Drama in South Korea’s crypto market: Altcoins lead the rise, seniors rush into the market, martial law triggers flash crash

Author: Nancy, PANews

After 44 years, South Korea suddenly experienced a martial law farce that lasted only 6 hours. This sudden move shocked South Korea and the world, and triggered violent market fluctuations, allowing Korean elderly people who had just entered the market to feel the huge fluctuations in the crypto market.

Although martial law in South Korea has been lifted, the interweaving of political turmoil and market volatility has brought huge arbitrage opportunities, and the influx of large amounts of funds has also highlighted the crypto market's ability to resist regional risks.

South Korea's sudden martial law caused market turmoil, and funds poured in to buy at the bottom

Late at night on December 3, South Korean President Yoon Seok-yeol suddenly declared an emergency martial law, accusing the largest opposition party in South Korea of coercing the National Assembly, disrupting the country, and paralyzing the entire administrative system, and said that he would purge "anti-national forces." Subsequently, the National Assembly building was blocked, and a large number of armored vehicles drove into the city center, and the South Korean market sentiment quickly fell into panic. It should be noted that the last time South Korea declared martial law was in 1980. This move made many people worry whether the real version of "Seoul Spring" would be repeated.

However, just a few hours later, the South Korean National Assembly passed a request to lift martial law after an emergency meeting. The opposition Democratic Party said it would accuse President Yoon Seok-yeol, the Minister of Defense, and the Minister of Public Administration and Security of sedition and promote impeachment. The Democratic Party said it was pushing for the impeachment of President Yoon Seok-yeol and expected to complete the drafting of the impeachment documents today; the ruling party in South Korea also "reached a certain consensus" on issues such as Yoon Seok-yeol's withdrawal from the party, the resignation of the entire cabinet, and the removal of the Minister of Defense.

With the lifting of martial law and the South Korean government's statement that it would provide unlimited liquidity to the market when necessary, market sentiment gradually stabilized. Although the future direction of South Korea's political situation is still unknown, political turmoil has brought huge profit space to the market.

During the period when martial law was in effect, the Korean financial market experienced significant fluctuations. Due to the strict KYC and foreign exchange control system in the Korean market, the liquidity of Korean crypto exchanges was relatively isolated. The political changes caused a sharp plunge in the Korean crypto market, including a short-term drop of 30% for Bitcoin and a short-term drop of 60% for XRP. This wave of flash crashes caused a serious negative premium in the Korean market, and a large amount of arbitrage and bargain hunting funds poured into Korean exchanges, even causing transactions on platforms such as Upbit and Bithumb to be interrupted or delayed.

According to CoinMarketCap data, in 24 hours, the trading volume of several crypto exchanges in South Korea totaled $34.2 billion, a record high for the year, of which Upbit's trading volume reached $27.25 billion. At the same time, according to Lookonchain monitoring, after South Korea announced "martial law", many whales transferred a large amount of USDT to Upbit, probably to buy at the bottom. Within 1 hour after the announcement of "martial law", more than 163 million USDT flowed into Upbit. With the influx of bargain hunting and arbitrage funds, the negative premium of cryptocurrencies on Upbit narrowed soon after.

It is worth mentioning that the martial law crisis in South Korea has also led to speculation in some concept stocks and MEME tokens related to rebuilding South Korea. For example, the A-share "Hanjianheshan" stock price opened at the daily limit, and the MEME coin "KoreaCTO" soared dozens of times in a short period of time last night.

Old altcoins become the new favorite of Korean investors, and those born in the 1960s enter the market with their retirement savings

The Korean crypto market has always been famous for its prominent retail herd effect and kimchi premium. With the recent warming market, the trading volume has once exceeded that of the Korean stock market. Judging from the explosion of market trading volume, the gradual improvement of policy supervision and the changes in investor structure, South Korea has become one of the important players in the global crypto market.

According to data from CryptoQuant cited by Korean media Pulse, the total monthly stablecoin trading volume of South Korea's top five CEXs, Upbit, Bithumb, Coinone, Korbit and GOPAX, was about 16.17 trillion won (US$11.5 billion), a seven-fold increase from the approximately 2 trillion won recorded at the beginning of the year. It is also the first time that South Korea's monthly stablecoin trading volume has exceeded 10 trillion won.

In fact, with the changes in the Korean economy and domestic monetary policy, more and more Korean investors have begun to invest in the crypto market and show great enthusiasm. According to a report released by 10x Research on December 3, in the past 24 hours, the retail trading volume of the Korean crypto market surged to US$18 billion, setting the second highest level this year, exceeding the local stock market's US$14 billion trading volume.

Behind this growth, South Korea's elderly population has also become an important participant in the local crypto market. According to Pioneer Economics, on the platforms of Upbit and Bithumb, the major cryptocurrency exchanges in South Korea, the number of user accounts over 60 years old reached 775,700 (as of the end of September), an increase of 30.4% from the end of 2021. Users in this age group hold a total of 6.7609 trillion won in cryptocurrency assets, with an average investment of approximately 8.72 million won (approximately US$6,173), the highest among all age groups. At the same time, the current deposit balance of South Korea's five major banks was 592.67 trillion won, a decrease of 26.95 trillion won (approximately US$19.1 billion) from the end of June, setting a new low since January this year.

