Berachain Powers an Ultimate Leap in Real-Time Blockchain Performance

- Berachain is a highly performing layer 1 blockchain that has a high transaction speed.

- This helps the developers to position themselves better in Ethereum-compatible contracts. It also takes advantage of the platform’s lower latency

- This blockchain has the capacity to look into sub-second block time, consisting of a structure that is occupied for real-time use cases

Berachain is a highly performing layer 1 blockchain, which is built on an agreement mechanism. The network has a high transaction speed, which makes it a strong opposition to other blockchain networks. The structure targets both DeFi and real-time applications. The network is built with Cosmos SDK and integrated with the Ethereum Virtual Machine (EVM).

This collaboration helps the developers to position themselves better in Ethereum-compatible contracts. It also takes advantage of the platform’s lower latency.

Source: Google Images

Source: Google Images

Also Read: Coldware & Berachain Increase Market Position as Pi Network Usability Increases Holder Frustration

Technical Innovation Driving Adoption for Berachain

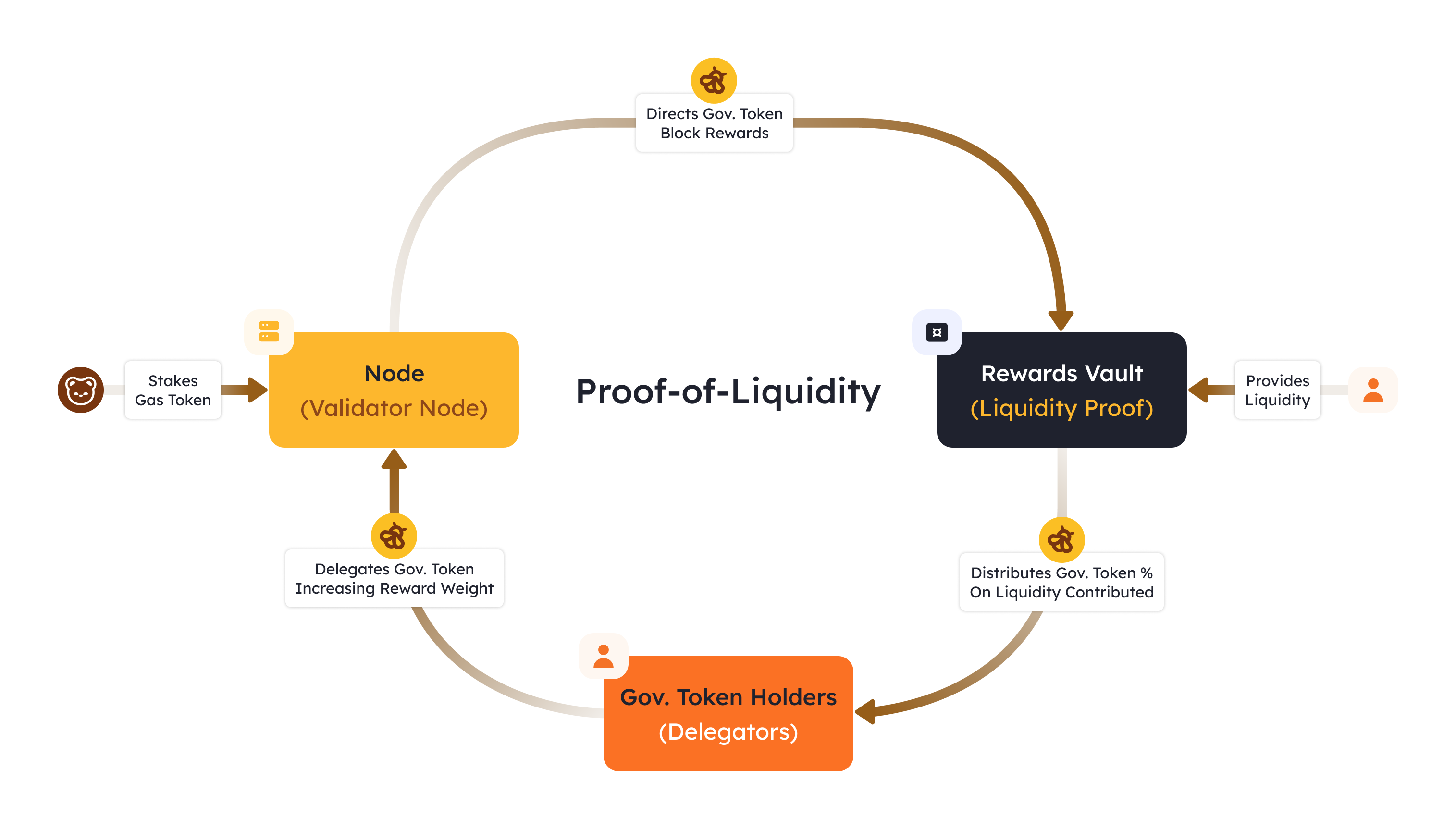

The fundamental side of Berachain’s structure is the Proof-of-Liquidity (PoL) mechanism, which is a distinctive structure that binds validator rewards to liquidity contributions within it. This structure mainly focuses on the motive between validators, liquidity providers, and investors. This also creates a balanced environment.

This blockchain has the capacity to look into sub-second block time, consisting of a structure that is occupied for real-time use cases. The network’s collaboration with Cosmos-based chains by the Inter-Blockchain Communication (IBC) protocol increases the cross-chain uses. This structure can also increase transaction flow, giving the network an immense merit in the blockchain industry.

Source: Google Images

Source: Google Images

Growing Ecosystem and Developer Interest

The network has recently seen an increasing developer population following its launch. The public testnut, codenamed Artio, has now attracted DeFi, liquidity structures, and NFTs. The initial response from the community was affirmative. The most keen sides of the platform are low latency and high transaction throughput.

Berachain has positioned itself as a promising blockchain. Analysts view Berachain as the most promising. Its role is said to be the one that fuels optimism and shapes the coming market trends.

Also Read: Berachain Surges to $3.26B TVL Overtakes Arbitrum and Base

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny