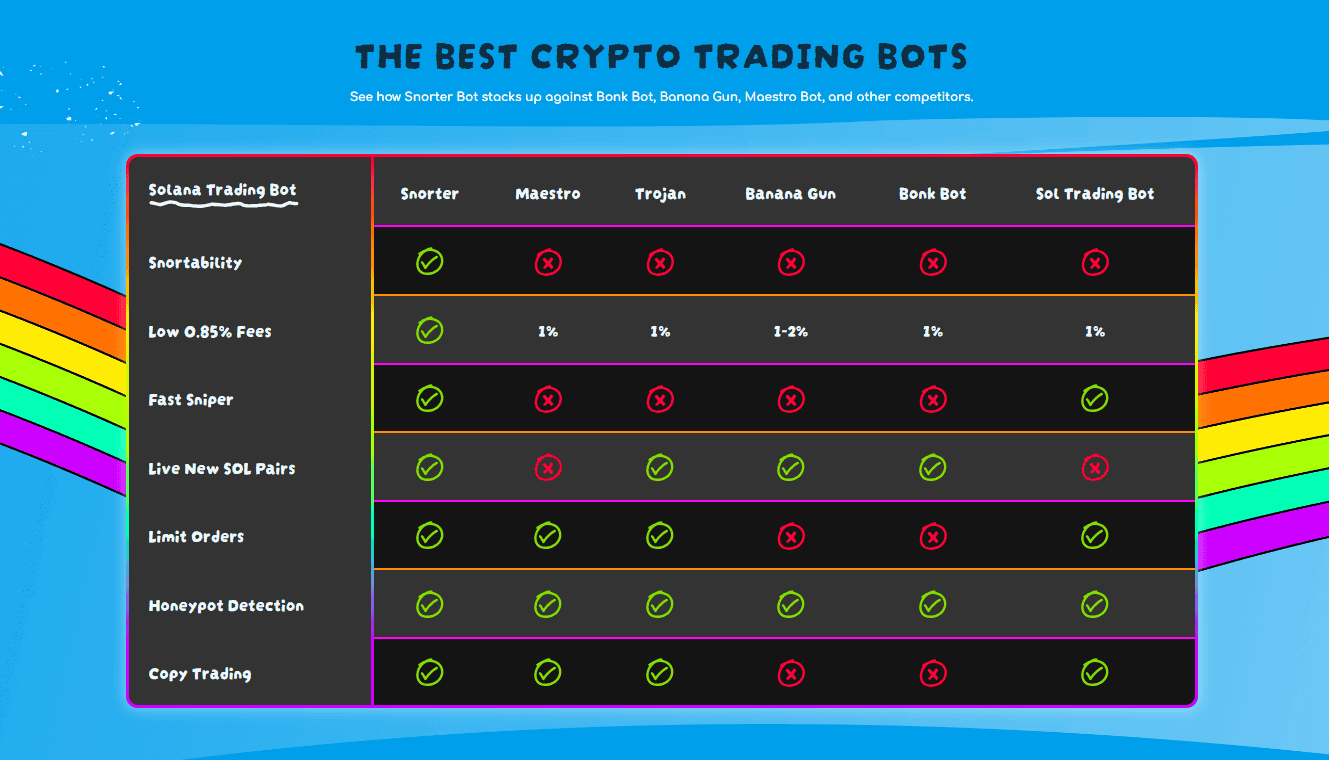

What really distinguishes Snorter from other bots on the market is $SNORT. By holding $SNORT, you get access to a range of exclusive features all designed to help you take home maximum profits.

First, $SNORT reduces your trading fees to 0.85%, well below the market average of 1%, and removes the daily trading cap, allowing you to make more trades with higher margins.

That’s why it makes sense to buy your $SNORT tokens early while the price is still fixed. The $SNORT presale is dynamic, so the sooner you buy tokens, the cheaper they’ll be. Currently, $SNORT has raised over $3.9M and is priced at $0.1045.

Join the Snorter Token presale today and earn up to 118% per annum in staking rewards.

2. Bitcoin Hyper ($HYPER) – Bringing Faster Speeds and Lower Fees to Bitcoin with a Solana-Based Layer-2

Bitcoin Hyper ($HYPER) aims to revitalize the Bitcoin ecosystem. Bitcoin is highly valuable as an investment but is not the best asset for daily trading.

In simple terms, the Bitcoin network processes transactions slowly. It is also congested, resulting in higher fees as traders compete to prioritize their transactions. Compared to Ethereum or Solana, Bitcoin’s scalability is almost nonexistent.