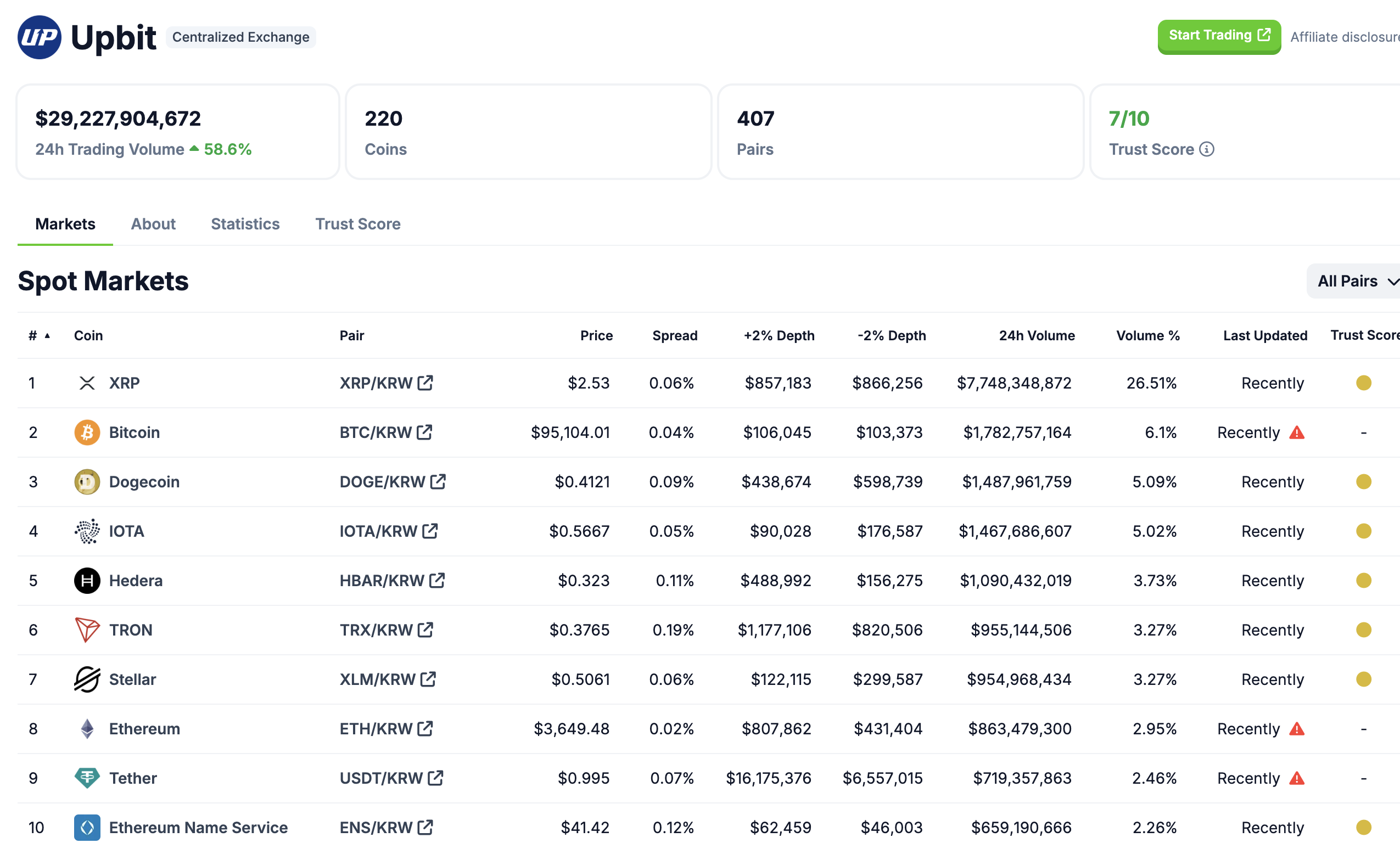

In terms of investment target selection, altcoins with large fluctuations have become a popular choice for Korean investors. Taking Upbit data as an example, among the top ten assets in terms of trading volume in the past 24 hours, in addition to Bitcoin, Ethereum and stablecoins, altcoins such as XRP, DOGE, IOTA and H BAR also ranked at the top in terms of trading volume.

In addition, the South Korean government is also actively promoting the development of its crypto market at the policy level. For example, the South Korean National Assembly has recently reached an agreement to postpone the implementation of crypto taxes until 2027, which is the third postponement of the tax since it was first proposed in 2020; the South Korean government has formulated a plan to gradually allow companies to open fiat currency accounts for virtual assets, first allowing real-name accounts (first phase) for non-profit legal persons such as central government departments, local governments, public institutions, and universities; Simon Kim, CEO of Hashed, South Korea's largest cryptocurrency venture capital firm, disclosed that the South Korean government may soon allow domestic currency issuance and open institutional investment in cryptocurrencies. But at the same time, South Korea is also tightening its supervision of the crypto market, including South Korea's expansion of the scope of cryptocurrency price manipulation investigations to individual investors, and the chairman of the South Korean FSC announced that it will take strong measures to prevent virtual assets from becoming a "loophole" in the anti-money laundering system.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Unprecedented Surge: Gold Price Hits Astounding New Record High