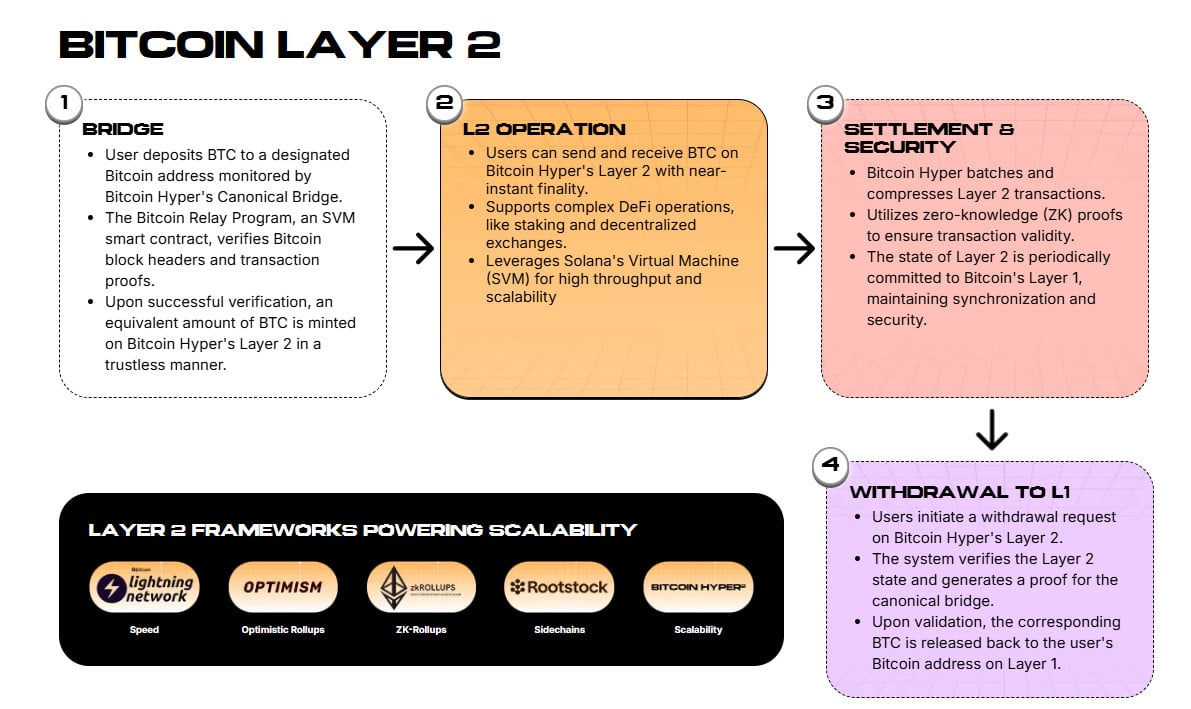

That’s where Bitcoin Hyper comes in. The solution is simple: supercharge the Bitcoin network by adding a Layer-2 using a Solana Virtual Machine (SVM) with zK rollups. That way, Bitcoin gets all the benefits of Solana like transaction speeds and low fees without moving away from $BTC.

Bringing Solana to Bitcoin also introduces smart contract features, opening the door to a whole ecosystem of dApps that facilitate NFT trades, crypto swaps, and other DeFi services.

All of these exciting features are powered by $HYPER, which acts as a utility token for the Bitcoin Hyper network. It reduces your fees when you transact in it, making crypto swaps cheaper. It’s also used in the DAO to assign voting rights on new proposals.

Besides its functions on the main network, $HYPER will also unlock exclusive features in dApps built on Bitcoin Hyper, keeping the token’s value in high demand.

While you’re at it, Bitcoin Hyper also offers some enticing staking rewards of up to 70% per year. Remember it’s a changing presale, so the longer you wait, the lower those rewards will become.

Get your $HYPER tokens before the presale ends.

3. Ethereum ($ETH) – The Potential Future of Cryptocurrency with Smart Contract Capabilities

Ethereum is a centralized blockchain that has paved the way for much of the existing crypto industry. By offering cryptographically verified code that can be run on-chain, Ethereum has eliminated the need for independent third-parties to mediate contracts between two entities.

That’s opened the door for an entire DeFi industry that runs without centralized exchanges or banks. Today, that same industry is worth over $92B – and if Chalom and Kannan’s analysis is anything to go by, we’ve barely even gotten started.

Source: CoinMarketCap

That’s why it’s considered the most serious Bitcoin competitor in the crypto market to date. It’s trading around $4.4K at the moment after a slight consolidation phase, but there’s currently an expectation that the Fed are just about to cut interest rates in a meeting on the 18th.

If so, this could potentially send $ETH rocketing past its previous ATH and over the $5K line. If it breaks this key point of resistance, the psychological effect alone could cause $ETH to pump even further.

You can purchase $ETH through any major CEX or DEX.

All crypto products are volatile. Be sure to always do your own research before investing – and only invest what you’re prepared to lose. This article is not financial advice.

You May Also Like

Xenea Wallet Daily Quiz 11 February 2026: Claim Your Free Crypto Coins Now

Crucial Fed Rate Cut: October Probability Surges to 94%